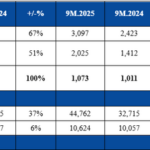

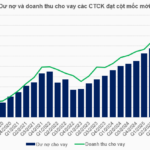

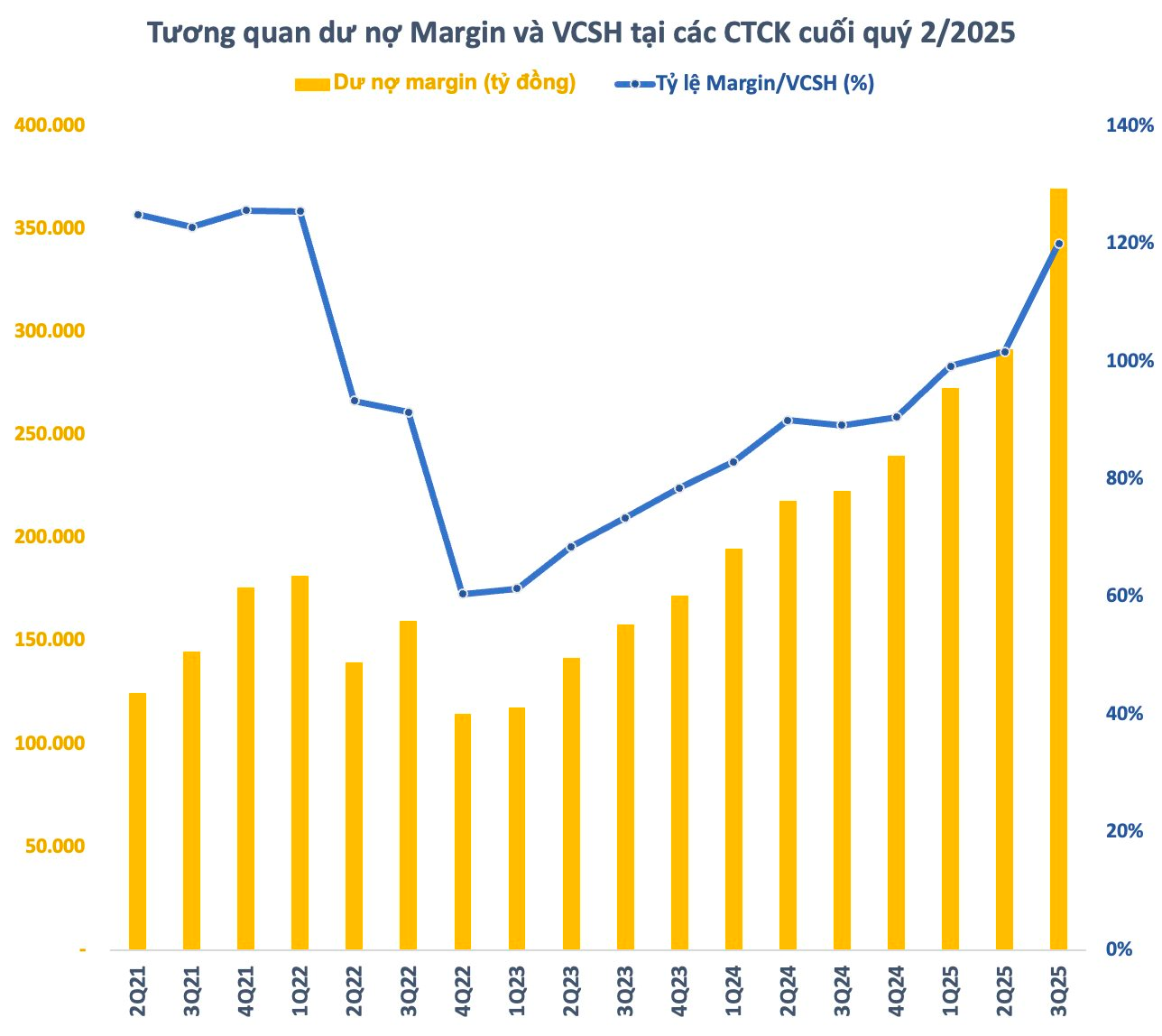

According to statistics, as of the end of Q3/2025, the margin lending debt at securities companies (SCs) is estimated at approximately VND 370 trillion, an increase of VND 78 trillion compared to the end of Q2, marking a historic high in Vietnam’s stock market.

