From Market Disruptor to Troubled Times: The Danh Khôi Group’s Turbulent Journey

Once hailed as one of the most dynamic players in Ho Chi Minh City’s mid-to-high-end real estate segment, Danh Khôi Group (HNX: NRC) is now navigating a period of significant turmoil. Delayed projects, tight cash flow, and underperforming investments have become the norm.

Founded in 2006, Danh Khôi began as a real estate brokerage and distribution company. In recent years, it shifted focus towards project development and investment, expanding through mergers and acquisitions (M&A).

This phase saw Danh Khôi forge partnerships with prominent Japanese firms like Tokyu Group, Anabuki Housing Service, and Sanei Architecture Planning, alongside collaborations with domestic enterprises.

The 2018-2021 period marked Danh Khôi’s “acceleration” phase.

The 2018-2021 period marked Danh Khôi’s “acceleration” phase, with the company announcing a series of large-scale projects in Ho Chi Minh City, Binh Thuan, Ba Ria – Vung Tau, Da Nang, and Khanh Hoa.

Notable projects include: The Meraki Vung Tau; The Aston Luxury Residence (Nha Trang); The Royal Boutique Hotel & Condo Da Nang; Aria Da Nang Hotel & Resort; and Takashi Ocean Suite Ky Co (Quy Nhon).

… to Stalled Projects and the Failed “Dai Nam Deal”

Despite rapid project portfolio expansion, Danh Khôi’s execution has been less than stellar. Many projects remain mired in legal complexities or face sluggish construction due to cash flow shortages and a sluggish market.

Key projects like Aria Da Nang stand as unfinished concrete skeletons, while The Aston Nha Trang faces delays compared to initial commitments. Notably, the company previously sold units before meeting legal requirements.

Amidst project challenges, in 2024, Danh Khôi announced plans to acquire a portion of the Dai Nam Residential Area project (Binh Phuoc) from Tan Khai LLC, a subsidiary of Dai Nam Corporation chaired by Huynh Uy Dung (“Dung Lo Voi”), for VND 195 billion.

Funding was to come from existing shareholders via a VND 10,000 per share issuance of 100 million shares. However, this plan faltered as NRC’s market price was less than half the offering price.

Record Losses, Going Concern Doubts, and a “Survival Pivot”

