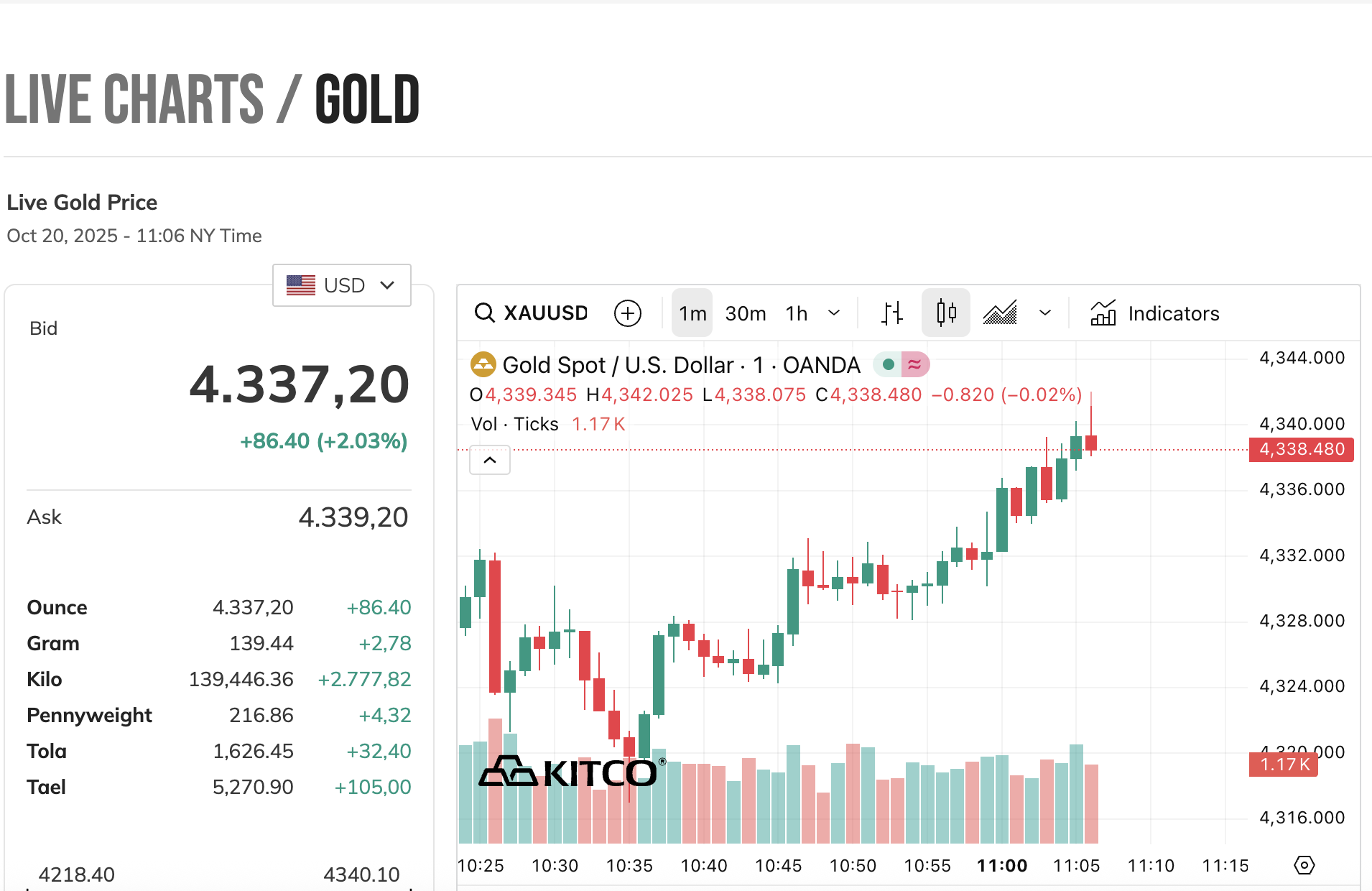

As of the evening of October 20th, global gold prices rebounded sharply after a steep decline in the previous Friday’s session. By 22:05 (Vietnam time), spot gold prices surged by over 2% compared to the previous week’s close, reaching nearly $4,337 per ounce. U.S. December gold futures climbed 3.4% to approximately $4,358 per ounce.

Source: Kitco.com

Earlier, spot gold had hit a record high of $4,378.69 per ounce on Friday but closed 1.8% lower—its sharpest decline since mid-May—following comments from U.S. President Donald Trump that eased some concerns about U.S.-China trade tensions.

Jeffrey Christian, managing partner at CPM Group, noted that political and economic worries are driving prices higher again after Friday’s sell-off. He added, “We expect prices to rise further in the coming weeks and months, and we wouldn’t be surprised to see $4,500 per ounce soon.”

The prolonged U.S. government shutdown, now in its 20th day, has delayed the release of critical economic data, leaving investors and policymakers data-starved ahead of next week’s Federal Reserve policy meeting.

Meanwhile, traders are pricing in a 99% chance of a Fed rate cut next week, with another cut expected in December. Gold, a non-yielding asset, tends to benefit from a low-interest-rate environment.

Investors are also closely monitoring updates on U.S.-China trade negotiations, after President Trump confirmed on Friday that his planned meeting with Chinese President Xi Jinping remains on track.

SJC Gold Bar Prices Plummet by 15 Million VND in Just 2 Days

In just two days, the price of SJC gold bars in the free market plummeted by a staggering 15 million VND from its peak.

USD Price Reverses Downward

During the week of October 13–17, 2025, the US dollar reversed its course and weakened in the international market as the United States signaled a softer stance in trade negotiations with China.