Trading Activities

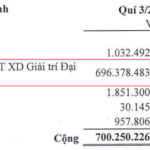

The Q3/2025 financial report of Ba Ria – Vung Tau Housing Development Joint Stock Company (Hodeco – stock code: HDC) reveals a financial revenue of over 700 billion VND, with more than 696 billion VND coming from the sale of shares in Ocean Entertainment Construction Investment Joint Stock Company. The capital contribution to this affiliate company at the end of Q2/2025 was 570 billion VND.

Ocean Entertainment Construction Investment Joint Stock Company is the developer of the Ocean Tourism Complex project (commercially known as Antares), spanning 19.6 hectares with a total investment of nearly 8,500 billion VND.

Rendering of the Ocean Tourism Complex project.

As of September 30, HDC has a short-term receivable of nearly 336 billion VND from Success Real Estate Co., Ltd., stemming from Hodeco’s sale of shares in Ocean Entertainment Construction Investment Joint Stock Company. This is secured by a deposit of over 44 billion VND from Tan Cuong Investment Consulting and Trading Joint Stock Company and a payment guarantee letter dated June 27, 2025, from MB Bank, valued at over 291 billion VND.

Similarly, Mekong Capital Joint Stock Company (stock code: VC3) has approved the investment in a high-end apartment complex project within the Binh Duong Urban Industrial Service Complex (commercially known as The Charms Binh Duong) on lot A4, New Urban Area (Zone 1), Binh Duong Ward, Ho Chi Minh City.

This Group A project has a total investment of 3,733 billion VND, including land use rights transfer costs and construction investment expenses. The implementation period is from 2025 to 2029.

Previously, the People’s Committee of Binh Duong Province (former) allowed Mekong Capital to acquire and develop The Charms Binh Duong project from Becamex Industrial Development and Investment Corporation (Becamex Group – stock code: BCM).

This deal originated from the principle contract No. 19/HDNT/2021 signed on February 2, 2021, when Mekong Capital agreed to acquire a portion of the project in the New Urban Area of Binh Duong (Zone 1) from BCM, with a total value of over 515 billion VND.

The reviewed consolidated financial report for the first six months of 2025 of VC3 shows that, as of June 30, 2025, the in-progress production and business costs at The Charms Binh Duong project were nearly 476 billion VND, with VC3 still owing over 315 billion VND to BCM. The Charms Binh Duong project is part of the New Urban Area (Zone 1) with an area of over 709 hectares, where BCM is the infrastructure developer. The total investment is nearly 1,500 billion VND.

A recent high-profile real estate M&A deal involves foreign participation, specifically from Malaysian giants. United Overseas Australia Ltd (UOA) has announced the acquisition of a prime 2,000 m² plot in the heart of Ho Chi Minh City (former District 1), with a total transfer value of 68 million USD, equivalent to approximately 1,700 billion VND.

Rendering of The Charms Binh Duong project.

UOA has completed the acquisition of VIAS Hong Ngoc Bao Joint Stock Company through three wholly-owned subsidiaries: UOA Vietnam Pte Ltd, UTD Vietnam Pte Ltd, and UTM Vietnam Pte Ltd. The land is slated for the development of a modern office tower with approximately 20,000 m² of floor space, with an estimated total investment of 120 million USD.

Another Malaysian company, SkyWorld, has signed an agreement to acquire a 9,400 m² plot in Lai Thieu Ward (Ho Chi Minh City) for over 32 million USD. The plan is to develop this land into a high-end apartment complex with a 40-story block, offering over 1,200 apartments to the market.

Bcons Group, in partnership with Mercuria SPV from Japan, will develop the Bcons Asahi project with prices under 2 billion VND per unit, located on the frontage of National Highway 1K in Ho Chi Minh City. The Bcons Asahi apartment complex has 29 floors and 2 basements, providing 490 apartments with living spaces ranging from 35 to 74 m².

Notable Momentum

Commenting on the M&A market outlook, Matthew Powell, Director of Savills Hanoi, believes that the Vietnamese government’s target of 8% GDP growth in 2025, through structural reform programs, increased public investment, and private sector support, is a positive sign. Administrative reforms, including reducing the number of provinces from 63 to 34 and eliminating district-level administration, are expected to streamline governance, enhance efficiency, and facilitate investment flows.

Additionally, Resolution 68-NQ/TW aims to promote the development of the private sector by focusing on legal reforms, reducing business barriers, improving access to land and capital, protecting property rights, and fostering fair competition. This is a crucial foundation for Vietnam to attract high-quality capital in a context where global investors are increasingly concerned about a stable and transparent legal environment.

Bcons Asahi is strategically located on the frontage of National Highway 1K in Ho Chi Minh City.

“Despite global uncertainties and trade tensions, Vietnam remains committed to structural reforms and investment attraction efforts. While challenges persist, stable FDI inflows and infrastructure development indicate a cautiously optimistic outlook for long-term growth,” said Matthew Powell.

Nguyen Le Dung, Head of Investment Advisory Services at Savills Hanoi, notes that the Vietnamese real estate M&A market has shown clear signs of recovery since late last year, thanks to the positive impact of the new Land Law and Real Estate Business Law.

According to Dung, the improved legal framework has significantly boosted investor confidence and facilitated smoother and more transparent M&A transactions.

Meanwhile, Vo Hong Thang, Deputy General Director of DKRA Group, reports that M&A activities have been notably vibrant since the beginning of the year. Statistics from listed companies show a 20-30% increase in publicly announced M&A projects compared to the same period last year, with actual figures potentially higher due to unannounced deals. Notably, most investors are prioritizing projects that are legally compliant or near completion.

Thang added that the draft amendments to the Land Law and Real Estate Business Law 2023 are significant drivers for the market. The new regulations will simplify land reclamation procedures, improve access to clean land funds, and reduce legal risks for investors.

VC3 and MekongHomes Joint Venture Launches $85 Million Urban Development Project in Gia Lai

The People’s Committee of Gia Lai Province has officially approved the selection of the investor consortium Nam Mekong – MekongHomes for the Cat Khanh Urban Area project. Spanning over 41.6 hectares, this ambitious development boasts a total investment of nearly VND 2,000 billion.

Mekong Capital Steps In for BCM in $160 Million Luxury Apartment Project in Ho Chi Minh City

The Charms Binh Duong, a prestigious project located at Lot A4 within the new urban area (Zone 1) of Binh Duong Ward, Ho Chi Minh City, has been officially approved for investment by the Mekong South Corporation. With a total capital exceeding 3.7 trillion VND, this development promises to redefine luxury living in the region.