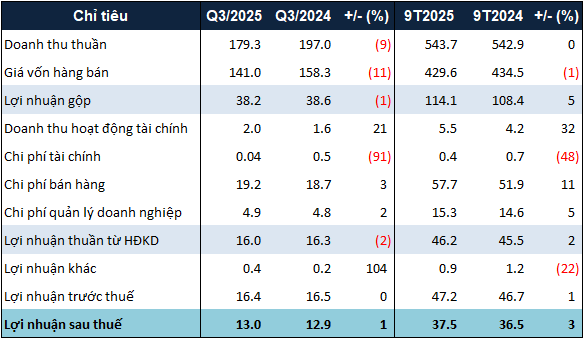

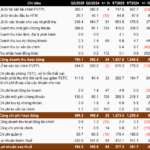

Specifically, in Q3, SAF recorded net revenue of over 179 billion VND, a 9% decrease compared to the same period last year. However, thanks to an 11% reduction in cost of goods sold, the company’s gross profit remained stable at approximately 38 billion VND.

Selling expenses and administrative expenses rose by 3% and 2% respectively, reaching over 19 billion VND and nearly 5 billion VND. Nonetheless, financial revenue increased by 21% to 2 billion VND, partially offsetting the additional expenses.

As a result, SAF achieved an after-tax profit of 13 billion VND, a slight increase year-over-year. For the first nine months of the year, the company’s after-tax profit reached nearly 38 billion VND, up 3%.

|

Business results for the first 9 months of 2025 of SAF. Unit: Billion VND

Source: VietstockFinance

|

Compared to the pre-tax profit target of 61 billion VND, SAF’s nine-month pre-tax profit represents a fulfillment rate of over 77%.

On the balance sheet, SAF’s total assets as of September 30, 2025, stood at approximately 282 billion VND, a 9% increase from the beginning of the year. The largest component, short-term cash holdings, rose by 20% to over 143 billion VND. Conversely, inventory decreased slightly by 4% to 61 billion VND.

Meanwhile, total liabilities increased by 41% to 113 billion VND. Notably, customer prepayments surged from 132 million VND to over 4 billion VND. Short-term payable expenses also jumped by 88% to over 11 billion VND, primarily due to a nearly 5 billion VND land rental expense.

– 10:23 21/10/2025

Long Giang Reports Return to Loss in Q3

After two consecutive profitable quarters, Long Giang Investment and Urban Development Corporation (HOSE: LGL) has reported a loss in Q3 2025.

Hương Sơn Hydropower Profits Surge 32% Amid Favorable Weather and New Electricity Rates

Huong Son Hydro Power Joint Stock Company (UPCoM: GSM) has released its Q3/2025 financial report, revealing a 32% year-over-year increase in after-tax profit. This impressive growth is primarily attributed to higher water levels in the reservoir and the implementation of a new electricity pricing mechanism.

KIS Reports 84% Surge in Q3 Net Profit, Rebounding from First-Half Slump

KIS Vietnam Securities Corporation (KIS Vietnam) reported a remarkable net profit of over VND 194 billion in Q3, surging 84% year-over-year. This impressive growth was driven by strong performance across key business segments, including proprietary trading, brokerage, and lending. The stellar Q3 results helped offset the company’s lackluster performance in the first half of the year.

Bầu Đức Celebrates: Hoàng Anh Gia Lai (HAG) Reports 25% Surge in Q3 Net Profit Despite 80% Revenue Plunge in Pig Farming Sector

In the first nine months of the year, cumulative net revenue surpassed 5.6 trillion VND, marking a 34% increase compared to the same period in 2024. Post-tax profit recorded an impressive 1.312 trillion VND, reflecting a robust 54% growth year-over-year.