Just a few days ago, a brief conversation between two major investors—one specializing in real estate and the other deeply immersed in stocks—revealed intriguing insights into year-end investor psychology.

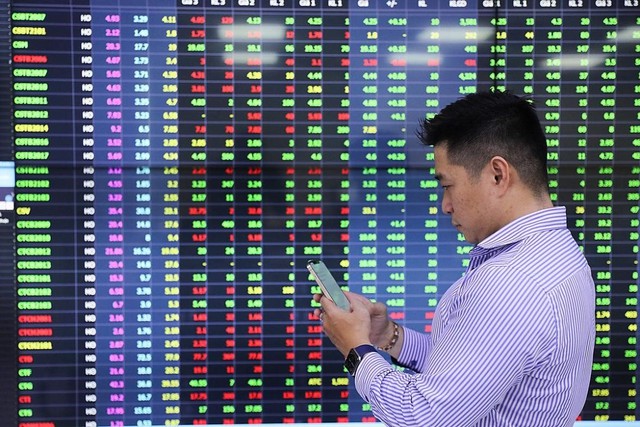

“About five days ago, a real estate investor friend called me, saying stocks were surging and he wanted to shift some capital into the market. I just smiled and thought, ‘Here we go—when a ‘shark’ who’s only known real estate starts asking about stocks, it’s time to exit.’ Sure enough, days later, the VN-Index plunged nearly 100 points,” recounted Mr. T.

According to Mr. T, herd mentality remains the most dangerous catalyst in the stock market. “Everyone fears missing out (FOMO), but they forget that when everyone’s euphoric, risk is at its peak. Markets operate in cycles: those who enter last often pay the price,” he shared.

The October 20th trading session ended with a historic shock as the VN-Index plummeted nearly 95 points (5.47%), closing at 1,636.43—the steepest decline in Vietnam’s stock market in 25 years. Panic gripped the market, with hundreds of stocks hitting their lower limits, particularly in banking, real estate, and securities sectors. Many individual investors saw hundreds of millions, even billions, vanish in a single session.

In the morning session of October 21st, despite the VN-Index briefly rising by 28 points, widespread selling pressure reversed the trend, pushing the index back to 1,630 points.

According to Mr. Phan Dũng Khánh, Investment Advisory Director at Maybank Investment Bank, this phase tests the resilience of long-term investors as market capital sharply divides across investment channels.

Mr. Khánh noted that the VN-Index’s recent surge resulted from multiple factors: expectations of market upgrades, abundant domestic capital, and investor optimism following economic recovery. However, he emphasized that effective investing should focus on medium to long-term horizons, not short-term speculation.

“Markets always correct, but looking further ahead, growth potential remains vast. The key is to commit to the long haul—each correction becomes an accumulation opportunity,” Mr. Khánh stressed.

Nonetheless, the expert warned of a resurgence in “speculative waves,” particularly in stocks rising unusually fast relative to corporate fundamentals.

“Short-term investors must stay alert with overheated stocks. Those who enter last often pay the price. Even as markets peak, many investors remain unprofitable due to poor timing or stock selection,” he noted.

Following the hot streak, investment capital is shifting from speculative groups to safer channels like gold, real estate, and fundamentally strong stocks.

While stocks have risen 38% year-to-date, gold and silver surprised with 50–60% gains, outpacing deposit rates and USD appreciation.

According to Mr. Phan Dũng Khánh, this reflects investors’ defensive stance amid complex geopolitics and persistent inflation. “Gold isn’t just a haven in uncertainty—it’s a portfolio balancer. Those holding since the year’s start have profited handsomely,” he said.

However, he cautioned that buying gold at high prices warrants careful consideration. While asset preservation is feasible, short-term speculation carries significant risk.

As for silver, though also in a strong uptrend, its pace lags far behind gold. Mr. Khánh pointed out that while gold has consistently hit new highs over the past three years, silver took 14 years to return to its peak price.

“This underscores gold’s primacy as a haven and long-term asset accumulator, while silver, though appealing short-term, remains largely speculative,” Mr. Khánh assessed.

Real estate remains a long-term asset class, not a short-term race.

Regarding real estate, Batdongsan.com.vn data shows that apartment searches in Q3/2025 rose 22%, while detached homes increased 15%, indicating capital returning to segments with genuine demand.

Mr. Nguyễn Quốc Anh, Deputy General Director of Batdongsan.com.vn, observed: “Q3/2025’s real estate market saw clear recovery but with strong filtering. Projects with transparent legal status, prime locations, and integrated infrastructure will attract significant capital.”

Echoing this, Mr. Phan Dũng Khánh noted that the real estate market is recovering selectively, focusing on “real” projects tied to end-user demand and developer capability.

“Like stocks, real estate is a long-term asset class, not a short-term race. Those choosing the right projects will thrive, while those following the crowd risk capital lock-in,” Mr. Khánh stated.

From another perspective, Mr. Bùi Văn Huy, Deputy Director of FIDT, believes that in the medium to long term, stocks remain attractive as government policies lean toward loosening to achieve high growth targets, interest rates stay low, gold peaks, and high real estate prices require substantial capital, leaving stocks as the most appealing alternative.

For those lacking capital for direct real estate investment, Mr. Khánh suggested indirect exposure through bank, securities, real estate, or AI-related tech stocks—sectors with long-term growth potential.

According to Mr. Huy, current market valuations are reasonable, offering opportunities for patient, long-term investors. However, he advised monitoring exchange rate risks, inflation, and geopolitical developments for appropriate deployment strategies.

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.