Accelerating Profit Growth: LPBank’s Impressive Financial Performance

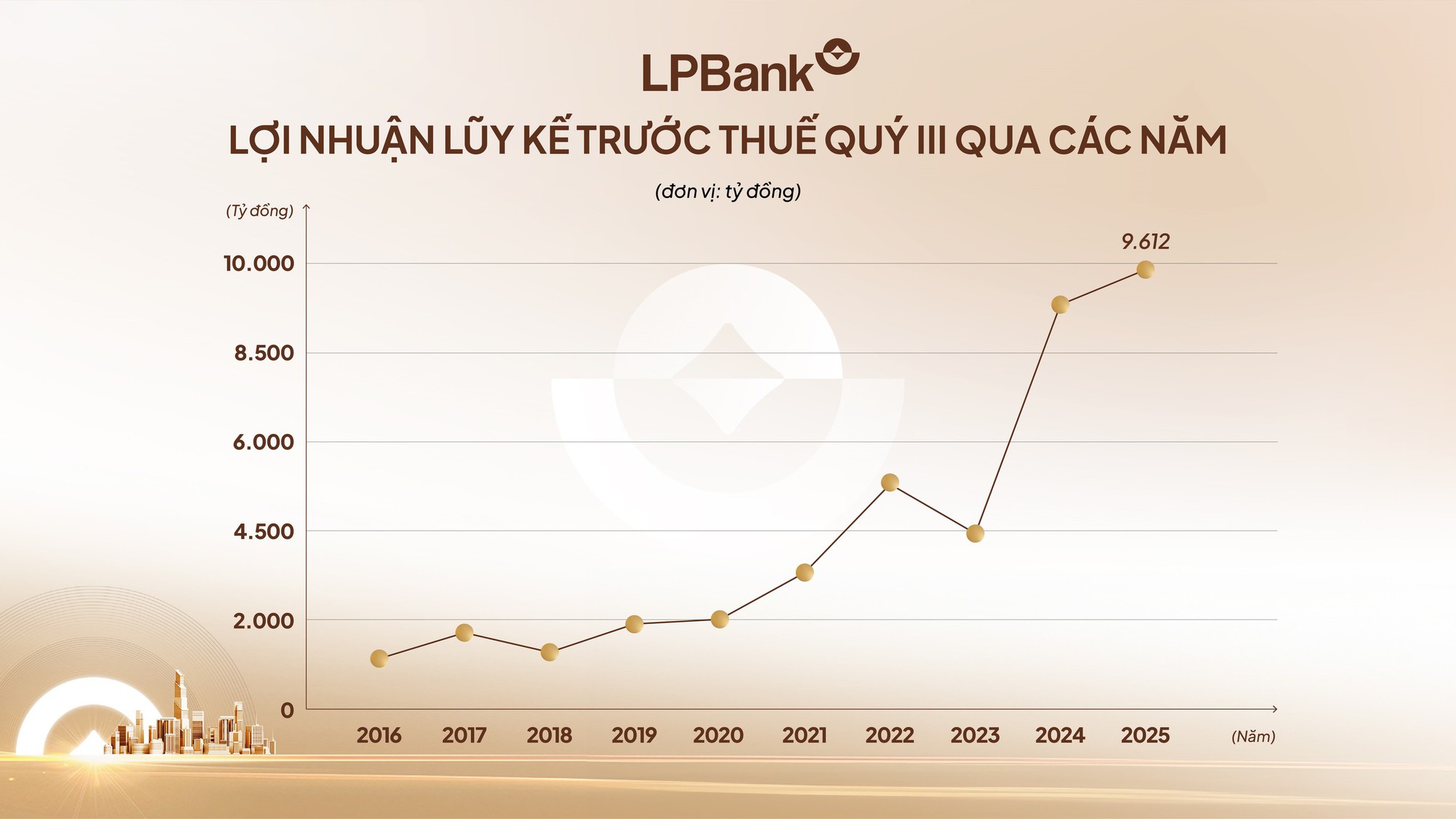

On October 20, 2025, LPBank released its Q3 financial report, revealing a remarkable pre-tax profit of VND 9,612 billion for the first nine months of the year, marking a 9% increase compared to the same period in 2024. The primary driver of this growth was Q3, with pre-tax profits reaching VND 3,448 billion, a 15.3% surge from Q2. This performance not only highlights consistent growth but also underscores significant operational improvements, setting a strong foundation for a breakout in Q4.

