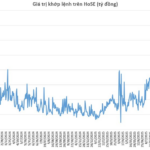

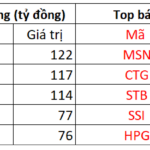

Closing the session on October 20, the VN-Index retreated to 1,636 points, marking a record decline of 94.76 points (-5.47%). Trading volume surged, with over 1.7 billion units traded on HOSE, corresponding to a value of more than 53 trillion VND.

After two consecutive sessions of decline, the stock market has shed a total of 130 points from its peak, equivalent to a discount of nearly 8%. This plunge has wiped out all the gains achieved since the beginning of October.

Amidst the intense volatility, it’s understandable for investors to feel anxious, but emotional decisions can put them at a disadvantage. So, what’s the most rational strategy right now?

To provide investors with additional insights, we had a discussion with Mr. Nguyễn Trọng Đình Tâm – Deputy Director of the Analysis Division at ASEAN Securities Corporation.

In your opinion, what caused the sudden selling pressure in the stock market? Does this sharp correction indicate underlying risks, or is it merely a technical adjustment?

Mr. Nguyễn Trọng Đình Tâm: The news of inspections into bond issuance activities at certain companies has fostered a cautious trading sentiment in the market. Additionally, the market index had not experienced any significant corrections since April 2025, leading to a buildup of selling pressure. This pressure intensified when less favorable information emerged.

Looking back at the explosive rally of 2021, the market witnessed several large fluctuations accompanied by heavy selling pressure on many stocks, most notably in the period leading up to the 2021 Lunar New Year.

However, these periods are necessary to absorb selling pressure and create buying opportunities for new capital. It’s important to note that the later a correction occurs within an uptrend, the greater the volatility.

Based on (1) technical factors (Elliot Wave patterns) and (2) fundamental factors (market-wide profit growth), I believe this strong volatility is still a technical correction within the broader uptrend of the market.

After the record decline, what’s your prediction for the VN-Index?

Mr. Nguyễn Trọng Đình Tâm: The VN-Index is likely to continue its downward momentum at the start of the next session (October 21) before stabilizing around the accumulation zone formed in September 2025. The near support level for the index is around 1,600 +/- points, while the near resistance is at 1,650 +/- points.

Although the market may experience technical rebounds after this volatile session, the formation of a solid bottom for the VN-Index needs to be confirmed by classic technical patterns (such as Bullish Engulfing or Hammer candles accompanied by explosive volume).

From a medium-term perspective, the market will resume its upward trajectory after the current correction, supported by favorable macroeconomic conditions, attractive market valuations, and the momentum from the potential market upgrade.

It’s highly likely that the VN-Index will continue to set new highs in late 2025 and early 2026, with the first target zone around 1,800 points.

Which sectors are likely to recover first once the market stabilizes?

Mr. Nguyễn Trọng Đình Tâm: Before the VN-Index’s first recovery, the strongest stocks from the previous phase tend to stop declining and recover first, such as those in the Vingroup and Vietjet groups.

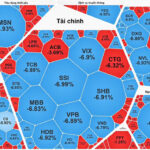

However, during the phase when the market forms a solid bottom (expected 1 to 3 weeks after the first recovery), other sectors may take the lead. Typically, these are familiar sectors like Banking, Securities, and Real Estate. These sectors are projected to achieve double-digit profit growth in 2025. Additionally, Securities stocks often move in sync with the broader market.

It’s also important to note that not all stocks within a sector will follow the same trend, as this depends on the supporting narrative at any given time. For example, since the beginning of 2025, private commercial bank stocks have attracted more capital compared to state-owned commercial bank stocks.

Market downturns are always a “test” for individual investors’ psychology. What’s the most common mistake they should avoid?

Mr. Nguyễn Trọng Đình Tâm: I believe the most crucial aspect of stock investing is portfolio management. After today’s decline, many investors are seeking new information to explain the market’s state, but this isn’t very productive when many stocks have already hit their lower limits. Moreover, much of the information and data are beyond an investor’s ability to grasp, forecast, or estimate.

Instead of searching for explanations, investors should proactively manage their portfolios by setting predefined stop-loss and take-profit points.

For example, if an investor buys a stock expecting a 21% profit and applies a 1:3 risk/reward ratio, the appropriate stop-loss level is 7%. If the stock drops more than 7%, the investor should execute a stop loss to preserve portfolio value. Similarly, if the investor has already made 18% profit, they can set a take-profit level at +15% and lock in gains if the price falls below this threshold.

Furthermore, a common psychological trap in stock investing is waiting for a stock to appear “safe” before buying, often signaled by a strong upward trend. This is illogical, as a low cost basis is the best way to ensure portfolio safety.

What actions should individual investors prioritize to protect their portfolios?

Mr. Nguyễn Trọng Đình Tâm: Investors who bought stocks at high prices and are currently at a short-term loss can sell a portion at the start of the October 21 session, then wait for a rebound to manage their positions, avoiding panic selling at any cost.

Investors with a high cash ratio will naturally have more flexibility. They can gradually open positions in sectors that consistently attract significant capital (such as Banking, Securities, and Real Estate), while avoiding companies facing bond-related issues.

For investors heavily in the red, now is the time to reevaluate their buying strategies and portfolio management methods. Simply put, if we’ve made substantial profits over several months, one day of heavy losses shouldn’t be too alarming.

Market Plunges by Nearly 95 Points: What Are Brokerages Saying?

Securities companies advise investors to prioritize reducing margin levels or bringing them back to a safe ratio, emphasizing that panic selling is unnecessary.

Market Plunge: Stocks Tumble Nearly 95 Points, Leaving Investors Stunned

The stock market plummeted dramatically in the final minutes of the session, marking the steepest decline in history, with 150 stocks hitting their lower limit.