Triều An Hospital’s Q3 2025 Financial Report Highlights Impressive Growth

Trieu An General Private Hospital Joint Stock Company (Triều An Hospital), chaired by Mr. Tram Be, has released its Q3 2025 financial report, showcasing remarkable business growth. The hospital’s after-tax profit surged to nearly VND 32 billion, a 3.2-fold increase compared to the same period last year.

This growth is primarily driven by a 16% rise in net revenue, reaching over VND 201 billion. Meanwhile, the cost of goods sold increased only slightly by 2% to VND 155 billion, significantly improving the gross profit margin.

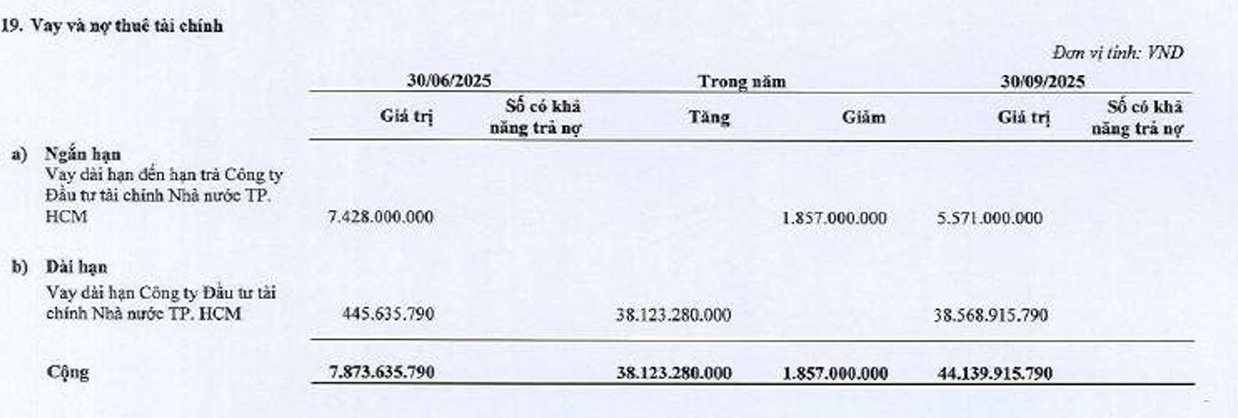

Beyond the business results, a notable change in the debt structure is evident on the balance sheet.

Debt Structure Changes in Q3 2025

Specifically, as of September 30, 2025, Triều An Hospital’s total loans and financial leases surged to VND 44.1 billion, a 5.6-fold increase from VND 7.8 billion at the end of Q2 2025. The entire debt is owed to HCMC State Financial Investment Company (HFIC). This rise is primarily due to a new long-term loan of over VND 38.1 billion from HFIC during the quarter.

The increase in borrowing corresponds with a significant shift in assets. According to the financial report, the “Short-term Advances to Suppliers” category soared by 120% in just three months, from VND 36.9 billion to VND 81.1 billion. The majority of this increase is attributed to advances to Amec Holdings Co., Ltd., which rose sharply from VND 31.7 billion at the end of Q2 to VND 74.1 billion at the end of Q3.

The purpose of this capital was clarified in the 2025 Annual General Meeting (AGM) documents. The Board of Directors proposed a plan to borrow VND 70 billion from HFIC for the “New Medical Equipment Procurement Project,” totaling VND 105 billion. The loan term is expected to be 7 years (2025–2032).

This project aligns with the “MS-01 Package: Supply and Installation of Medical Equipment for Triều An Hospital,” valued at VND 105.9 billion, which the Amec Holdings – Duy Minh Consortium won in February 2025. Key equipment includes a Photon-Counting CT System from Siemens Healthcare (Germany), a Digital Mammography System from Genoray (South Korea), and an ENT Endoscopy System from Olympus.

Excerpt from Resolution No. 09/2023/NQ-HĐND of the HCMC People’s Council, Appendix 1

The loan is part of HCMC’s interest support program under Resolution No. 09/2023/NQ-HĐND. HFIC is tasked with lending to priority sectors, including healthcare. The resolution provides 50–100% interest support for healthcare projects, with a maximum loan amount of VND 200 billion per project for up to 7 years.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.