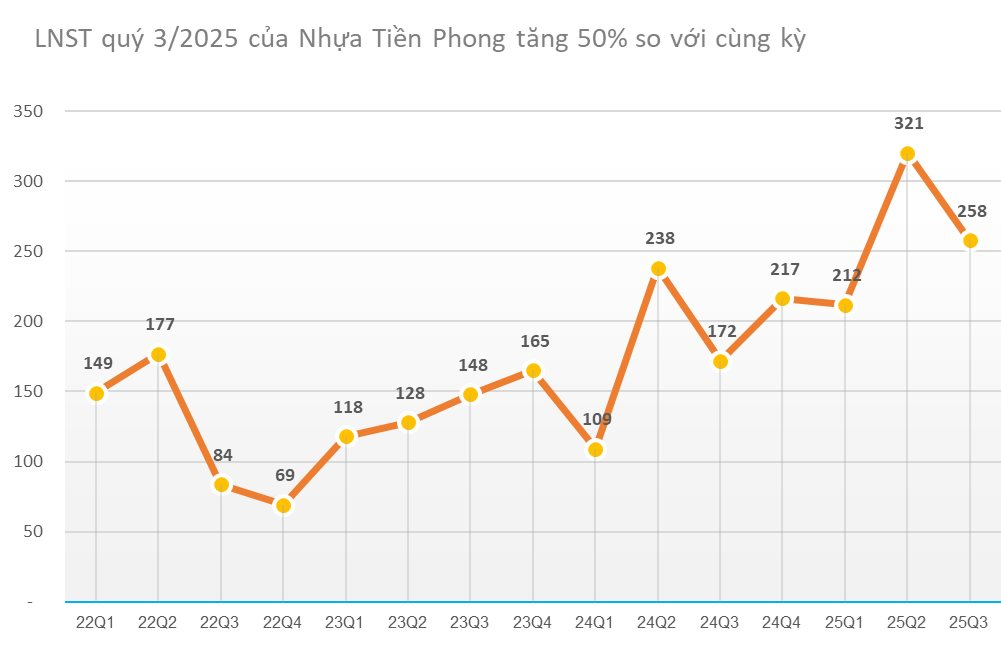

Tien Phong Plastic Joint Stock Company (stock code: NTP) has released its consolidated Q3/2025 financial report, revealing a net revenue of VND 1,610 billion—a 34% increase compared to the same period last year—and a post-tax profit of VND 258 billion, up by 50%. Although the Q3/2025 profit is slightly lower than Q2/2025, it remains the second-highest in the company’s history.

Tien Phong Plastic attributes this growth to increased sales revenue and reduced raw material costs, as evidenced by a gross profit margin of 31%, up from 28.5% in the previous year. Additionally, the company enhanced financial profits through effective management of cash and cash equivalents.

In the first nine months of the year, Tien Phong Plastic achieved a cumulative net revenue of VND 4,869 billion—a 27% increase—and a post-tax profit of VND 790 billion, up by 52%. Earnings per share (EPS) reached VND 4,619.

As of September 30, 2025, Tien Phong Plastic’s total assets reached VND 6,920 billion—an 8% increase from the beginning of the year. Cash, cash equivalents, and savings deposits totaled nearly VND 2,900 billion, accounting for 42% of total assets.

On October 16, 2025, Tien Phong Plastic became the only Vietnamese construction plastics company to achieve the World Class category—the highest level—at the Asia-Pacific International Quality Award (GPEA 2025) held at the Beijing International Convention Center, China.

Mr. Chu Van Phuong, Board Member and CEO of Tien Phong Plastic Joint Stock Company, receives the Asia-Pacific International Quality Award (GPEA 2025) at the World Class level.

Over the 25-year history of this award, Tien Phong Plastic is one of only two Vietnamese companies to receive it twice, in addition to winning the National Quality Award seven times, including three Gold Awards.

Vietnam’s Top MG Car Dealer Reports 99% Drop in Q3 Profit to Less Than VND 400 Million

In the first nine months of 2025, net revenue continued its upward trajectory, climbing 13% year-over-year to reach 988 billion VND. However, net profit after tax for the period plummeted 63% to 34 billion VND, a stark contrast to the 92 billion VND recorded in the same period of 2024.

KienlongBank Surges Ahead with Strategic Milestones, Shattering 30-Year Profit Records and Leading Market Momentum

KienlongBank (Kien Long Commercial Joint Stock Bank; UPCoM: KLB) has recently unveiled its Q3 2025 business results, reporting a consolidated pre-tax profit of VND 616 billion. Key performance indicators, including total assets, mobilized capital, and outstanding loans, have all surged significantly, nearing annual targets. This impressive growth underscores the bank’s robust management capabilities and clear strategic direction.

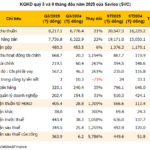

Savico’s Q3 Profits Surge 5,800%, Stock Hits Consecutive Upper Limits

Savico (HOSE: SVC) reported record-breaking Q3/2025 profits, surpassing all previous years by a significant margin. This remarkable achievement was driven by a one-time financial gain of VND 537 billion from the divestment of a real estate project.