At the same time, the total equity of SCs reached around VND 308 trillion, up VND 21 trillion from the end of Q1. The Margin/Equity ratio as of September 30 surged to 120%, the highest in 14 quarters since Q2/2022, nearing the peak levels seen in late 2021 to early 2022.

Regulations stipulate that SCs cannot lend margin exceeding twice their equity at any given time. With the Margin/Equity ratio at the end of Q3/2025, SCs are estimated to have approximately VND 246 trillion available for margin lending in the near future.

It’s important to note that this figure is theoretical, and in practice, the market-wide Margin/Equity ratio has never reached the 2x threshold, even during the most active trading periods.

Additionally, some SCs with remaining room may face liquidity constraints due to allocations to other channels like bonds and securities. Furthermore, the amount investors can borrow via margin depends on their collateral, including cash and stocks.

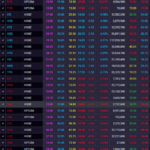

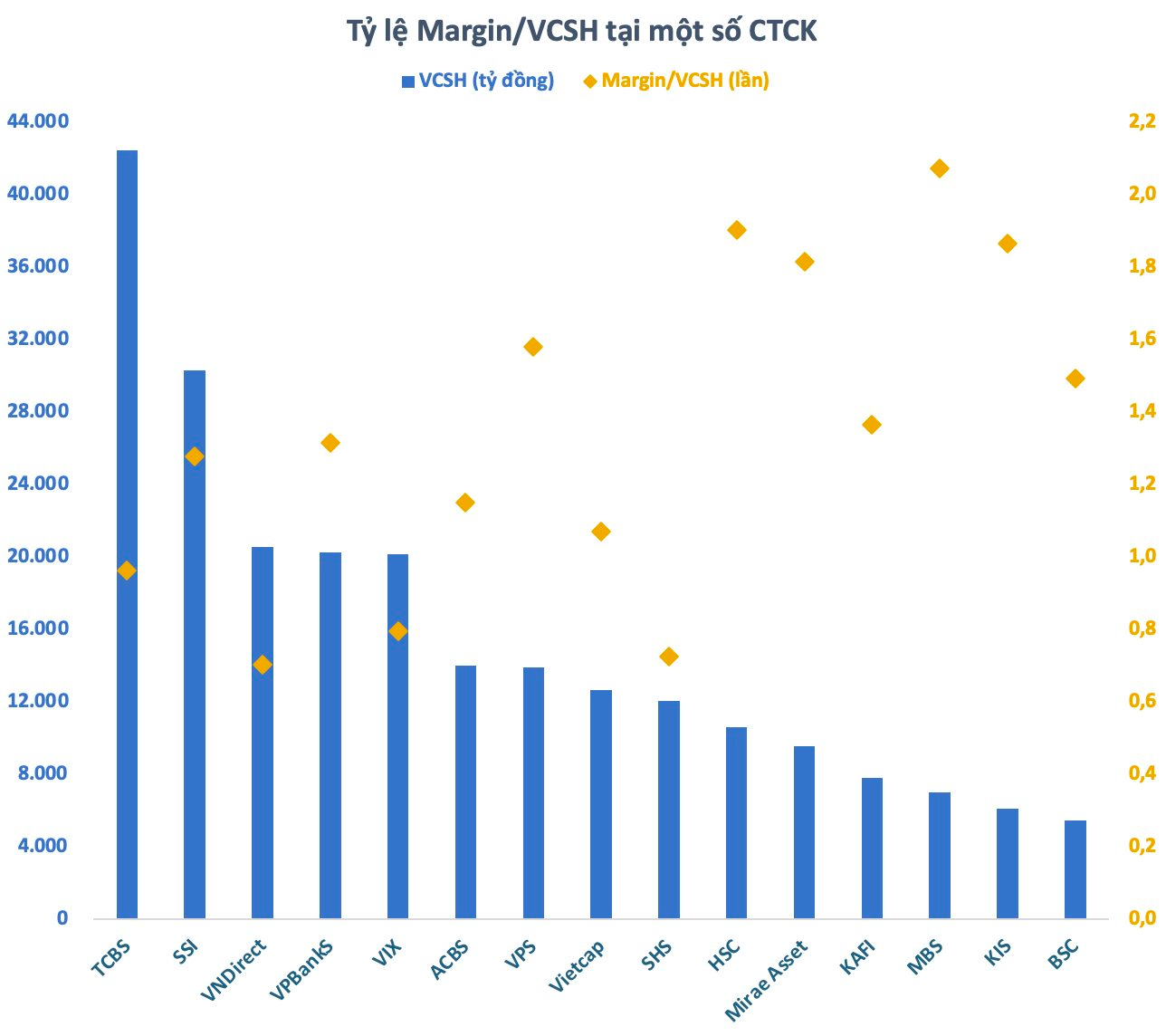

On an individual SC basis, there is a clear divide. Leading SCs in terms of equity, such as TCBS, SSI, VNDirect, VPBankS, and VIX, still have significant room for lending, with Margin/Equity ratios below 1.5x. Conversely, SCs like HSC, Mirae Asset, MBS, and KIS VN are nearing the maximum threshold, primarily due to slower growth in capital and retained earnings compared to margin demand.

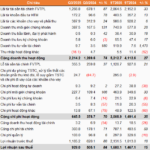

As margin lending becomes increasingly vital to SC operations, the race to raise capital is intensifying. Most top-tier SCs have announced plans to increase capital in the coming period.

In early September, SSI unveiled plans to issue 415.5 million shares to existing shareholders, raising capital from VND 20.779 trillion to nearly VND 25 trillion, leading the industry. At VND 15,000 per share, SSI aims to raise approximately VND 6.2 trillion, earmarked for margin lending, bond investments, and deposit certificates.

