As of September 30, 2025, SHB’s total assets reached 852.695 trillion VND, a 14% increase compared to the end of 2024, steadily progressing toward the 1 million trillion VND target by 2026.

Outstanding credit loans hit nearly 616.6 trillion VND, up 15% year-to-date, reinforcing SHB’s role as a vital economic artery. The bank consistently supplies capital and drives growth aligned with the Party and State’s directives. SHB’s tailored credit products, programs, and preferential loan packages cater to diverse customer segments—individuals, households, SMEs, and large enterprises—directing capital toward priority sectors and key industries as Vietnam enters a new era.

SHB maintains its position among Vietnam’s most efficient banks through robust investments in digital transformation and advanced technology integration. The bank rigorously manages asset quality, targeting a bad debt ratio below 2%. All capital adequacy ratios exceed both SBV regulations and international standards, with CAR surpassing 12%—significantly above the 8% minimum per Circular 41/2016/TT-NHNN.

Strengthening Financial Foundations – Accelerating Transformation

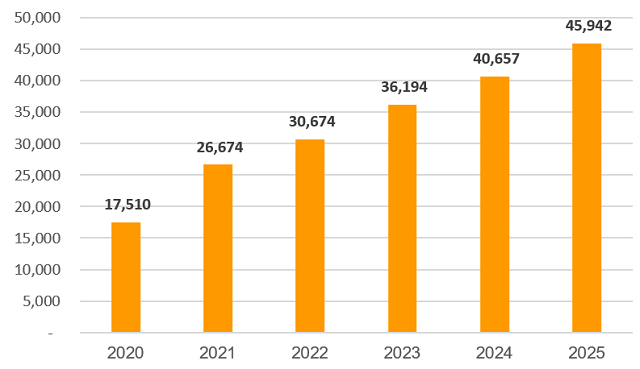

SHB recently finalized its charter capital increase to 45.942 trillion VND, as approved by the 2025 Annual General Meeting. This included issuing dividend shares at a 13% rate for the second 2024 dividend payment, following a 5% cash dividend earlier in the year. The total 2024 dividend payout reached 18%, with plans to sustain this level in 2025.

On October 16, 2025, SHB announced a shareholder record date to seek written approval for a new 2025 charter capital increase. This move solidifies SHB’s market position, enhances financial stability, and boosts competitiveness, enabling business expansion under its comprehensive transformation strategy. The bank remains committed to meeting the growing capital demands of Vietnam’s economy, supporting the government’s growth objectives.

SHB’s Charter Capital Over the Years

|

Robust capital resources empower SHB to invest in cutting-edge technology, enhance customer experiences, and optimize credit and business operations. This underscores SHB’s commitment to fostering economic growth and delivering sustainable value to shareholders.

SHB is executing a bold, comprehensive transformation strategy to become the “Bank of the Future.” This strategy integrates AI, Big Data, and Machine Learning across operations, risk management, and product development.

Through innovative financial solutions, SHB maintains strategic partnerships with leading state and private enterprises, both domestically and internationally. The bank develops ecosystem and supply chain strategies for satellite SMEs and individual customers, solidifying its reputation as a top-tier institution.

Globally, SHB is a trusted partner for international financial institutions like the World Bank, JICA, ADB, and KFW, serving as a relending bank for national projects and participating in ADB’s global trade finance programs.

SHB was recently honored in Vietnam’s Top 10 Most Profitable Companies and Top 50 Most Effective Businesses. The bank also earned accolades such as “Bank for the People,” “Best Public Sector Bank in Vietnam” (FinanceAsia), “Best Sustainable Finance Bank in Vietnam” (Global Finance), and “Best SME Finance Bank in Vietnam.” Brand Finance ranked SHB among Vietnam’s Top 33 most valuable brands and the global Top 500 banks by brand value in 2025.

SHB’s transformation strategy focuses on four pillars: policy and process reforms, people-centric development, customer and market-driven operations, and IT modernization. The bank aims to lead in efficiency, digital banking, retail services, and capital provision for strategic corporate clients, with a vision to become a top regional modern retail, green, and digital bank by 2035.

– 13:18 21/10/2025

LPBank Surges Ahead in Profit Race, Reporting Over 9.6 Trillion VND in Earnings After 9 Months

LPBank (Loc Phat Bank) has unveiled its financial report for the first nine months of 2025, boasting a pre-tax profit of 9.612 trillion VND—an unprecedented high in the bank’s history. Surging ahead in the profit race, LPBank is setting new benchmarks, solidifying its sustainable growth foundation, and striving toward long-term objectives.

BAOVIET Bank: Positive Credit Growth in the First Nine Months

With a modern retail banking development strategy deeply rooted in digital transformation, BAOVIET Bank (BAOVIET Bank Joint Stock Commercial Bank) achieved impressive business results in the first nine months of 2025. The bank recorded reasonable credit growth, strengthened risk management efficiency, and positive profit growth compared to the same period last year.

Unlocking ETF Market Growth: Insights from South Korea, Taiwan, and Gold ETFs

The Vietnamese market is increasingly diversifying its investment options, introducing innovative fund types such as ETFs (Exchange-Traded Funds) and bond investment funds. Additionally, regulatory authorities are actively exploring the development of a novel fund category: gold-backed ETFs.

Eight Key MobiFone Leaders Integrated into the People’s Public Security Forces

After transitioning from the State Capital Management Committee to the Ministry of Public Security eight months ago, MobiFone Telecommunications Corporation has emerged as a key player in serving national security and defense. This shift has marked a significant transformation, with the company demonstrating notable progress in its new role.