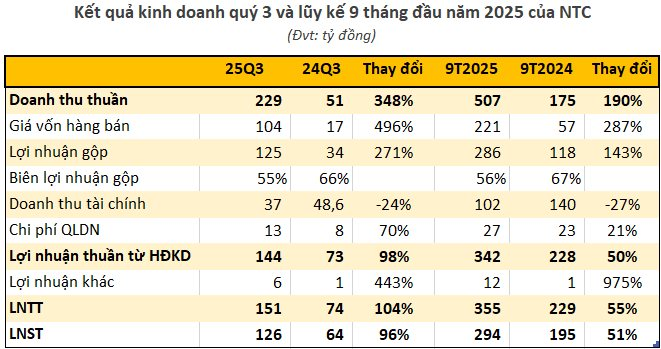

Nam Tan Uyen Industrial Park JSC (stock code: NTC) has released its Q3/2025 financial report, showcasing a remarkable 348% surge in net revenue to VND 229 billion compared to the same period last year. The company attributes this growth primarily to the recognition of infrastructure rental revenue from industrial park contracts, allocating contract values over the lease term instead of a one-time recording for a land sublease contract as in the previous year.

Additionally, the cost of goods sold soared by nearly 500% year-on-year to VND 104 billion, resulting in a 270% increase in gross profit to VND 125 billion.

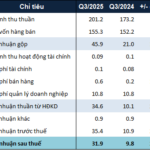

During the quarter, financial revenue dipped by 24% to VND 37 billion, while administrative expenses climbed by 70% to VND 13 billion.

After deducting other expenses, Nam Tan Uyen reported pre-tax profit of nearly VND 151 billion, doubling the figure from the same period in 2024. Net profit reached almost VND 126 billion, also doubling year-on-year.

In the first nine months of 2025, Nam Tan Uyen recorded VND 507 billion in net revenue and VND 355 billion in pre-tax profit, marking a 190% and 55% increase, respectively, compared to the same period last year.

For 2025, the company set a business target of VND 793 billion in revenue and VND 284 billion in post-tax profit. Although Nam Tan Uyen has only achieved 64% of its revenue goal, it has already surpassed its full-year profit target.

Established in 2004, Nam Tan Uyen currently has a charter capital of VND 240 billion. Its three largest shareholders, holding 73.22% of the charter capital, are Phuoc Hoa Rubber JSC (32.85%), Vietnam Rubber Industry Group JSC (GVR) (20.42%), and Saigon VRG Investment JSC (19.95%).

Nam Tan Uyen is the primary developer of three industrial parks in Tan Uyen Town, Binh Duong Province: Nam Tan Uyen Industrial Park (332 ha), Nam Tan Uyen Expanded Industrial Park (288.52 ha), and Nam Tan Uyen Expanded Industrial Park Phase 2 (346 ha).

The company also invests in various projects within and outside its core industry, including Binh Long Rubber Industrial Park (Binh Phuoc, 37.79% ownership), Bac Dong Phu Industrial Park (Binh Phuoc, 40% ownership), Truong Phat Rubber JSC (20% ownership), and Dau Giay Industrial Park (Dong Nai, 22.17% ownership).

Nam Tan Uyen is renowned for its consistent and generous cash dividend policy. From 2017 to 2023, the company paid cash dividends ranging from 60% to 120%, with a remarkable 200% dividend payout in 2018. In 2024, the company approved a minimum 60% cash dividend.

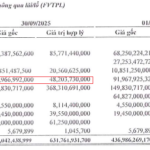

In other developments, 24 million NTC shares have been approved for listing on HoSE, with the first trading session scheduled for October 28, 2025. The reference price for the debut session is VND 161,470 per share, with a ±20% price fluctuation range.

On the stock market, NTC closed its final trading session on UPCoM on October 15, 2025, at VND 165,000 per share. The HoSE listing price is 2% lower than the closing price on UPCoM.

Sao Ta Shrimp Company’s Profits Surge Despite Facing Over 100 Billion VND in Countervailing Duties

Fimex VN (HOSE: FMC), a leading shrimp processor and exporter, has announced its Q3 2025 consolidated net revenue of VND 2.98 trillion, marking a 5% year-on-year increase. The company also reported a net profit of VND 97 billion, reflecting a significant 22% growth compared to the same period last year.

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.

National Securities Eyes 10 Million More SAM Shares Despite Nearly 50% Paper Loss

Amidst a 15% decline in SAM shares over the past month, National Securities Corporation (NSI) plans to invest over 70 billion VND to acquire an additional 10 million shares of SAM Holdings (HOSE: SAM), increasing its ownership stake to 4.31%. As of the end of September 2025, this investment in SAM is currently reflecting a loss of nearly half its value.