Mr. Le Ngoc Lam, CEO of BIDV. Photo: Forbes.

Speaking at the 2025 Business Forum: Pivoting for Growth, hosted by Forbes Vietnam, Mr. Le Ngoc Lam, CEO of BIDV, emphasized that banks are actively seeking viable projects and businesses for loan disbursement. The government and the State Bank have also relaxed credit limits, facilitating capital flow into production.

Regarding current interest rates, Mr. Lam noted that Vietnam’s rates are significantly lower than those in the region and globally. This creates a favorable environment for increased business investment.

As a leading state-owned financial institution with the largest credit market share, BIDV consistently allocates capital to support business investments, particularly those integrated into global supply chains. The bank offers diverse short-, medium-, and long-term credit packages to drive innovation, technology adoption, and enhanced production capabilities, ultimately boosting global value chain participation.

However, Mr. Lam highlighted a critical challenge akin to the “chicken or egg” dilemma. Businesses aiming to join global supply chains often must invest upfront to demonstrate capability and product quality before securing output contracts. Banks, meanwhile, hesitate to lend without clear revenue agreements. A potential solution involves government-backed guarantee funds or support mechanisms to encourage bold investments in global supply chains.

“Banks are eager to lend and finance,” Mr. Lam stressed, addressing how businesses can access capital. He outlined key requirements for bank financing: strengthening financial capacity, ensuring transparent financial systems, improving corporate governance with international standards, meeting ESG criteria in business strategies, and presenting clear, viable business plans to build bank confidence.

“With transparency and concrete plans, banks can confidently provide financing,” he added.

BIDV is also a seasoned lender for infrastructure and construction projects, particularly in transportation and energy. These BOT projects often require long-term financing, and BIDV can provide capital for up to 15–20 years.

The bank raises capital through various channels, including bond issuance, foreign loans, and other long-term sources. However, operating in a market-driven environment, offering preferential loans as investors expect is challenging. Mr. Lam suggested that state support and partnership mechanisms are essential to encourage infrastructure investment.

“PPP mechanisms are now much clearer. In a project, government funding, the company’s equity (around 15%), and bank financing are combined. Banks evaluate project viability and may recommend adjustments to ensure debt serviceability, including increasing government support if needed.”

Some transportation BOT projects now benefit from government revenue guarantees. If actual revenue falls short of projections, the government covers the shortfall, ensuring debt repayment and providing assurance to investors and banks,” Mr. Lam explained.

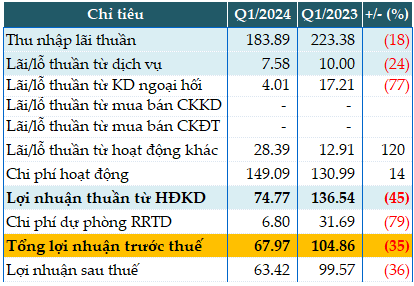

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.

BIDV CEO: All Banks Aiming for Credit Growth

BIDV’s CEO, Mr. Le Ngoc Lam, asserts that Vietnam’s current interest rate landscape is highly competitive compared to regional and global standards. This favorable environment, coupled with the State Bank’s unrestricted credit limits, presents an opportune moment for businesses to ramp up their investments.