The Rise of Green-Certified Office Spaces

According to Knight Frank, approximately 48% of major transactions in Q3/2025 were driven by logistics companies, reflecting a significant shift in leasing demand. Beyond large floor areas, averaging 1,500–3,000m², these businesses prioritize green-certified buildings.

This trend isn’t confined to Ho Chi Minh City. In Hanoi, 100% of major leasing deals in the past quarter occurred in green-certified buildings, signaling a clear shift toward quality and sustainability among businesses.

Alongside the logistics sector’s rise, demand for higher-quality offices continued to dominate in HCMC, accounting for 54% of transactions. Many companies are restructuring workspaces, moving from older buildings to modern offices that better support operations and employee welfare.

Businesses increasingly opt for green-certified offices – Illustration

|

Net Absorption Plummets in Hanoi

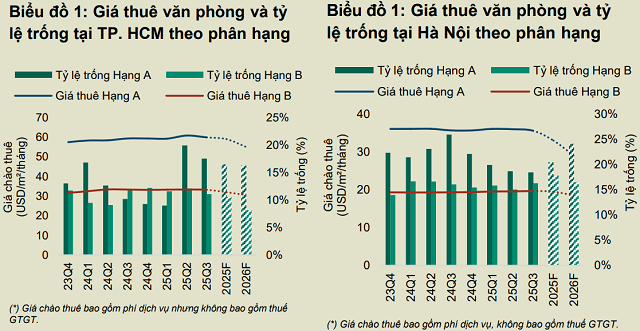

HCMC’s average rent in Q3 was $40.4/m²/month, down 1% quarterly and 1.6% yearly. This slight reduction stems from landlords’ flexible leasing policies amid limited new supply. Hanoi’s average rent remains significantly lower at $24.2/m²/month.

By grade, HCMC’s Grade A rents averaged $59.9/m²/month (down 1.5% quarterly), while Grade B rents were $33.2/m²/month (down 0.5%). Many landlords in central and non-central areas reduced rents and offered rent-free periods, lowering the vacancy rate to 13% (87% occupancy), a positive sign of effective incentives.

Conversely, Hanoi’s occupancy fell to 83%, down 0.9 percentage points quarterly, due to increased vacancies in Grade B buildings, particularly older properties and newly completed projects.

HCMC’s leasing demand remained robust, with net absorption of 18,400m² in Q3 (up 9.4% quarterly and 1.7% yearly), driven by logistics expansion. Hanoi’s net absorption dropped 66% quarterly to 6,300m², though high-quality buildings like Grand Terra and Capital Place maintained stable occupancy, thanks to multinational demand, especially in IT.

Source: Knight Frank

|

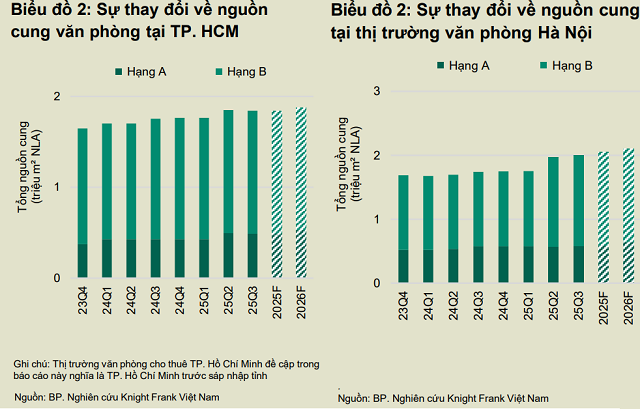

Hanoi’s Future Supply Concentrated in West Lake West

HCMC saw no new supply in Q3, maintaining 1.8 million m² of Grade A and B offices. District 1 remains the core, accounting for over half of total supply. Hanoi added 27,800m² from Pearl Tower (My Dinh), reaching nearly 2 million m², with 70% in central and western areas.

Knight Frank forecasts HCMC’s Q1/2026 supply to include The Kross (32,000m²), the first major Grade A addition in years. Total future supply (Q4/2025–2026) is modest at 32,000m².

Hanoi expects 101,800m² of new offices in Q4/2025–2026, mainly in Ba Dinh, Cau Giay, and Bac Tu Liem. By 2030, West Lake West will add nearly 600,000m², comprising 40% of future supply, likely pressuring occupancy and rents.

Source: Knight Frank

|

HCMC Faces Grade B Shortage Until 2028

Knight Frank reports no new Grade B projects in HCMC’s CBD until 2028, due to rising land and construction costs. Limited CBD land meeting Grade B standards has shifted new supply to lower-tier segments or non-central areas.

Alex Crane, Managing Director of Knight Frank Vietnam – Photo: Knight Frank

|

Alex Crane, Knight Frank Vietnam’s Managing Director, notes the mismatch between mid-range demand and supply. “A tenant seeking 2,000m²—typical for MNCs—has only two CBD options, both over 10 years old,” he said.

CBD Grade B rents average $42/m²/month, $10–20 higher than non-central areas. Nearly 60% of CBD buildings pre-date 2015, with only 17% green-certified (vs. 57% for Grade A), highlighting urgent upgrade needs.

Crane sees this supply gap as both challenge and opportunity. “Future Grade B supply is 60% in South Saigon, with growth potential due to land availability and infrastructure. Meanwhile, older CBD buildings should modernize and adopt flexible operations to attract MNCs increasingly demanding green standards.”

– 07:20 22/10/2025

Skyrocketing Real Estate Prices: When a Motorcycle Can Only Buy You… “A Beautiful Window Frame”

Dr. Vo Tri Thanh highlights that Vietnamese real estate prices have significantly outpaced their true value and the purchasing power of citizens, posing a risk of distorting investment structures. Meanwhile, Savills experts attribute the root cause to limited supply and escalating development costs, creating a market imbalance that further distances homebuyers from their dream of stable housing.

Gold Prices Surge Past 160 Million VND/Tael: Investors Lock in Profits, Shift Focus to Coastal Real Estate for Emerging Opportunities

As domestic gold prices surge past 160 million VND per tael, Vietnam’s asset market is witnessing a pronounced shift in capital flows, moving away from traditional safe-haven channels toward tangible assets with higher profit potential. Coastal land plots are poised to emerge as the most attractive investment destination in Q4/2025 and Q1/2026.

“Dr. Nguyễn Văn Đính: How Some Developers and Distributors Use ‘Drip Feeding’ to Create Scarcity and Fuel FOMO”

According to Dr. Nguyen Van Dinh, speculative groups hoarding properties and leveraging margin trading to profit from price differences are driving housing prices even higher. Despite this, numerous projects continue to report high absorption rates, with some even selling out on the day of their launch.

Luxury Condos Surpass $4,300/sqm: Transactions Driven by Expectations of Further Price Increases

In the past quarter, real estate transactions were predominantly driven by second-home buyers and beyond, according to industry experts. These buyers were motivated by expectations of continued price appreciation or the desire to secure assets.