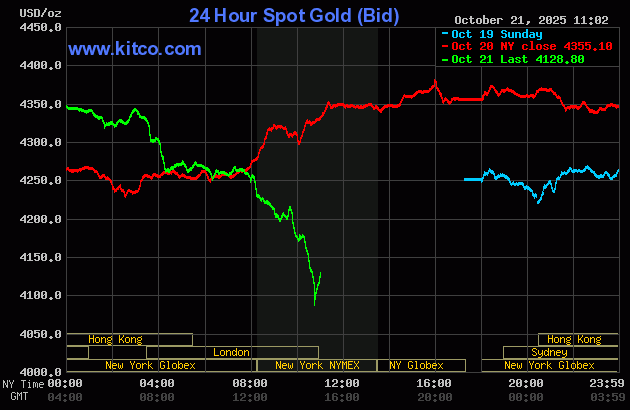

On October 21st, global gold prices plummeted, dropping below the critical $4,200 per ounce mark at 8:30 PM, marking a staggering $165 per ounce decline.

By 9:00 PM, the downward trend intensified, with gold further slipping to $4,170 per ounce. Compared to yesterday’s peak (October 20th), spot gold prices have fallen by nearly $210 per ounce, equivalent to a 4.8% drop.

As of 9:40 PM, the shock continued as spot gold lost the $4,100 per ounce level, plunging to $4,088 per ounce—a $260 per ounce decline in just over a day.

According to Reuters, stock markets saw a modest rise on Tuesday, fueled by easing U.S.-China trade tensions and reduced concerns over credit risks in the banking sector, which collectively pressured gold prices downward.

In Asia, the near-certain ascension of Sanae Takaichi as Japan’s next Prime Minister propelled Tokyo’s Nikkei index to a new record high, while weakening the yen. U.S. President Donald Trump expressed optimism about reaching a “fair” trade deal with Chinese President Xi Jinping during their upcoming meeting in South Korea. This positive outlook, coupled with a rare earth minerals supply agreement between Australia and the U.S., bolstered investor confidence.

Market sentiment took a hit last week following a surge in bad loans at U.S. regional banks, sparking fears of widespread credit risk. The prolonged U.S. government shutdown further pressured risk assets.

However, these concerns have since subsided, encouraging capital to flow back into the market ahead of earnings reports from major corporations.

“The market has gracefully navigated the ‘wall of worry,’ with fresh capital infusing risk assets like a new oxygen supply,” remarked Chris Weston, Head of Research at Pepperstone.

Expectations of imminent Federal Reserve policy easing, alongside White House economic advisor Kevin Hassett‘s statement that the U.S. federal government shutdown could end this week, have emboldened investors to re-enter the stock market.

The broad recovery lifted all three major U.S. stock indices sharply overnight, with the Semiconductor Index (SOX) setting a new record.

In currency markets, a stronger U.S. dollar added pressure on gold, driving the precious metal sharply lower after its recent record highs. The dollar rose 0.7% against the yen to 151.83 yen/USD. Japan’s prospective Prime Minister Sanae Takaichi is expected to pursue economic stimulus policies and oppose rate hikes—a scenario unfavorable for the yen and Japanese bonds but supportive of equities.

The Bank of Japan (BoJ) is also set to meet next week. Traders currently assign just a 20% probability of a rate hike, despite Governor Kazuo Ueda keeping all options open without specifying a timeline.

Lan Anh

Gold Bar Prices Surge on October 20th

Global gold prices rebounded after a slight dip earlier on October 20th. Domestically, SJC gold bar prices surged by 500,000 to 1,500,000 VND per tael compared to last weekend’s closing rates.

SJC Gold Bar Prices Plummet by 15 Million VND in Just 2 Days

In just two days, the price of SJC gold bars in the free market plummeted by a staggering 15 million VND from its peak.