The bank’s growth momentum is fueled by two key pillars: stable net interest income of VND 11,253 billion and non-interest income contributing VND 3,671 billion. Notably, net income from services accounted for VND 2,533 billion, demonstrating the success of LPBank’s revenue diversification strategy.

Alongside robust financial results, LPBank has significantly improved asset quality. The non-performing loan (NPL) ratio for the first nine months was maintained at 1.78%, lower than the previous year. This strong credit foundation allows the bank to optimize its provisioning buffer, with the NPL coverage ratio (LLR) held at a safe 76.33%. Rigorous risk management has been pivotal in safeguarding profits and driving sustainable growth.

LPBank: The Industry Leader in Operational Efficiency

While profits are the reward, operational efficiency is the foundation. LPBank has emerged as the industry leader in cost optimization, with a cost-to-income ratio (CIR) of 28.31% for the first nine months—one of the lowest in the sector. In Q3 alone, operating costs decreased by 5.7% year-on-year, a positive indicator of the effectiveness of technological solutions.

This success stems from LPBank’s strategic focus on digital transformation as a critical pathway to enhance competitiveness and customer-centricity. Following the successful implementation of the T24 CoreBanking system in just seven months—recognized by Temenos—LPBank has continued to deploy digital solutions. Notably, AI integration into its call center has automated nearly 48.5% of call volume, reducing costs and achieving a customer satisfaction (CSAT) score of 4.15/5. LPBank is also among the first four banks to partner with the Ministry of Public Security to implement social welfare payments via VNeID under Scheme 06, enabling access to over 200 services directly through the app.

Comprehensive Growth Reinforces Market Leadership

LPBank’s growth is not only qualitative but also quantitative. As of September 30, 2025, total assets reached VND 539,149 billion, an 18.3% increase year-on-year and more than double the figure from four years ago. Core banking operations saw outstanding loans grow by 17% to VND 387,898 billion since the start of 2025. Deposits also rose by 15% to VND 389,638 billion, supporting credit expansion.

In the first nine months, LPBank leveraged its network strengths while diversifying and enhancing product quality. The bank launched Profit Lộc Phát 2.0, upgraded its LPBank Priority program, and introduced innovative products like the LPBank Visa Signature credit card and LPBank Private Lounge services, targeting premium customers.

These positive results have solidified LPBank’s market position and reputation. The bank has consistently ranked highly in prestigious lists, including the Top 50 Most Efficient Vietnamese Enterprises by Investment Bridge Magazine, Top 10 Private Commercial Banks (7th place), Top 10 Most Profitable Private Enterprises in Vietnam – PROFIT500 (8th place), and Top 6 Private Banks with the Highest Tax Contributions in 2025. Recently, LPBank welcomed its 5 millionth retail customer—a milestone affirming its leadership in retail banking and customer trust.

With a robust financial foundation, exceptional operational efficiency, and a comprehensive digital transformation strategy, LPBank exemplifies a dynamic, resilient, and sustainable bank. The achievements of the first nine months of 2025 not only highlight its intrinsic strength but also pave the way for a strong finish in Q4, propelling LPBank toward new heights as a leading private bank in Vietnam.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.

Eight Key MobiFone Leaders Integrated into the People’s Public Security Forces

After transitioning from the State Capital Management Committee to the Ministry of Public Security eight months ago, MobiFone Telecommunications Corporation has emerged as a key player in serving national security and defense. This shift has marked a significant transformation, with the company demonstrating notable progress in its new role.

Vietnam’s Prime Minister: Economy Demonstrates Resilience Against External Shocks, Leading Global Growth

At the opening session of the 10th Meeting of the 15th National Assembly, Prime Minister Pham Minh Chinh highlighted eight remarkable achievements in the implementation of the Socio-Economic Development Plan for 2025 and the five-year period 2021–2025. Notably, Vietnam’s economy has demonstrated robust resilience against external shocks, sustaining one of the highest growth rates globally. The country’s economic scale has surged, climbing five positions to rank 32nd worldwide.

Viettel Celebrates Wave of Success: Viettel Telecom Sets Unprecedented Goals as Viettel Stocks Surge to Record Highs

Stock liquidity surged to impressive levels compared to previous sessions. By the end of the morning session, over 1.5 million VTP shares, 576,900 VGI shares, 877,900 CTR shares, and 15,300 VTK shares had changed hands.