According to Q3/2025 data from batdongsan.com.vn, interest in real estate sales is recovering, with condominiums leading the way and townhouses and private homes showing signs of improvement.

Prices continue to rise, posing affordability challenges for middle and low-income earners. This trend may persist if legal and supply bottlenecks remain unresolved, making sales more difficult.

Amid cash flow pressures and large inventories, many developers are seeking to stimulate demand and expand their customer base, including corporate shareholders.

Discounts for Shareholders Buying Property

At Dat Xanh Group’s (HOSE: DXG) 2025 Annual General Meeting in May, Strategic Council Chairman Luong Tri Thin announced that the company had nearly completed 15,000 units, sufficient for the 2025-2027 sales period. For the first phase of The Privé project, DXG shareholders can receive discounts and incentives.

Under the first sales policy, shareholders owning 10,000 shares of DXG or DXS receive a 2% discount on apartments priced from 99 million VND/m². However, this policy only applied to the first phase and has since been suspended. In the second phase, buyers with residency or employment in Hanoi and the new Ho Chi Minh City (post-merger) will receive a 2% discount, with prices ranging from 120-130 million VND/m² (excluding VAT), a 20-30% increase, expected to launch in October.

The Privé (formerly Gem Riverside), covering 6.7 hectares in Nam Rach Chiec Urban Area, Thu Duc, was initially launched in 2018 with 8 towers and 2,100 units, priced at 37-40 million VND/m². After canceling purchase agreements with buyers, DXG revised the project’s plan, increasing density to 12 towers with 3,175 units.

First-phase sales policy for The Privé project by DXG

|

In June 2025, Tan Tao Investment and Industrial Corporation (UPCoM: ITA) announced a “special incentive” for shareholders purchasing land plots in the An Khang area of E.City Tan Duc “City of Knowledge and Culture.”

Shareholders buying land receive a 2% discount on the sale price. For the first 50 plots, an additional 12% discount applies if paid within 12 months, or 8% within 18 months. Transfer fees are 2% of the transfer value.

E.City Tan Duc, covering nearly 166 hectares in Duc Hoa Ha and Huu Thanh communes, Duc Hoa district, Long An (now Tay Ninh), is priced at 23 million VND/m², below the local market rate of 25-28 million VND/m².

Shareholders Need Not Be Direct Buyers

Since 2024, many listed companies have offered special discounts to shareholders purchasing their real estate products.

Truong Anh Tuan, Chairman of Hoang Quan Real Estate (HOSE: HQC), announced at the 2024 AGM that HQC shareholders would receive a 1% discount on social housing and low-income housing.

This discount can be applied directly to the sale price or as cash. Notably, the policy applies to shareholders holding even a single share.

Shareholders need not be direct buyers. If a shareholder refers a friend who purchases a property, both the shareholder and the buyer receive a 1% discount upon confirmed referral.

In mid-September, Hoang Quan Land (also chaired by Tuan) announced a 2% discount for shareholders buying properties developed by Hoang Quan, valid until year-end.

In September 2024, Phat Dat Group (HOSE: PDR) announced a loyalty program for shareholders marking its 20th anniversary.

Shareholders holding at least 50,000 PDR shares for six months receive an 8% discount, combinable with other project incentives. This applies to projects like Bac Ha Thanh Urban Area (former Binh Dinh) and Thuan An 1 and 2 complexes (former Binh Duong).

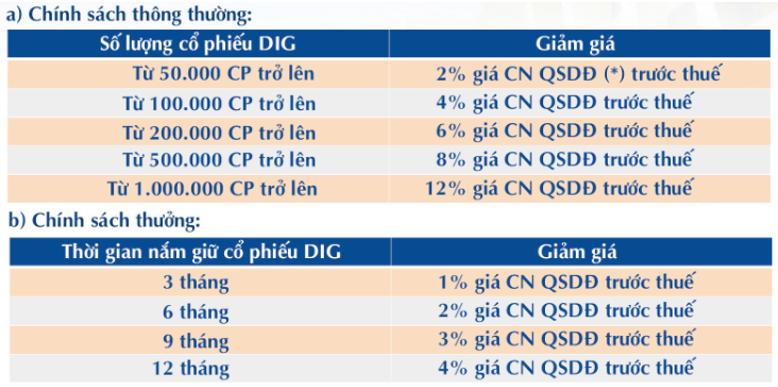

Last year, DIC Corporation (HOSE: DIG) approved the sale of 599 land plots in DIC Victory City Hau Giang at 12 million VND/m².

Shareholders holding 100,000 DIG shares for a year receive an 8% discount, increasing to 16% for those holding 1 million shares.

Incentives for shareholders in the third phase of DIC Victory City Hau Giang. Photo: DIG

|

DIG CEO Nguyen Quang Tin stated the policy strengthens shareholder ties and encourages long-term investment. It will be extended to projects like ATA Phu My, Cap Saint Jacques Complex, DIC Lantana City Ha Nam, and DIC Nam Vinh Yen, Vinh Phuc.

Shareholder Discounts Do Not Create Real Demand

According to Dinh Minh Tuan, Sales Director at Batdongsan.com.vn, shareholder discounts help companies sell inventory and retain investors.

However, Tuan notes this model is not easily scalable. Companies must be listed, have available inventory, and a strong market reputation. “Financial investors prefer liquidity, while real estate is long-term, making this a challenging strategy for companies.”

Market experts argue these discounts do not create real demand, as most shareholders invest in stocks, not property. This is a marketing tool to build trust, targeting short-term investors rather than genuine homebuyers.

Tuan emphasizes real estate investment risks. Even with permits, buyer risks persist if developers lack construction capacity.

Buyers must assess project legality, regardless of discounts. For transparent companies, combining discounts with financial investment can be viable.

“Risks lie in developer capacity and project legality, not discounts. Discounts are like vouchers; ultimate responsibility rests with buyers,” Tuan concludes.

Widespread adoption is unlikely, as this policy suits specific companies, not the entire market.

“Stock and real estate investors have different preferences. Discounts often come with conditions, limiting eligibility,” experts analyze.

– 12:00 21/10/2025

“Rapidly Grown Yet Cash-Strapped: This Company Eyes Acquisition of Dai Nam KDC, Owned by Husband of Nguyen Phuong Hang”

Once a prominent player in the mid-to-high-end market with a series of standout projects, Danh Khôi Group (NRC) now finds itself with only a few hundred million in cash and stalled projects. Despite its current challenges, the group once surprised investors with its bold move to acquire a portion of Đại Nam Tourism Complex from Huỳnh Uy Dũng (known as Dũng “Lò Vôi”).

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?