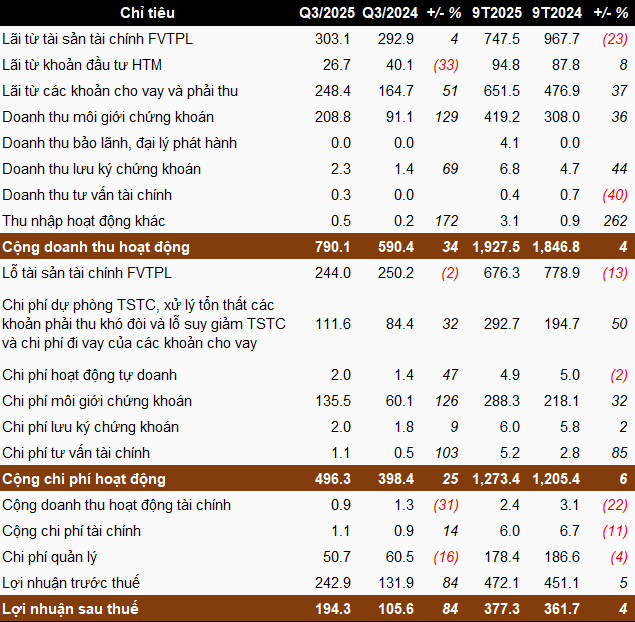

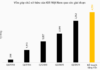

For the proprietary trading segment, KIS recorded a profit of over 57 billion VND, a 38% increase year-on-year, driven by a significant reduction in losses from the sale of financial assets measured at fair value through profit or loss (FVTPL) and higher dividends and interest income from FVTPL financial assets.

In the brokerage segment, operational scale grew substantially, with revenue nearing 209 billion VND and expenses of approximately 136 billion VND, both nearly 2.2 times higher than the same period last year. As a result, the company achieved a gross profit of over 73 billion VND from brokerage, 2.4 times higher year-on-year.

Beyond proprietary trading and brokerage, another key activity for KIS is lending, which saw a 51% revenue growth, reaching over 248 billion VND.

The results in Q3 align with the market’s upward trend and the surge in liquidity during the quarter. Alongside KIS, numerous other securities companies have released their Q3 financial reports, showcasing robust profit growth across the aforementioned three business segments.

However, the push for lending and proprietary trading also led to a 32% increase in provisioning expenses, totaling nearly 112 billion VND.

Ultimately, KIS reported a net profit of over 194 billion VND in Q3, an 84% year-on-year increase. This result boosted the cumulative profit for the first nine months to over 377 billion VND, a modest 4% rise, offsetting the lackluster performance of the first two quarters.

|

Q3 and 9-month 2025 business results of KIS

Unit: Billion VND

Source: VietstockFinance

|

For 2025, KIS set a pre-tax profit target of 750 billion VND. With over 472 billion VND earned in the first nine months, the company has achieved 63% of its annual plan.

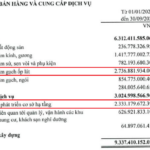

By the end of Q3, KIS’s total assets reached nearly 16.5 trillion VND, a 23% increase since the beginning of the year. The majority of this comprises lending debt of over 12.2 trillion VND, accounting for 74% of total assets, primarily from margin lending. Compared to the start of the year, debt has risen by 40%, marking a historic high for KIS.

The sharp increase in debt highlights the company’s focus on expanding its lending segment, explaining the growth in lending revenue.

| KIS Sets New Lending Debt Record |

Two other notable trillion-VND items include FVTPL financial assets, which increased from nearly 1.7 trillion VND to almost 2 trillion VND, primarily due to fair value investments in listed stocks, bonds, and unlisted securities, as well as held-to-maturity (HTM) investments, which rose from over 1.5 trillion VND to nearly 1.7 trillion VND. Conversely, cash and cash equivalents decreased from 1.1 trillion VND to approximately 289 billion VND.

Regarding capital sources, the company has nearly 8.4 trillion VND in liabilities, a 21% increase since the beginning of the year. The company borrows from both domestic and foreign banks, as well as other entities.

– 16:25 21/10/2025

VNDIRECT’s Q3 Net Profit Surges 84% Amid Favorable Market Conditions

VNDIRECT Securities Corporation (HOSE: VND) has released its Q3/2025 financial report, revealing a remarkable post-tax profit of VND 929 billion, marking an 84% surge compared to the same period last year. The company’s core business segments, including proprietary trading, brokerage, and margin lending, all experienced significant growth amidst favorable market conditions.

Where Does the Massive Capital from High-Profile IPOs Ultimately Flow?

The stock market is entering an unprecedentedly vibrant phase following a period of scarcity, as numerous companies, particularly in the securities sector, are launching initial public offerings (IPOs) worth trillions of dong. With such massive capital influx post-IPO, the question arises: how will these funds be utilized, and will the securities industry’s cash flow face dilution amid the recent surge in IPO activities?

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.