|

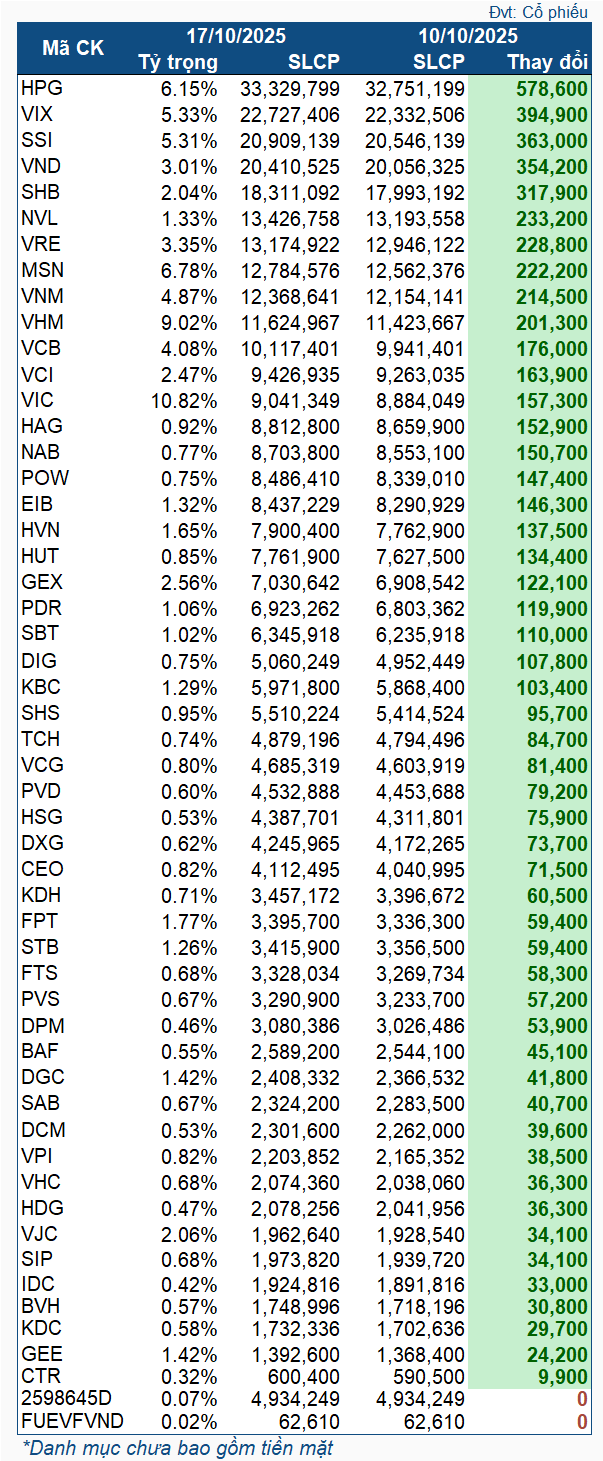

VNM ETF Stock Changes for the Week of October 10-17, 2025

|

The VNM ETF continued its net buying streak last week. The most heavily purchased stock by volume was HPG, with 578,600 shares. This was followed by VIX, SSI, and VND, each with over 350,000 shares bought. SHB also saw significant net purchases, with 317,900 shares.

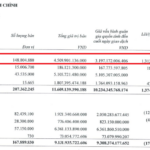

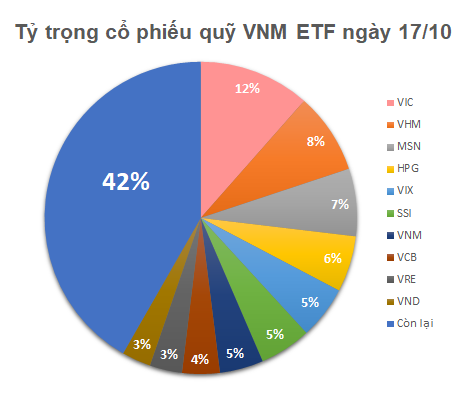

As of October 17, the total asset value of the VNM ETF surpassed $611 million, a notable increase from the $590 million recorded on October 10. Assets are allocated across 51 stocks, 1 fund certificate, and 1 stock warrant. The top holdings by weight are VIC at 11.5%, followed by VHM (8.39%), MSN (6.99%), HPG (5.81%), and VIX (5.48%).

– 12:00 October 22, 2025

Foreign ETFs Rebound with Net Buying Surge in Upgrade Week

During the week of October 6–10, the VanEck Vectors Vietnam ETF (VNM ETF) reversed its net selling trend, pivoting to robust buying of Vietnamese stocks. This shift coincided with FTSE Russell’s official announcement on October 8, upgrading Vietnam’s market classification from Frontier to Secondary Emerging status.

Dragon Capital Securities Completes Settlement of VND 900 Billion Bond Lot

On October 9, 2025, Rong Viet Securities successfully settled its VDSH2425004 bond issuance, repaying the principal amount of VND 900 billion and accrued interest of nearly VND 6.1 billion in full and on schedule.

VIX Reaps Massive Profits from Proprietary Trading and Margin Lending: Unveiling Its Current Portfolio Holdings

VIX Securities Corporation (HOSE: VIX) concluded Q3/2025 with a remarkable post-tax profit of over VND 2.449 billion, a ninefold increase year-on-year, driven by strong performance in proprietary trading and margin lending. This outstanding result propelled the company’s nine-month cumulative profit to over VND 4.1 trillion, setting a new record for VIX.