Technical Signals of VN-Index

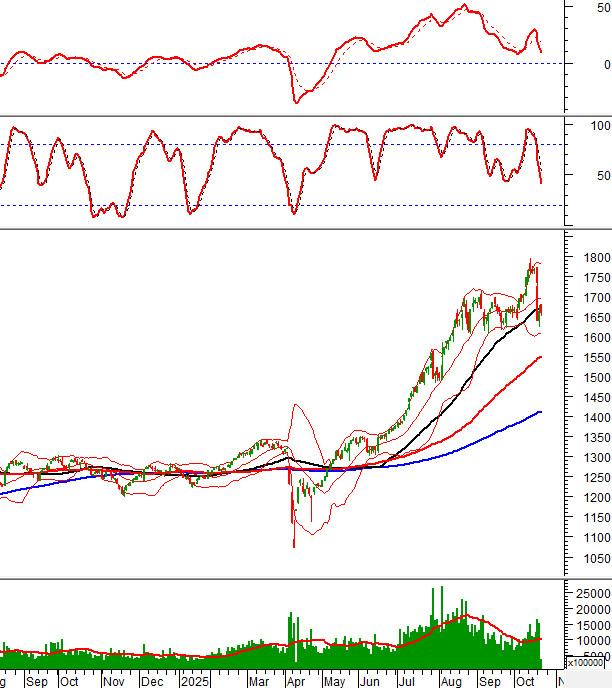

During the morning trading session on October 22, 2025, the VN-Index opened positively but soon entered a correction phase.

The author anticipates that the old August 2025 bottom will be tested again, as the index has remained below the 50-day SMA for three consecutive sessions.

Technical Signals of HNX-Index

In the morning session on October 22, 2025, the HNX-Index continued to hover near the Lower Band of the Bollinger Bands.

The MACD indicator is still declining sharply after falling below the zero line, so investors should exercise caution.

NTP – Tien Phong Plastic Joint Stock Company

In the morning session on October 22, 2025, the share price of NTP continued to rise, testing the previous September 2025 peak (around 67,000-69,000) with trading volume surpassing the 20-session average, indicating optimistic investor sentiment.

The MACD indicator remains above the zero line and continues to rise after generating a buy signal, while the price of NTP stays close to the Upper Band of the Bollinger Bands. This further supports the stock’s short-term recovery momentum.

PLX – Vietnam National Petroleum Group

In the morning session on October 22, 2025, the share price of PLX rose for the second consecutive session, forming a Big White Candle pattern with trading volume expected to exceed the 20-day average by the end of the session, reflecting active investor trading.

Currently, the stock price remains within a short-term Bearish Price Channel, while the MACD indicator has generated a new buy signal.

Additionally, the Stochastic Oscillator has risen out of the Oversold region after giving a buy signal, and the price of PLX has crossed above the Middle Band of the Bollinger Bands. This strengthens the prospects for a short-term recovery.

(*) Note: The analysis in this article is based on realtime data as of the end of the morning session. Therefore, the signals and conclusions are for reference only and may change by the end of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:02 October 22, 2025

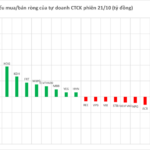

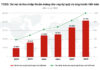

Foreign Investors Pour Nearly VND 2.5 Trillion into Vietnamese Stocks on October 21, with FPT in the Spotlight

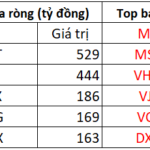

In the afternoon trading session, FPT shares witnessed the most significant net inflow from foreign investors across the entire market, with a remarkable surge in value reaching 529 billion VND.