Source: SBV

|

|

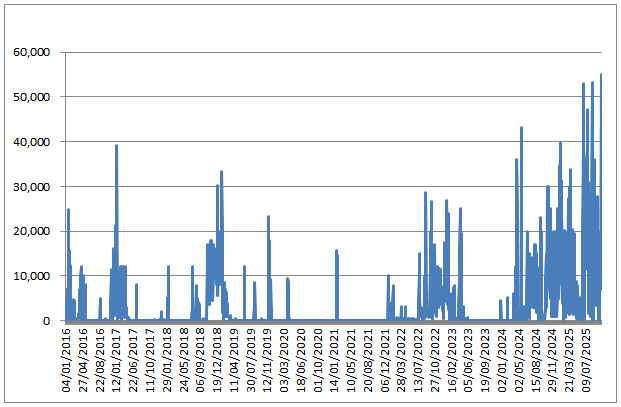

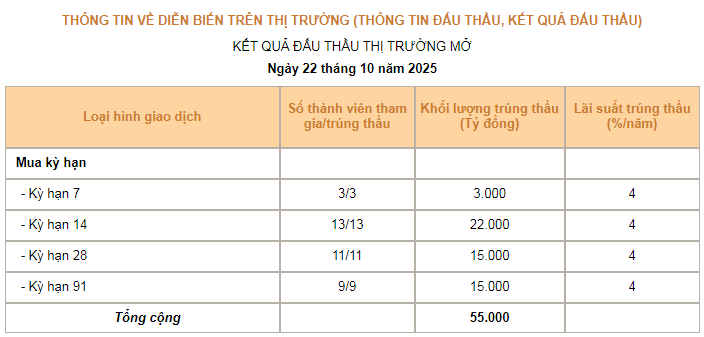

Term Purchase Volume (Injection). Unit: Billion VND

Source: VietstockFinance

|

Specifically, the State Bank of Vietnam lent commercial banks a total of 55,000 billion VND through the collateralized securities channel, while 9,000 billion VND matured on this channel during the session on October 22.

|

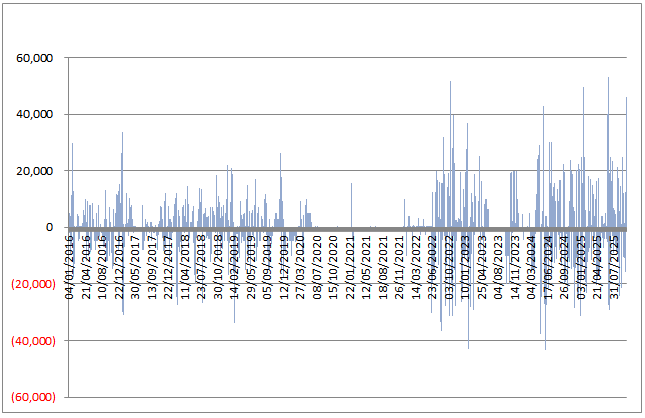

Net Injection Value in the Open Market. Unit: Billion VND

Source: VietstockFinance

|

As a result, the net amount of money injected into the system reached 46,000 billion VND – the third highest level since the beginning of the year, following the sessions on June 30 (net injection of 52,904 billion VND) and January 22 (net injection of 49,551 billion VND).

This move comes amid tightening liquidity in the system due to seasonal factors at the end of the year, as credit demand surges. As of September 25, 2025, total credit growth in the economy has increased by 13% compared to the end of 2024, higher than the 8.09% growth in the same period last year and approaching the annual target of over 16%.

|

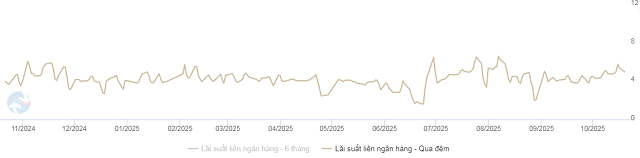

Overnight Interbank Interest Rate Trends Over the Past Year

Source: VietstockFinance

|

In the interbank market, the overnight interest rate on October 21 rose to 5.12%/year, 15 basis points higher than the previous session. The average transaction value decreased slightly by 2% compared to the previous session, reaching nearly 603,000 billion VND/day.

|

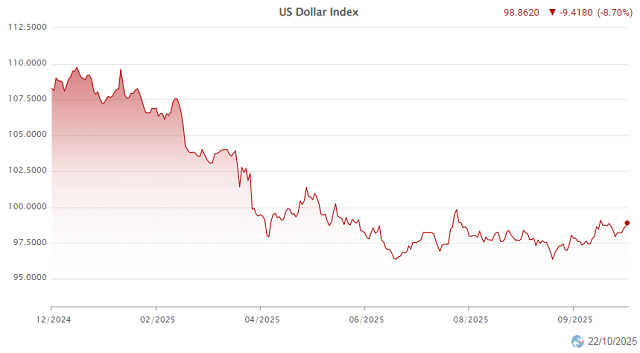

DXY Trends from the Beginning of 2025 to October 22

Source: VietstockFinance

|

In the international market, the USD Index (DXY) reached 98.81 points, up 0.15 points from the session on October 21.

The exchange rate listed at Vietcombank closed the session on October 22 at 26,123 – 26,353 VND/USD (buy – sell), unchanged from the previous day.

– 17:52 22/10/2025

Gold Shop Inspections Conducted in Two Localities

In this area, the gold shop, specializing in the trade of gold bars and the craftsmanship of fine jewelry, meticulously verifies all transactions, invoices, and documentation.

Techcombank Sets Record Q3 Profit, Sustaining Strong Growth Momentum

Techcombank (HOSE: TCB) has unveiled its Q3 2025 and 9-month financial results, showcasing record-breaking performance and underscoring the success of its comprehensive transformation strategy. The bank reported pre-tax profits of VND 23.4 trillion for the first nine months, with Q3 alone contributing VND 8.3 trillion—a 14.4% year-on-year increase and the highest quarterly profit in its history.

Central Bank Reverses Course with Net Injection into Open Market

During the week of October 13–20, 2025, the State Bank of Vietnam (SBV) reversed its stance, resuming net injections into the open market after two consecutive weeks of net withdrawals. This shift occurred amid fluctuating liquidity in the banking system, as evidenced by a sharp rise in overnight interest rates.