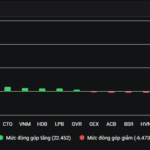

Today’s decline in the benchmark index marks the largest single-day drop in the history of the stock market. For the first time, the VN30-Index plunged by over 100 points. All 30 constituent stocks of the VN30 basket closed in the red, with 13 notable decliners including GVR, MBB, TPB, HDB, MSN, SHB, STB, TCB, VIB, VPB, HPG, SSI, and VRE. The market lacked any significant support to curb the downward spiral of the VN-Index.

Large-cap stocks experienced sharp declines alongside high liquidity, with five stocks trading over 2 trillion VND. Among them, SSI led with more than 2.778 trillion VND in trading value. By the close, several stocks still had millions of sell orders at the floor price, including TPB, HDB, MSN, STB, VPB, SSI, and VRE.

The number of stocks hitting the lower limit was dominant across key sectors such as banking, securities, and real estate, which have been market leaders in recent times. Real estate stocks like GEX, CEO, CII, NVL, PDR, DIG, DXG, KBC, KDH, TCH, HDB, NLG, and IJC were floored, with no buyers and millions to tens of millions of sell orders remaining by the session’s end.

Real estate stocks flooded the floor.

NVL had 19.3 million shares stuck at the floor price with no matching orders. The negative sentiment surrounding NVL began early in the day following news that the Government Inspectorate had transferred case files involving alleged bond-related violations at Novaland and its affiliates to the Ministry of Public Security for further investigation. During today’s session, NVL matched only 1.1 million shares, while sellers aggressively offloaded their holdings.

Findings from the Government Inspectorate’s in-depth investigation into the corporate bond market from 2015 to 2023 revealed that Novaland and its subsidiaries issued a total of 131 bond codes, raising over 67 trillion VND. Several entities were found to have potentially misused the raised capital.

At the close of the October 20 session, the VN-Index fell by 94.76 points (5.47%) to 1,636.43. The HNX-Index dropped 13.09 points (4.74%) to 263.02, and the UPCoM-Index declined 2.36 points (2.09%) to 110.31.

Liquidity surged, with HoSE trading value exceeding 53 trillion VND. Foreign investors net sold over 2.144 trillion VND, primarily in stocks such as MSN, CTG, STB, SSI, and HPG.

Derivatives Market Week 13-17/10/2025: Bulls Take the Crown

On October 10, 2025, both VN30 and VN100 futures contracts surged during the trading session. The VN30-Index experienced a robust rally, marked by a White Marubozu candlestick pattern, while trading volume exceeded the 20-session average, indicating sustained investor enthusiasm.

Stock Market Shatters All Records

The opening session of the week (October 13th) marked a historic milestone for Vietnam’s stock market, as the VN30-Index breached the 2,000-point threshold for the first time ever.