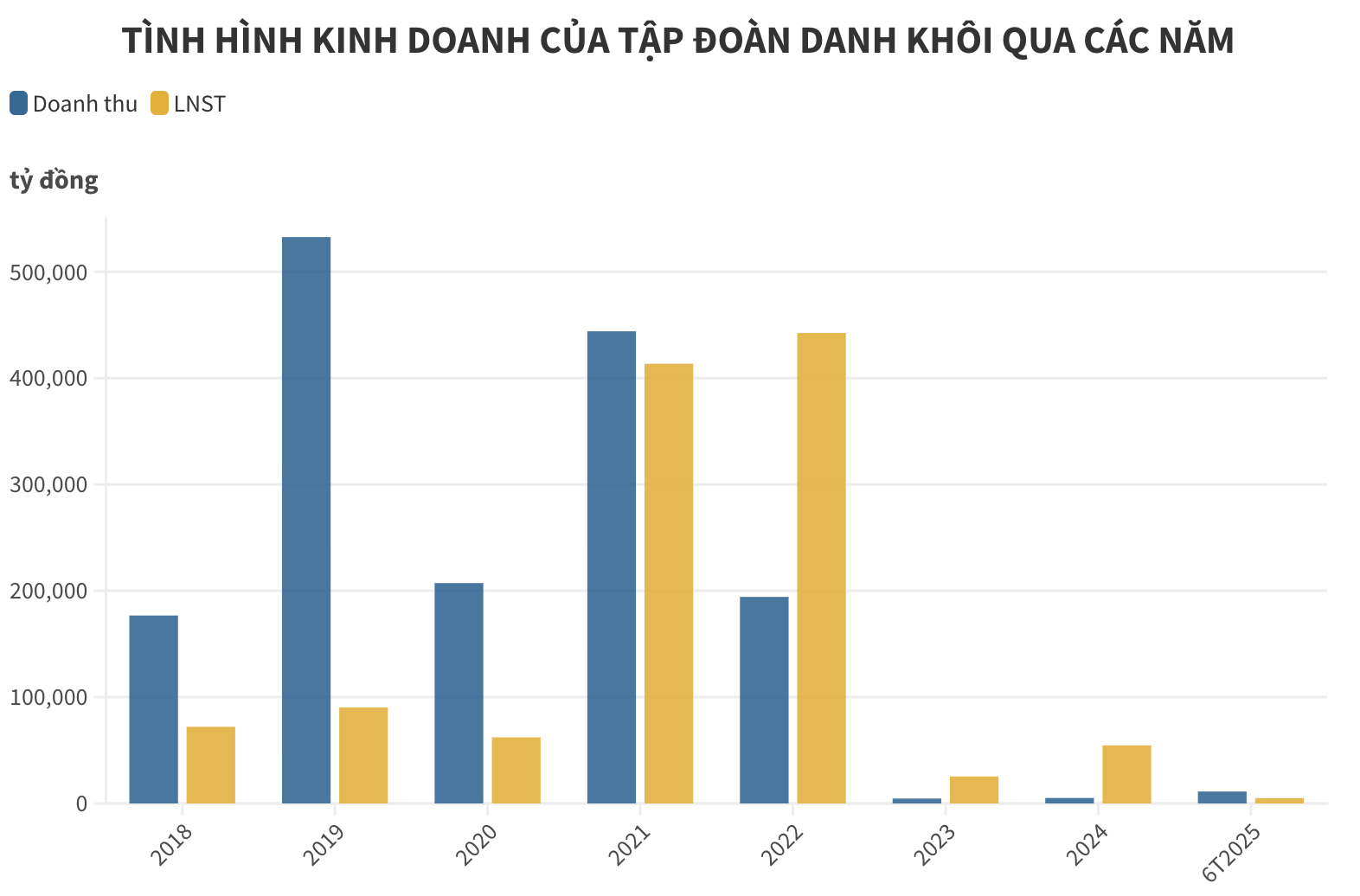

Financially, Danh Khôi’s 2018-2020 revenue fluctuated from VND 177 billion (2018) to VND 533 billion (2019), then dropped to VND 207 billion (2020), with after-tax profits ranging between VND 60-90 billion annually.

2021 marked a peak with nearly VND 200 billion in profit and VND 444 billion in revenue. However, performance declined in 2022 with a VND 73 billion loss, followed by a meager VND 4 billion revenue and VND 12 billion profit in 2023.

In 2024, revenue was just over VND 5 billion, with a record VND 63 billion loss, the highest since listing.

The first half of 2025 showed improvement with VND 11 billion revenue and nearly VND 5 billion profit, reversing a VND 10 billion loss from the same period last year. However, this remains modest compared to a VND 926 billion charter capital and VND 1.895 trillion asset base (as of June 30, 2025).

Critically, cash on hand was under VND 400 million by June 2025, while short-term receivables exceeded VND 440 billion. Inventory was minimal at under VND 10 billion, primarily brokerage and marketing costs for projects like Welltone Luxury Residence (The Aston) and The Meraki.

In the 2025 interim audit report, auditors highlighted going concern doubts due to bond payment breaches, tax arrears, and supplier debts. Danh Khôi is negotiating debt restructuring, recovering business cooperation debts, and diversifying into new sectors to improve cash flow.

Facing declining real estate revenue, Danh Khôi announced a strategy to expand into high-tech agriculture, pharmaceuticals, and medical supplies, alongside restructuring subsidiaries. The company also rebranded as NRC Corporation in June 2025.

To bolster finances, NRC plans to issue up to 92.6 million shares at VND 10,000 each, increasing charter capital to nearly VND 1.852 billion. This includes VND 338 billion for Vietnam Excellent Healthcare Investment Corporation shares, VND 300 billion for a Nha Trang real estate project, VND 270 billion for debt repayment, and VND 15 billion for working capital.

However, the plan’s feasibility is questionable as NRC shares trade at around VND 6,000, significantly below the issuance price.

Vietnam Establishes New Growth Model

Vietnam pioneers a groundbreaking approach by consolidating three key documents into one, establishing a new growth model, comprehensive institutional reforms, and paving the way for a development phase driven by science, technology, and human-centric innovation.

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?

Samsung Expands Smart Home Robot Production in Ho Chi Minh City

Samsung Electronics Home Appliances Complex (SEHC), a 70-hectare, $1.4 billion investment, broke ground in Ho Chi Minh City in May 2015. Initially focused on premium TVs, including SUHD TV, Smart TV, and LED TV, this state-of-the-art facility marks a significant milestone in Samsung’s global manufacturing footprint.