On October 20th, Vietnam’s stock market witnessed a historic plunge, marking its steepest decline in 25 years. The VN-Index closed down nearly 95 points (-5.47%), settling at 1,636.43 points.

Selling pressure spread across various sectors, particularly real estate, where numerous blue-chip stocks hit their lower limits. Notable examples include VRE, NVL, CEO, DXG, PDR, KDH, TCH, KBC, HDC, HDG, NLG, NTL, SZC, and NDN.

While not hitting their lower limits, Vingroup’s VIC and VHM also saw significant losses of 4.46% and 6.9%, respectively, contributing to a 15.7-point drop in the VN-Index. Overall, the real estate sector plummeted by nearly 5.5%, making it one of the hardest-hit sectors.

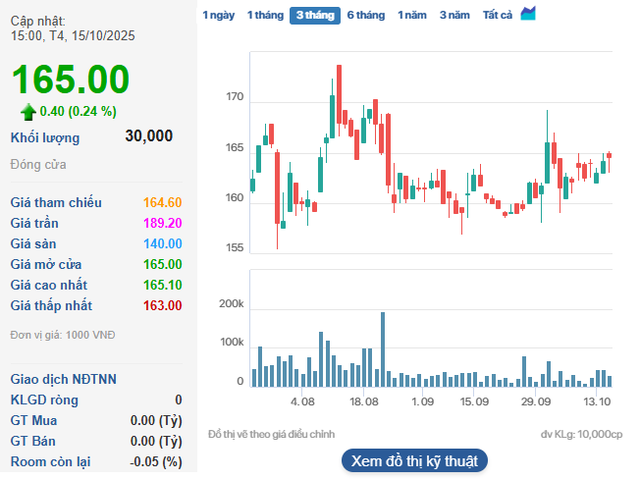

Amidst this downturn, NTC, the stock of Nam Tan Uyen Industrial Park JSC, emerged as a rare bright spot, bucking the trend ahead of its upcoming listing. Specifically, NTC inched up 0.24% to 165,000 VND per share.

This upward momentum comes as NTC prepares to list nearly 24 million shares on the HoSE on October 28, 2025. The reference price for the first trading day is set at 161,470 VND per share, the highest among industrial park real estate stocks. The price fluctuation range for the first trading day is ±20% relative to the reference price.

The company’s shareholder structure is highly concentrated, with the three largest shareholders holding over 73% of the charter capital: Phuoc Hoa Rubber JSC (32.85%), Vietnam Rubber Industry Group (20.42%), and Saigon VRG Investment JSC (19.95%). The remaining 27% is held by smaller shareholders, each owning less than 5% of the charter capital.

Established in 2005, Nam Tan Uyen was founded to develop the Nam Tan Uyen Industrial Park, spanning nearly 332 hectares (now fully occupied). From 2010 to 2015, the company expanded with the Nam Tan Uyen Industrial Park Extension project, covering approximately 289 hectares (also fully occupied). Since 2016, the company has been approved for the detailed 1/2000 planning of the Nam Tan Uyen Industrial Park Extension – Phase II, covering 346 hectares.

In terms of business performance, in the first six months of 2025, Nam Tan Uyen generated 277 billion VND in net revenue, a 124% increase compared to the same period last year. After-tax profit reached 169 billion VND, up 29%.

For 2025, Nam Tan Uyen set a business target of nearly 793 billion VND in revenue and 284 billion VND in after-tax profit. Thus, the company has already achieved nearly 60% of its annual profit goal.

Viettel Stocks Surge Against Market Trends

Closing the session on October 20th, the stock prices of Viettel Global (VGI), Viettel Construction (CTR), Viettel Post (VTP), and Viettel Consulting & Design (VTK) collectively surged, with gains ranging from 3.9% to 4.8%.

Vietnam Stock Market Blues: VN-Index Plunges to Record Low, VN30 Sheds Over 100 Points in a Single Session

After two consecutive steep declines, the VN-Index has plummeted by a total of 130 points from its peak. This sharp drop has erased all the gains accumulated since early October.