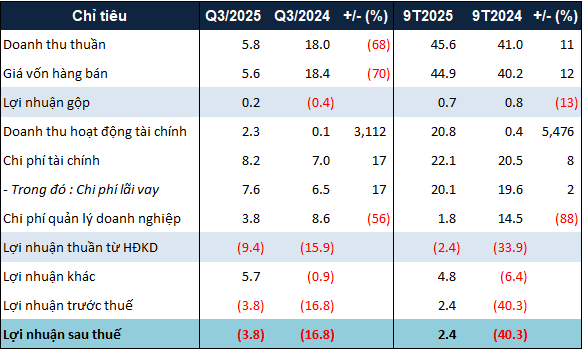

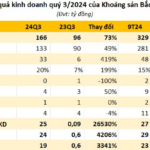

Specifically, LGL’s Q3 net revenue reached nearly VND 6 billion, a 68% decrease compared to the same period last year. Despite this, the company still recorded a gross profit of over VND 200 million, compared to a loss of over VND 400 million in the same quarter last year.

A highlight for LGL this quarter was its financial revenue surpassing VND 2.3 billion, a 32-fold increase, attributed to VND 1.7 billion in dividends from an affiliated company and interest income from loans.

Additionally, the company reduced its management expenses by 56% to nearly VND 4 billion, due to the reversal of provisions for receivables in the same period last year. Other income also reached nearly VND 6 billion, thanks to late payment penalties on receivables and land lease income from the 69 Vu Trong Phuong project.

However, these positive factors were not enough to offset the financial expenses, resulting in a post-tax loss of nearly VND 4 billion for LGL.

Thanks to profits in the first two quarters, the company still achieved a post-tax profit of over VND 2 billion in the first nine months, compared to a loss of over VND 40 billion in the same period last year. Nevertheless, LGL has only achieved nearly 14% of its VND 18 billion post-tax profit target for 2025.

|

LGL’s 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

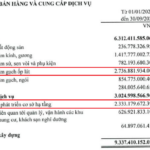

On the balance sheet, LGL’s total assets as of September 30, 2025, stood at over VND 1.4 trillion, unchanged from the beginning of the year. However, several items experienced significant fluctuations, such as nearly VND 115 billion in long-term prepaid expenses due to differences in capital contribution values for the Viet Hung project. In contrast, short-term receivables decreased by 33% to nearly VND 184 billion, as the company no longer recognized nearly VND 102 billion in receivables from the transfer of shares in Minh Phat Corporation.

Similar to total assets, total liabilities remained relatively stable at approximately VND 725 billion. Loan debt remained at over VND 321 billion.

Notably, the company reclassified some short-term payables from the beginning of the year to long-term payables at the end of September, including nearly VND 54 billion for the Thanh Thai project with Vietnam Trade Development and Investment Corporation, nearly VND 57 billion with the Central Cultural Relic Restoration and Equipment Corporation, over VND 39 billion for the Vu Trong Phuong project, and over VND 17 billion in late payment interest.

– 3:13 PM, October 21, 2025

KIS Reports 84% Surge in Q3 Net Profit, Rebounding from First-Half Slump

KIS Vietnam Securities Corporation (KIS Vietnam) reported a remarkable net profit of over VND 194 billion in Q3, surging 84% year-over-year. This impressive growth was driven by strong performance across key business segments, including proprietary trading, brokerage, and lending. The stellar Q3 results helped offset the company’s lackluster performance in the first half of the year.

Viglacera’s Q3 Profits Plummet 55% Amid Severe Storm Impact

Viglacera’s net profit in Q3 plummeted by over half due to adverse weather conditions and rising production costs. However, the nine-month results remain positive, with profits surging nearly 50%, driven by improved performance in industrial zone infrastructure leasing and construction materials segments compared to the same period last year.

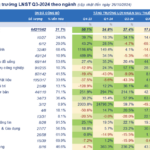

The Bottom Line: 642 Businesses Report 17.8% Increase in Q3 Profits, Real Estate Sector Bounces Back.

The third-quarter post-tax profits of 642 enterprises rose by 17.8% year-on-year, a notable increase yet shadowed by the impressive 27.4% surge in the previous quarter. This slight dip can be attributed to the high comparative base. Notably, the real estate sector experienced a profit decline this quarter, indicating a downward trajectory and a potential bottoming-out phase.