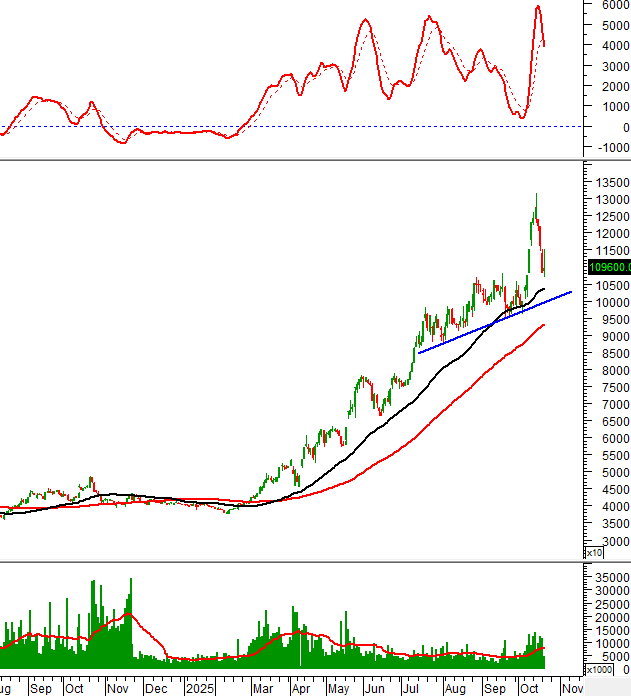

Technical Signals of VN-Index

During the morning trading session on October 21, 2025, the VN-Index continued to adjust and test the previous low from August 2025 (equivalent to 1,605-1,630 points).

Both the MACD and Stochastic Oscillator indicators plummeted after issuing strong sell signals, indicating that risks remain.

Technical Signals of HNX-Index

During the morning trading session on October 21, 2025, the HNX-Index is trending downward and clinging to the Lower Band of the Bollinger Bands.

The MACD indicator has reissued a sell signal and fallen below the zero line, so investors should exercise caution.

FPT – FPT Corporation

During the morning trading session on October 21, 2025, FPT stock prices rebounded strongly, forming a White Body candlestick pattern.

The Stochastic Oscillator has reversed and issued a strong buy signal in the oversold region.

Foreign investors halting net selling and resuming strong buying have improved the recovery prospects as prices test the previous low from April 2025.

VHM – Vinhomes JSC

During the morning trading session on October 21, 2025, VHM stock prices paused their decline, forming a candlestick with long upper and lower shadows.

The short-term trendline (equivalent to the 99,000-102,000 range) is nearby and will serve as crucial support.

Additionally, the 50-day SMA has previously provided strong support for VHM in late September 2025 and early October 2025, and it is expected to hold firm again.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning trading session. Therefore, the signals and conclusions are for reference only and may change after the afternoon session concludes.

Technical Analysis Department, Vietstock Advisory Division

– 12:04 October 21, 2025

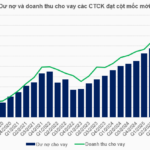

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.

Market Pulse 21/10: Foreign Capital Returns, Driving Strong Market Recovery

In a session marked by early selling pressure, buyers regained control as the afternoon session progressed, sustaining an upward trajectory until the market’s close. Today, the VN-Index climbed 27 points to settle at 1,663.43, while the HNX-Index advanced 1.6 points, closing at 264.65.

Viettel Stocks Surge Against Market Trends

Closing the session on October 20th, the stock prices of Viettel Global (VGI), Viettel Construction (CTR), Viettel Post (VTP), and Viettel Consulting & Design (VTK) collectively surged, with gains ranging from 3.9% to 4.8%.