The stock market rebounded strongly after a record-breaking decline, with FPT shares unexpectedly taking center stage as they surged to the ceiling, reaching VND 93,000 per share with no sellers. This marks the first time the stock has hit its ceiling since the tariff bottom in mid-April.

This dramatic uptick brings renewed hope for a revival of Truong Gia Binh’s stock after a prolonged downward spiral. Previously, FPT had plummeted 35% from its peak, dropping to VND 87,000 per share—its lowest point in 18 months. This was accompanied by unprecedented selling pressure from foreign investors.

From the beginning of the year up to the session on October 21, foreign investors had net sold over VND 17,000 billion in Vietnam’s leading technology stock. This left FPT with a room of over 217 million shares (approximately 13% of the total outstanding shares), a rare occurrence in its history. However, a positive signal emerged in the latest session as foreign investors unexpectedly net bought nearly 6 million FPT shares.

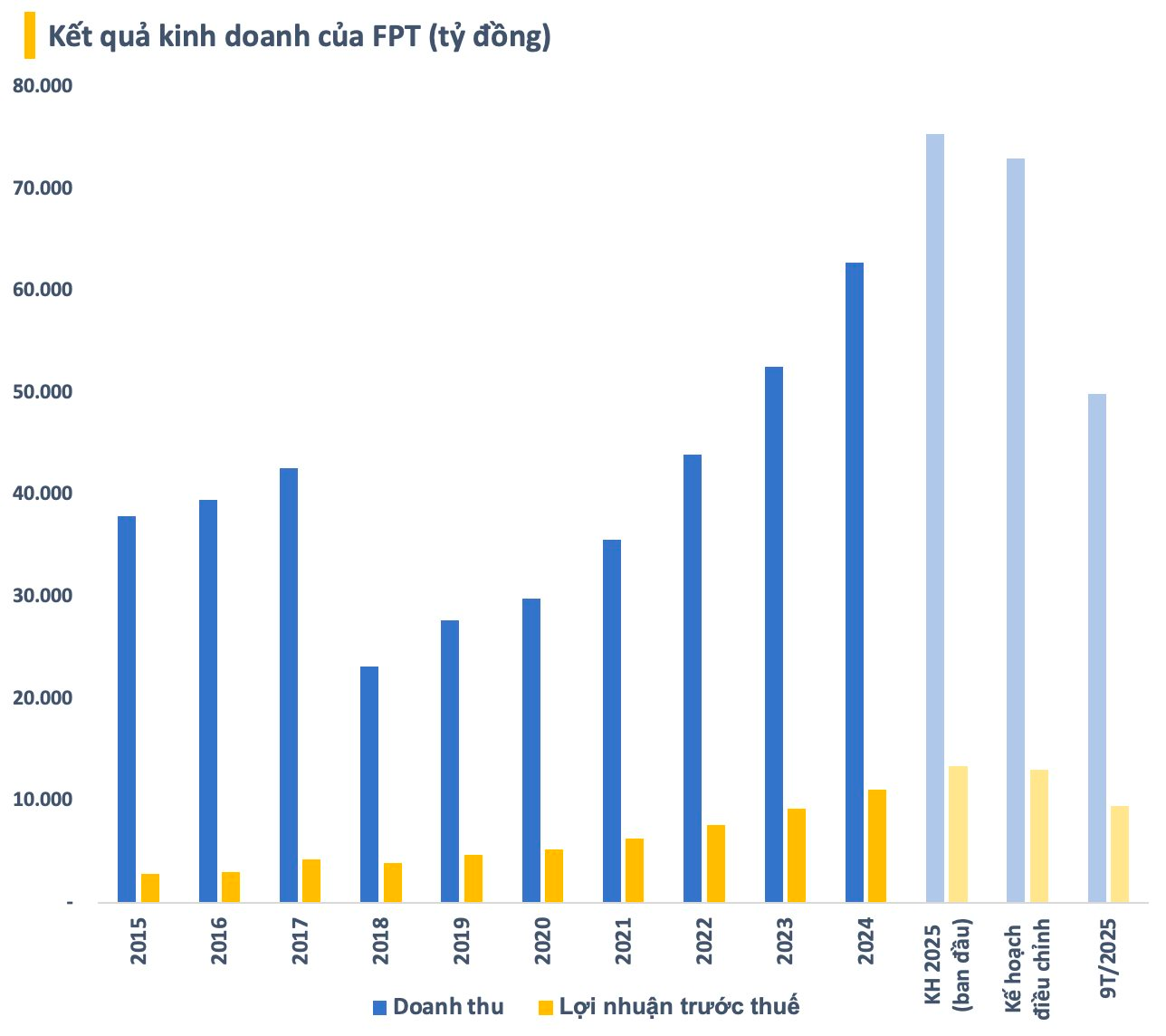

FPT’s surge followed the announcement of its 9-month business results, reporting revenue of nearly VND 49,900 billion and pre-tax profit of VND 9,540 billion, up 10% and nearly 18% year-on-year, respectively. Net profit attributable to the parent company’s shareholders reached VND 6,867 billion, growing 19.2%, with EPS at VND 4,043 per share, an 18% increase from the previous year.

In Q3/2025 alone, FPT’s pre-tax profit reached approximately VND 3,400 billion, a 16% increase year-on-year. Net profit rose 16.5% to VND 2,435 billion.

At the investor meeting in August, Vietcap’s update revealed that FPT’s leadership had adjusted its plan under the new baseline scenario, targeting 15% revenue growth and 18%-19% profit growth year-on-year. These figures are lower than the targets set at the Annual General Meeting, which aimed for 20% revenue growth and 21% pre-tax profit growth.

Under the revised plan, FPT aims for 2025 revenue and pre-tax profit of approximately VND 73,000 billion and VND 13,000 billion, respectively. With the current results, FPT has achieved 68% of its revenue target and 73% of its profit goal under the adjusted plan.

A positive highlight is the new signed revenue from the Overseas IT Services segment, which reached VND 29,363 billion in the first 9 months, a 14.4% increase year-on-year. FPT has secured 19 major projects (each over USD 10 million), nearly double the number from the same period last year.

Despite global economic challenges, the Overseas IT Services segment maintained 12.8% revenue growth, reaching VND 25,574 billion, with pre-tax profit of VND 4,073 billion, up 12.7% year-on-year. The primary growth driver was the Japanese market, which grew by 26.3% year-on-year.

Samsung Expands Smart Home Robot Production in Ho Chi Minh City

Samsung Electronics Home Appliances Complex (SEHC), a 70-hectare, $1.4 billion investment, broke ground in Ho Chi Minh City in May 2015. Initially focused on premium TVs, including SUHD TV, Smart TV, and LED TV, this state-of-the-art facility marks a significant milestone in Samsung’s global manufacturing footprint.

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.

SHB Reports 36% Surge in Pre-Tax Profit for Q1-Q3, Bolstering Financial Strength

Saigon-Hanoi Commercial Joint Stock Bank (SHB) continues its robust growth trajectory, reporting a pre-tax profit of VND 12,307 billion for the first nine months of 2025. This impressive figure marks a 36% year-on-year increase and represents 85% of the bank’s annual target.

Vietstock Daily 22/10/2025: Bottom-Fishing Demand Emerges

The VN-Index rebounded after successfully testing its August 2025 low (around 1,605-1,630 points). If this level holds, short-term recovery prospects look more promising. However, the risk of a correction remains as the MACD and Stochastic Oscillator indicators continue to weaken following strong sell signals.