Vietnam’s stock market experienced a turbulent trading session following its most significant historical decline. However, a surge in bottom-fishing demand during the afternoon session propelled the VN-Index into positive territory. By the close of the October 21st session, the VN-Index climbed 27 points to reach 1,663.43. Trading value on the HoSE exchange hit a substantial 45.7 trillion VND.

Foreign trading activity emerged as a highlight, with foreign investors turning net buyers to the tune of 2.476 trillion VND across the market. Here’s a breakdown:

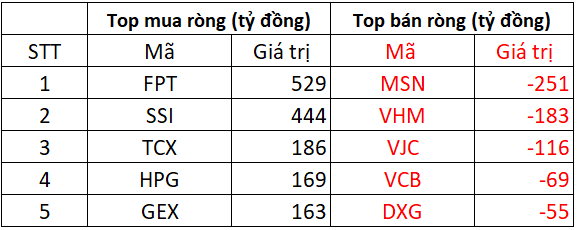

On HoSE, foreign investors net bought approximately 2.408 trillion VND

On the buying side, FPT shares saw the most significant foreign accumulation, with a remarkable 529 billion VND, while SSI also attracted 444 billion VND in net buying. TCX, HPG, and GEX followed closely, each with over 100 billion VND in net purchases.

Conversely, foreign investors heavily offloaded MSN shares, totaling 251 billion VND. VHM and VJC were also net sold, with 183 billion VND and 116 billion VND, respectively. Additionally, VCB and DXG saw net selling of several dozen billion VND each.

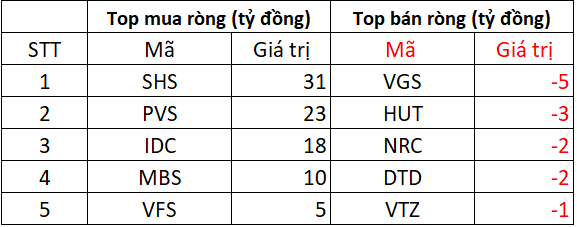

On HNX, foreign investors net bought around 83 billion VND

In terms of purchases, SHS shares led with 31 billion VND in net buying. Foreign investors also injected 10 to 23 billion VND into PVS, IDC, and MBS, with VFS seeing 5 billion VND in net buying.

On the selling side, VGS, HUT, NRC, and DTD topped the net selling list, ranging from 2 to 5 billion VND, while VTZ saw 1 billion VND in net selling.

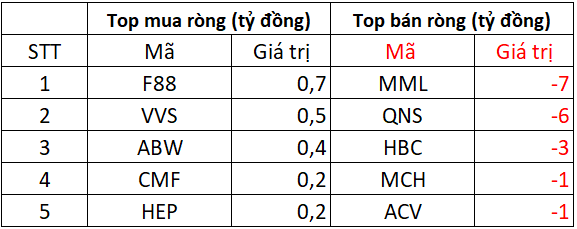

On UPCOM, foreign investors net sold approximately 16 billion VND

On the buying side, shares like F88, VVS, ABW, and CMF saw net purchases of a few hundred million VND each.

Conversely, MML, QNS, and HBC faced net selling of 3 to 7 billion VND, while MCH and ACV saw 1 billion VND in net selling.

Record-High Margin Debt: Major Brokerages Nearing Lending Limits

Leading the pack in equity capital (VCSH) are firms like TCBS, SSI, VNDirect, VPBankS, and VIX, all of which still have significant lending capacity. In contrast, the margin-to-equity ratio at other securities companies such as HSC, Mirae Asset, MBS, and KIS VN is nearing its maximum limit.