According to Mr. Nguyen Quoc Anh, the reported average price of new condominium launches at 100 million VND/m² primarily reflects newly launched projects. However, many existing properties in several districts still trade below this threshold. A notable trend is the shift from central areas to suburban locations.

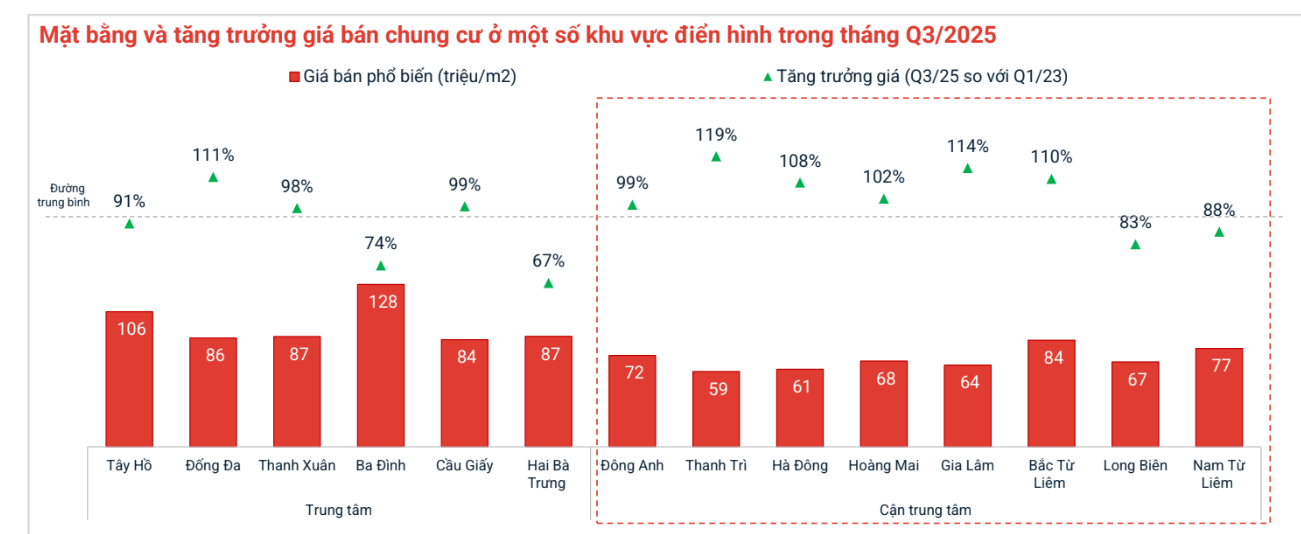

For instance, while the average price in Tay Ho District stands at approximately 106 million VND/m², other areas like Bac Tu Liem (84 million VND/m²), Long Bien (67 million VND/m²), and Nam Tu Liem (77 million VND/m²) offer more affordable options. This indicates that both new and older condominiums are available below 100 million VND/m².

Another concern raised by Mr. Quoc Anh is the rapid price growth in non-central districts, which has sparked investor apprehension. For example, Thanh Tri District saw a 119% increase, with an average price of 60 million VND/m², while Gia Lam District rose by 114%, reaching 67 million VND/m².

Condominium prices in Thanh Tri and Gia Lam surged in Q3/2025 compared to Q1/2023.

Amidst this rapid price escalation, Mr. Quoc Anh notes that investors are questioning whether the market is approaching its peak. A bi-annual survey by batdongsan.com on consumer behavior in Q1/2025 included 57% male and 43% female respondents, with 83% aged 18–44—a demographic actively engaged in real estate. Thirty-four percent were from Hanoi, and 27% from Ho Chi Minh City.

Sixty-five percent of respondents reported monthly incomes between 15–50 million VND, a common range in the market. When asked about recent real estate transactions, 55% had purchased property, 10% had sold, and 64% bought for personal use, while 36% invested.

“These responses reflect survey participants and may not represent the entire market,” Mr. Quoc Anh clarified. The most sought-after property types were condominiums (34%), land (33%), and private houses (21%).

Looking ahead, 31% of respondents plan to invest in condominiums in the next 12 months. Notably, interest in private houses (33%) has surpassed land, which has seen a significant decline in popularity. This shift underscores a growing focus on residential properties and stable investments, particularly among investors.

$5 Billion Highway Expansion: Saigon Bridge to Tan Van Interchange Set to Widen to 16 Lanes

The Hanoi Highway Expansion Project spans a total length of 15.7 km, extending from Saigon Bridge to the Tan Van Interchange. The expansion is designed to accommodate 12 to 16 lanes, with a total investment of nearly 5 trillion VND.

Five-Year Ban Proposed for Land Auction Defaulters by the Ministry of Justice

The Ministry of Justice has proposed stringent penalties for bidders who default on land auctions, including a ban from participating in future auctions for a period ranging from 6 months to 5 years. Additionally, defaulters will be required to fully compensate for any damages incurred as a result of their non-compliance.

Urban Darkness: Addressing the “No Streetlights” Crisis and Strategies to Stabilize Housing Prices

Amidst the growing concern of numerous new urban developments lying eerily vacant despite their modern infrastructure, Dr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Association, has proposed six comprehensive solution groups aimed at restoring housing prices to a reasonable level.

Potential 5-Year Ban on Land Auctions for Defaulting Bidders; Proposal to Increase Deposit to 50%

The Ministry of Justice has proposed stringent penalties for individuals who default on land auction deposits, including a ban on participation in future auctions for a period ranging from 6 months to 5 years. Additionally, defaulters will be required to fully compensate for any damages incurred as a result of their actions.