TCBS previously completed its IPO of 231.1 million shares at VND 46,800 each, increasing its charter capital to VND 23.133 trillion. Similarly, VPBankS plans to issue 375 million shares, equivalent to 25% of its current capital, at a minimum price of VND 12,130 per share, raising its charter capital to VND 18.750 trillion.

Among SCs nearing their limits, MBS is simultaneously implementing three capital increase schemes (ESOP, bonus shares, and rights issues) to raise its charter capital to nearly VND 6.7 trillion. HSC recently completed a capital increase to over VND 10.6 trillion in the last quarter and is likely to announce further capital plans soon.

Overall, the need for capital remains critical for SCs, especially after FTSE reclassified Vietnam from Frontier to Secondary Emerging market status. Billions in foreign capital and a wave of new international investors are expected to flow into Vietnam following this upgrade.

Foreign institutional investors are now permitted to trade without 100% pre-funding, necessitating further capital enhancements by SCs, particularly those nearing their limits. Even top-tier SCs cannot afford to lag in this increasingly competitive landscape.

With the upgrade momentum gaining clarity, SCs must continue raising capital to keep pace with market growth, attract investors, and avoid falling behind. Additionally, the emerging digital asset sector in Vietnam presents another attractive opportunity alongside traditional securities markets.

VNDIRECT’s Q3 Net Profit Surges 84% Amid Favorable Market Conditions

VNDIRECT Securities Corporation (HOSE: VND) has released its Q3/2025 financial report, revealing a remarkable post-tax profit of VND 929 billion, marking an 84% surge compared to the same period last year. The company’s core business segments, including proprietary trading, brokerage, and margin lending, all experienced significant growth amidst favorable market conditions.

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.

Vietnamese Real Estate Stock Surges Amid Record 95-Point Market Plunge

NTC shares of Nam Tan Uyen Industrial Park Joint Stock Company emerge as a rare bright spot, defying the trend ahead of its upcoming market transfer.