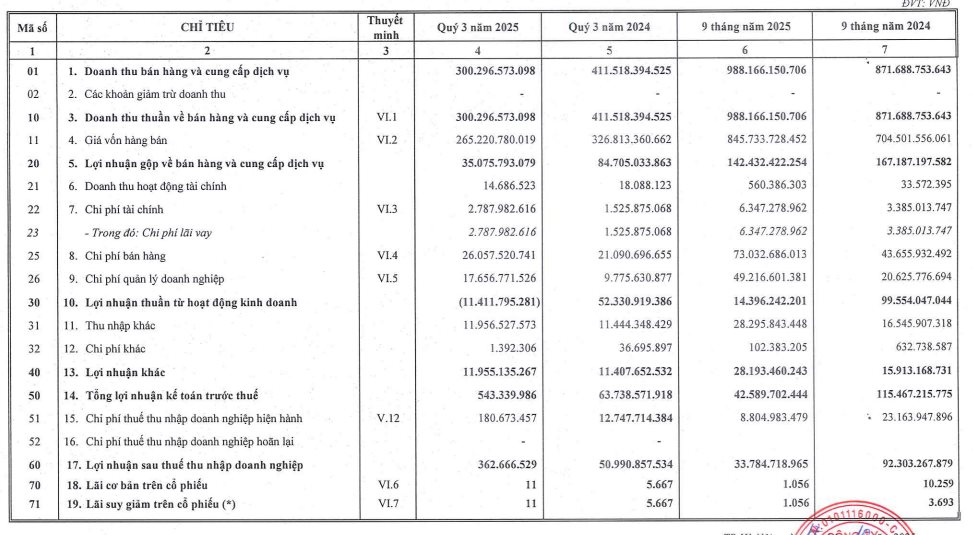

PTM Auto Manufacturing, Trading, and Services Joint Stock Company (Stock Code: PTM) recently released its Q3/2025 financial report. The company’s net revenue reached VND 300 billion, a 27% decline compared to the same period last year.

Cost of goods sold decreased by 19% to VND 265 billion, resulting in a 59% drop in gross profit to VND 35 billion.

During the quarter, PTM’s expenses rose across the board: financial costs increased by 82% to VND 2.8 billion, selling expenses rose by 24% to VND 26 billion, and administrative expenses surged by 81% to nearly VND 18 billion.

Consequently, PTM’s Q3 net profit plummeted by 99% to just VND 363 million, compared to nearly VND 51 billion in the same period of 2024.

The company attributed this decline to ongoing challenges in the automotive market, including fierce competition and weakened consumer demand. These factors led to lower-than-expected sales performance.

Additionally, increased operational costs due to business expansion further squeezed profit margins.

For the first nine months of 2025, cumulative net revenue rose by 13% year-on-year to VND 988 billion. However, net profit for the period dropped sharply by 63% to VND 34 billion, compared to VND 92 billion in the same period of 2024.

As of September 2025, PTM’s total assets grew by 31% to VND 755 billion, primarily driven by a 176% increase in inventory to VND 354 billion.

On the liabilities side, total debt surged 2.6 times since the beginning of the year to VND 287 billion, with short-term loans rising from VND 26 billion to over VND 180.5 billion.

PTM is a subsidiary of HAXACO (Stock Code: HAX), Vietnam’s leading distributor of Mercedes-Benz vehicles. PTM specializes in distributing MG vehicles through a strategic partnership with SAIC Motor Vietnam, holding approximately 40% of the MG distribution market share.

The company operates 14 authorized MG dealerships and 2 affiliated dealerships nationwide.

PTM was first listed on HNX in 2009, then moved to UPCoM in 2015. However, its trading was suspended on UPCoM in late 2018 due to non-compliance with public company requirements.

On August 22, 2025, 32 million PTM shares resumed trading on UPCoM with an initial reference price of VND 20,000 per share. As of October 17, the stock closed at VND 15,400 per share.

KienlongBank Surges Ahead with Strategic Milestones, Shattering 30-Year Profit Records and Leading Market Momentum

KienlongBank (Kien Long Commercial Joint Stock Bank; UPCoM: KLB) has recently unveiled its Q3 2025 business results, reporting a consolidated pre-tax profit of VND 616 billion. Key performance indicators, including total assets, mobilized capital, and outstanding loans, have all surged significantly, nearing annual targets. This impressive growth underscores the bank’s robust management capabilities and clear strategic direction.

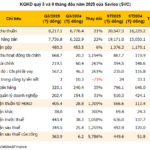

Savico’s Q3 Profits Surge 5,800%, Stock Hits Consecutive Upper Limits

Savico (HOSE: SVC) reported record-breaking Q3/2025 profits, surpassing all previous years by a significant margin. This remarkable achievement was driven by a one-time financial gain of VND 537 billion from the divestment of a real estate project.