In its latest announcement, Tien Phong Securities Joint Stock Company (TPS, code ORS) released its Q3/2025 financial report, revealing an operating revenue of VND 356 billion, a 34% decline compared to the same period last year. Consequently, TPS’s pre-tax profit decreased by 19% year-on-year to VND 134 billion. The Q3 earnings helped TPS offset all losses incurred in the earlier months of 2025, with a cumulative nine-month pre-tax profit of nearly VND 34 billion.

Alongside its business recovery, TPS also unveiled plans to expand into the digital asset sector. Recently, the company approved the establishment of Tien Phong Digital Asset Company.

The newly founded company, officially named Tien Phong Digital Asset Technology Joint Stock Company, has a chartered capital of VND 120 billion. Established on October 14, 2025, its headquarters are located on the 11th floor of Doji Tower, 5 Le Duan Street, Hanoi.

Tien Phong Digital Asset’s primary business activities include commercializing scientific research results, technology development, and innovation; investing in technology incubation centers and science and technology enterprise incubators.

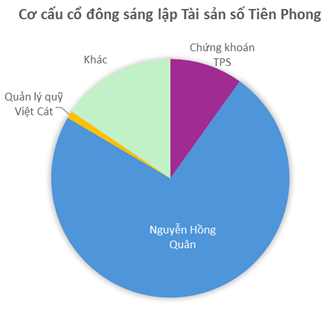

Regarding the founding shareholder structure, TPS holds 10% of the capital, equivalent to VND 12 billion. TPS Chairman Nguyen Hong Quan owns 74.3% of the capital, valued at over VND 89 billion. Mr. Quan also serves as the Chairman of Tien Phong Digital Asset Company.

Viet Cat Fund Management JSC, a subsidiary of Tien Phong Bank (TPBank), contributed VND 1.2 billion, holding 1% of the capital.

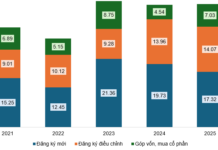

Prior to TPS, several major players in the securities industry have ventured into the digital asset space following the issuance of Resolution No. 5/2025/NQ-CP on September 9, 2025, by the Vietnamese Government, which pilots the cryptocurrency market in Vietnam. Companies such as Techcom Securities (TCBS), SSI, VPBank Securities, HD Securities, and VIX Securities have established legal entities and invested in domestic digital asset exchange operators. These organizations are gearing up for a long-term competition in a new arena with the potential to shape the future of digital capital.

Exclusive Discounts for Shareholders: Real Estate Firms Roll Out Special Home Purchase Offers

Many listed real estate companies are expanding their policies to offer shareholders incentives when purchasing project products. While this strategy isn’t new, experts caution it carries inherent risks related to developer capability, project legality, and scalability, as not all businesses can effectively implement it.

“Rapidly Grown Yet Cash-Strapped: This Company Eyes Acquisition of Dai Nam KDC, Owned by Husband of Nguyen Phuong Hang”

Once a prominent player in the mid-to-high-end market with a series of standout projects, Danh Khôi Group (NRC) now finds itself with only a few hundred million in cash and stalled projects. Despite its current challenges, the group once surprised investors with its bold move to acquire a portion of Đại Nam Tourism Complex from Huỳnh Uy Dũng (known as Dũng “Lò Vôi”).

Vietnam Establishes New Growth Model

Vietnam pioneers a groundbreaking approach by consolidating three key documents into one, establishing a new growth model, comprehensive institutional reforms, and paving the way for a development phase driven by science, technology, and human-centric innovation.