Specifically, Mr. Trần Công Thành, Chairman of the Board of Directors, has registered to sell 2.8 million shares of CTP out of his total holdings of 3 million shares. If the transaction is successful, his ownership in CTP will significantly drop from 24.79% to 1.65%.

Similarly, Mr. Dương Văn Tịnh, a Board Member and CEO, has registered to sell 1.9 million shares, while currently holding nearly 1.97 million shares (equivalent to 16.26% of the capital). After the transaction, Mr. Tịnh will retain only approximately 68,000 shares, corresponding to 0.56% of the charter capital.

Previously, during the period from September 18 to October 13, Mr. Tịnh had registered to sell all of his nearly 1.97 million shares, and Mr. Thành registered to sell 2 million shares out of his total 3 million holdings. However, by the end of the registration period, neither leader was able to sell any shares due to market prices not meeting expectations.

| Price movement of CTP stock from the beginning of 2024 to the session on October 22, 2025 |

This new capital reduction registration occurs as the price of CTP shares continues to decline sharply, hitting the floor of 8,000 VND/share at the end of the session on October 21 and further dropping to 7,800 VND/share in the morning session on October 22. At this price level, Mr. Thành could earn approximately 22 billion VND, while Mr. Tịnh could earn around 15 billion VND if they successfully sell all the registered shares.

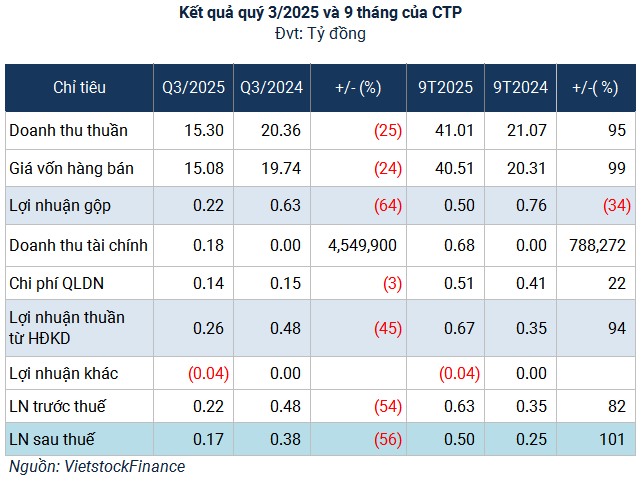

The negative stock performance follows CTP‘s announcement of a significant decline in Q3/2025 business results. Net revenue for the quarter reached over 15 billion VND, a 25% decrease compared to the same period last year. Cost of goods sold nearly consumed all revenue, leaving a gross profit of only 224 million VND, down 64%. As a result, net profit for Q3 was only 166 million VND, a 56% decrease.

CTP attributed the decline primarily to low workload during the period, some contracts not yet eligible for revenue recognition, and increased input costs and business management expenses, which narrowed the gross profit margin.

For the first nine months of 2025, CTP recorded a net profit of nearly 497 million VND, more than double the same period last year, achieving 76% of the annual profit plan.

– 11:28 22/10/2025

European Tycoon Makes Five Trips to Vietnam, Committing to Billion-Dollar Investment: Emerging FDI Hotspot Revealed

To determine the allocation of a $1 billion investment, CTP’s leadership has made five trips to Vietnam this year. Among the locations selected by Otte is Hung Yen, a newly emerging FDI destination in the North.

What Does PMG Say After Establishing the “Christmas Tree” Pattern?

Following a request for explanation from the regulatory authority regarding a five-session consecutive floor-price decline (September 19–25), PetroMienTrung Investment and Production Joint Stock Company (HOSE: PMG) has issued a response. The content of this response mirrors the rationale provided for the previous series of ceiling-price increases.

Two Individuals Register for OCB Stock Trading

Mrs. Trinh Mai Van and Mr. Nguyen Van Tuan registered to trade the same volume of OCB shares during the same period.