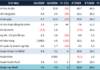

In Q3, SKG reported revenue of nearly VND 99 billion, a 21% increase year-over-year. Gross profit surged to approximately VND 22 billion, more than double the same period last year and on par with pre-COVID-19 levels. According to the company, this growth was driven by improved performance across most routes, notably the Phan Thiet – Phu Quy route, which saw a 50% revenue jump, significantly contributing to the quarter’s positive results.

Despite a slight decline in oil prices, fuel and operational costs continued to rise. However, through stringent cost control measures, SKG achieved a net profit of over VND 7.3 billion, a stark contrast to the VND 3.1 billion loss recorded previously.

Phu Quy Island, located approximately 100km off the coast of Binh Thuan and now part of Lam Dong Province, has been a key destination for SKG since 2018. The high-speed ferry route from Phan Thiet to Phu Quy reduced travel time from 6 hours to just 3 hours, making it a convenient choice for tourists. However, during Q3 and Q4 of the previous year, the route faced disruptions due to prolonged storms, forcing the company to suspend or reduce services.

The Phan Thiet – Phu Quy route has resumed efficient operations – Image: SKG

|

In 2024, the Phan Thiet – Phu Quy route generated over VND 48 billion in revenue for SKG, accounting for about 12% of total revenue, slightly lower than routes in the Kien Giang region, which remain the company’s traditional stronghold. The route’s gross profit exceeded VND 7 billion, representing 8% of total gross profit and ranking fifth among the 10 routes currently operated by SKG. Meanwhile, the Rach Gia – Phu Quoc route remains the largest contributor to both revenue and profit.

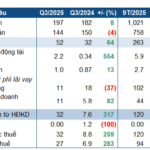

As of the first nine months, SKG achieved cumulative revenue of VND 348 billion, a 10% increase year-over-year, with net profit nearing VND 57 billion, up 27%. These results surpassed the annual profit target by 63%, far exceeding initial expectations, which were set conservatively at levels similar to the previous year. The significant difference is primarily due to the company’s losses in the final two quarters of 2024, which dragged down overall performance.

By the end of Q3, SKG‘s total assets exceeded VND 927 billion, a slight increase from the beginning of the year. The company holds over VND 190 billion in bank deposits and nearly VND 203 billion in prepayments to suppliers, primarily for new ship construction. SKG maintains a policy of no bank debt.

In the first three quarters, the company invested an additional VND 32 billion to upgrade and refit ships No. 9, 10, 11, and 12, while recording over VND 58 billion in fixed assets.

| SKG‘s Profit Exceeds Initial Expectations |

– 13:14 21/10/2025

Agribank Insurance Turns Profitable in Q3

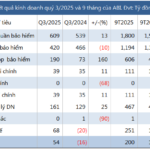

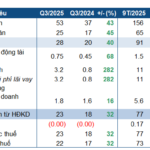

Following a third-quarter loss last year due to the impact of Typhoon Yagi, Vietnam Agricultural Bank Insurance Joint Stock Company (UPCoM: ABI) has rebounded to profitability in the third quarter of this year.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

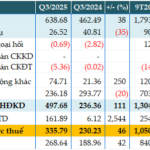

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

Q3 2025 Financial Report Update (October 20th): First Textile Firm Announces 35% Profit Surge, Real Estate Company Reports 65% Profit Decline

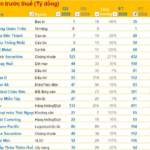

Seoul Metal reported a Q3 pre-tax profit of VND 24 billion, a 120% increase, while its 9-month figure reached VND 60 billion, up 74% year-on-year. In contrast, Sasco (SAS) posted a Q3 pre-tax profit of VND 133 billion, reflecting a 38% decline compared to the same period last year.

Ninh Binh Phosphate Fertilizer Quadruples Profits with Strategic Price Hike

Ninh Binh Phosphate Joint Stock Company (HNX: NFC) has released its Q3/2025 financial report, revealing a staggering 3.8-fold increase in net profit compared to the same period last year. This remarkable growth is attributed to the surge in both production volume and selling prices of phosphate and NPK fertilizers, coupled with a significant boost in financial income from deposit interest.