Source: VietstockFinance

|

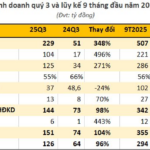

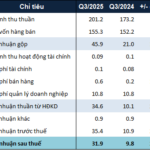

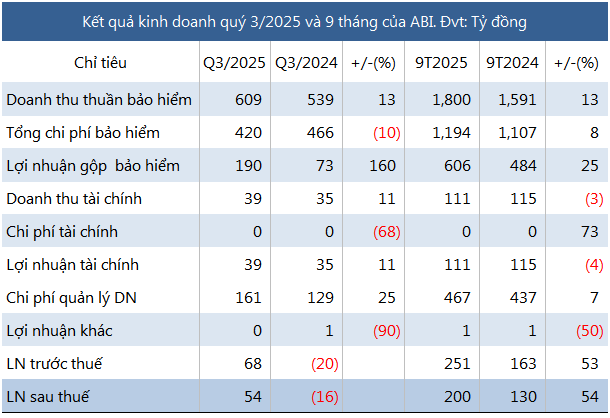

According to the Q3/2025 financial report, ABI’s net insurance revenue reached VND 609 billion, a 13% increase year-over-year. Within this, gross insurance premiums rose by 15% to nearly VND 614 billion, while reinsurance costs climbed 32% to approximately VND 113 billion.

Total insurance operating expenses decreased by 10% to VND 420 billion, primarily due to a 23% reduction in claims expenses, which fell to nearly VND 226 billion. As a result, gross profit from insurance operations surged 2.6 times compared to the same period last year, reaching VND 190 billion.

Financial activities also showed positive results, with gross profit increasing by 11% to VND 39 billion, mainly driven by income from term deposits.

Thanks to improvements in both business segments, despite a 25% rise in corporate management costs to VND 161 billion, ABI recorded a net profit of VND 54 billion, reversing the VND 16 billion loss from the same period last year.

In the first nine months of 2025, ABI achieved a net profit of VND 200 billion, a 54% increase year-over-year. Gross profit from insurance operations grew by 25% to VND 606 billion, while financial profits slightly decreased by 4% to VND 111 billion.

Compared to the minimum pre-tax profit target of VND 315 billion for 2025, ABI has achieved 80% of its goal after nine months.

As of September 30, 2025, ABI’s total assets exceeded VND 4,600 billion, a 7% increase from the beginning of the year. Term deposits over three months rose by 9% to nearly VND 3,446 billion, accounting for 74% of total assets.

Reinsurance assets increased by 6% to nearly VND 428 billion, including reinsurance premium reserves of over VND 191 billion (up 11%) and reinsurance claim reserves of nearly VND 236 billion (remaining stable).

ABI’s liabilities are all short-term, totaling over VND 2,900 billion, a 5% increase from the beginning of the year. Insurance reserves constitute the largest portion—approximately 70% of total liabilities, reaching over VND 2,400 billion, a 4% increase.

Author: Khang Di

– 13:58 22/10/2025

Sao Ta Shrimp Company’s Profits Surge Despite Facing Over 100 Billion VND in Countervailing Duties

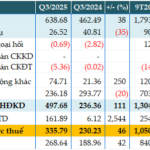

Fimex VN (HOSE: FMC), a leading shrimp processor and exporter, has announced its Q3 2025 consolidated net revenue of VND 2.98 trillion, marking a 5% year-on-year increase. The company also reported a net profit of VND 97 billion, reflecting a significant 22% growth compared to the same period last year.

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.

VietABank Slashes Operating Costs, Boosts Q3 Pre-Tax Profit by 46%

VietABank (HOSE: VAB) has reported a pre-tax profit of nearly VND 336 billion in Q3/2025, marking a 46% year-on-year increase. This impressive growth is attributed to the bank’s successful reduction in operational costs, as revealed in its recently released consolidated financial statement.