The stock market showed promising signs of recovery on October 21st, rebounding from a record-breaking decline earlier in the week. Key stock groups experienced robust growth, propelling the VN-Index up by 27 points to close at 1,663.43. Foreign trading activity emerged as a highlight, with a significant net buying surge of VND 2,476 billion across the market.

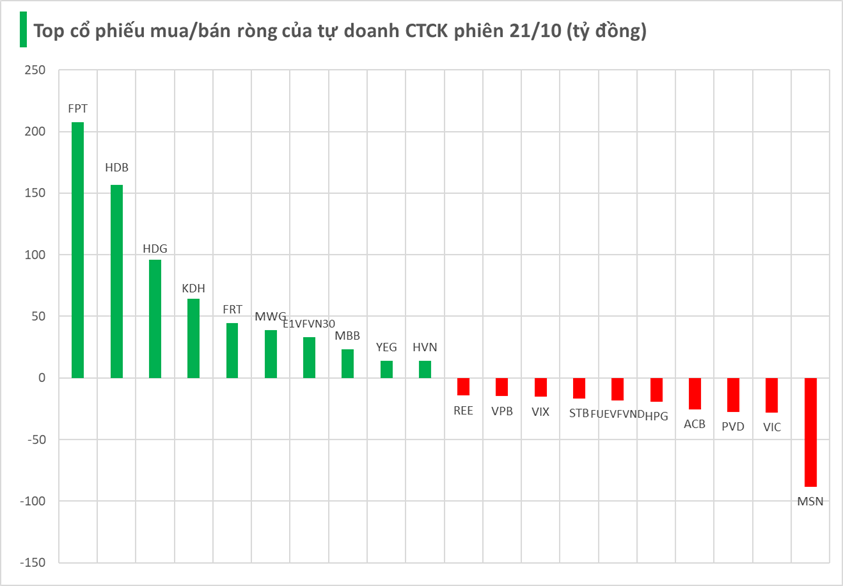

Securities firms continued their net buying trend, acquiring VND 434 billion on HOSE.

Specifically, FPT led the net buying with VND 208 billion, followed by HDB (VND 157 billion), HDG (VND 96 billion), KDH (VND 64 billion), FRT (VND 44 billion), MWG (VND 39 billion), E1VFVN30 (VND 33 billion), MBB (VND 23 billion), YEG (VND 14 billion), and HVN (VND 14 billion).

Conversely, securities firms heavily sold off MSN, with a net value of -VND 88 billion, followed by VIC (-VND 28 billion), PVD (-VND 28 billion), ACB (-VND 25 billion), and HPG (-VND 19 billion). Other notable net sell-offs included FUEVFVND (-VND 18 billion), STB (-VND 17 billion), VIX (-VND 15 billion), VPB (-VND 15 billion), and REE (-VND 14 billion).

What Lies Ahead for the Stock Market After the ‘Dark Day’?

Robust buying momentum in the afternoon session bolstered the VN-Index’s recovery, driven notably by the resurgence of large-cap stocks. The VN30-Index surged over 45 points, with FPT and HDB hitting their daily limits.

Vietstock Daily 22/10/2025: Bottom-Fishing Demand Emerges

The VN-Index rebounded after successfully testing its August 2025 low (around 1,605-1,630 points). If this level holds, short-term recovery prospects look more promising. However, the risk of a correction remains as the MACD and Stochastic Oscillator indicators continue to weaken following strong sell signals.

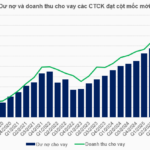

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.