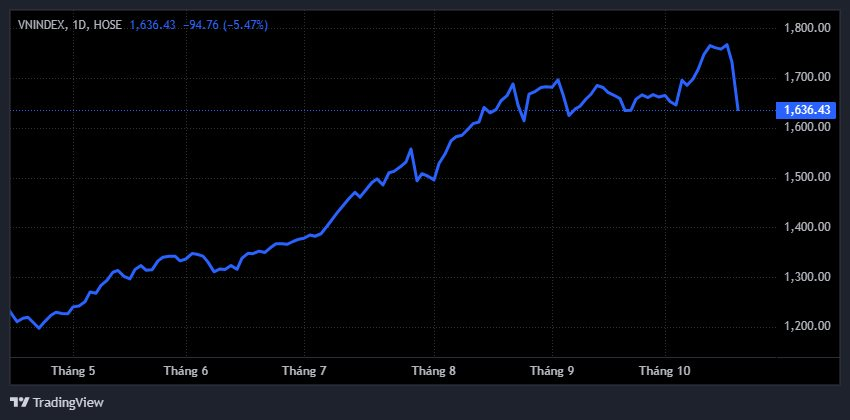

Intense selling pressure weighed heavily on Vietnam’s stock market during the first trading session of the week, setting multiple records. The VN-Index closed with a 95-point drop (-5.47%), falling below 1,636 points. This marks the largest absolute decline in VN-Index history. The last time the index saw a drop exceeding 5% was in early April, when the market was negatively impacted by news of reciprocal tariffs imposed by the U.S.

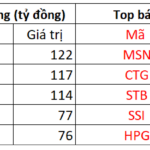

The heavy selling pressure drove nearly 652 stocks into negative territory, with almost 150 hitting their lower limit. Liquidity surged to a record high, with order-matching value on HoSE surpassing 50.3 trillion VND and order-matching volume reaching nearly 1.7 billion shares. Across all three exchanges, total trading value exceeded 53.2 trillion VND.

According to Mr. Do Bao Ngoc, Deputy Director of Kien Thiet Securities, the market showed signs of weakness from the previous week due to concerns about bad debt risks in the global banking system and tensions between the U.S. and China.

Additionally, information about bond activities of several major corporations drew investor attention. Although most involved parties have provided mitigation updates, in a less exuberant market sentiment, such news inadvertently acted as a catalyst, pushing investors into a defensive stance.

Beyond psychological factors and news, market technicals played a significant role in this steep decline. The market had experienced a prolonged uptrend driven by large-cap stocks, particularly in the banking and securities sectors. As the market reached high price levels, margin usage also rose to stressful levels. When leading stocks unexpectedly reversed, numerous accounts faced “margin calls.” Widespread forced liquidations in the afternoon session maximized selling pressure, causing indices to plummet.

Experts note that the VN-Index losing all three moving averages—MA10, MA20, and MA50—signals a formal short-term trend reversal to bearish. Given the current strong downward momentum, further adjustments over the next few sessions are possible before equilibrium is restored.

However, from a long-term perspective, the fundamental factors supporting market growth remain unchanged. Prospects for market upgrades, economic recovery expectations, and positive macroeconomic indicators persist. Thus, this correction appears driven primarily by psychological and technical factors rather than a qualitative shift in market outlook.

Mr. Do Bao Ngoc suggests that with such rapid adjustments, buying interest could soon emerge, establishing a new equilibrium around 1,550 to 1,600 points. Historically, deep sell-offs like this typically last only 1 to 2 sessions, followed by inflows targeting fundamentally strong, heavily discounted stocks.

Amid widespread sell-offs, experts see opportunities for cash-holding investors. Sharp declines create attractive valuations for many stocks with solid fundamentals and positive earnings. Investors should remain calm, avoid emotional decisions, and deploy capital gradually, focusing on long-term potential stocks.

Stock Market Plunges, Trading Volume on HoSE Hits Two-Month High

The VN-Index has plummeted for two consecutive sessions, shedding a total of 130 points from its peak, effectively erasing nearly all gains accumulated over the past month. This sharp decline has instilled a cautious sentiment among individual investors.

Vietstock Daily 21/10/2025: Panic Selling Surges, Short-Term Risks Escalate

The VN-Index plummeted sharply, marked by a long red candle accompanied by a surge in trading volume and a significantly higher number of declining stocks compared to advancing ones, reflecting overwhelming selling pressure across the board. The index breached the 1,700-point threshold, slicing through the Middle Bollinger Band and poised to retest the August 2025 lows (ranging between 1,605–1,630 points). Further compounding concerns, the MACD indicator triggered a sell signal as it crossed below the Signal line, signaling heightened short-term risks.

Vietnam’s Stock Market Poised for Higher Valuations

Vietnam’s economy and stock market have demonstrated remarkable resilience amidst global volatility. However, the current phase demands investors to exercise greater diligence in stock selection. In terms of attracting foreign investment, half of the necessary conditions have already been met.