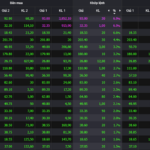

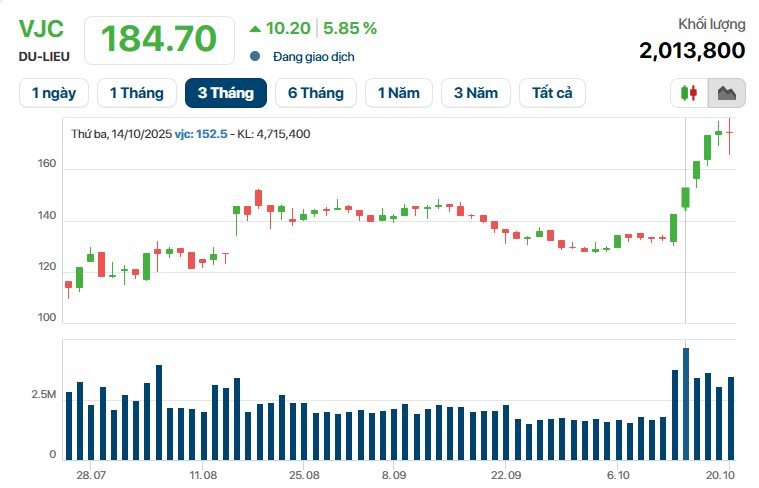

Following the VN-Index’s record-breaking 95-point plunge on October 20, the stock market showed signs of recovery on October 21. Notably, Vietjet’s VJC shares demonstrated positive momentum, even hitting the ceiling price of VND 186,700 per share during the session.

Currently, VJC shares are trading at VND 184,700 per share, up 5.85% with over 2 million shares traded.

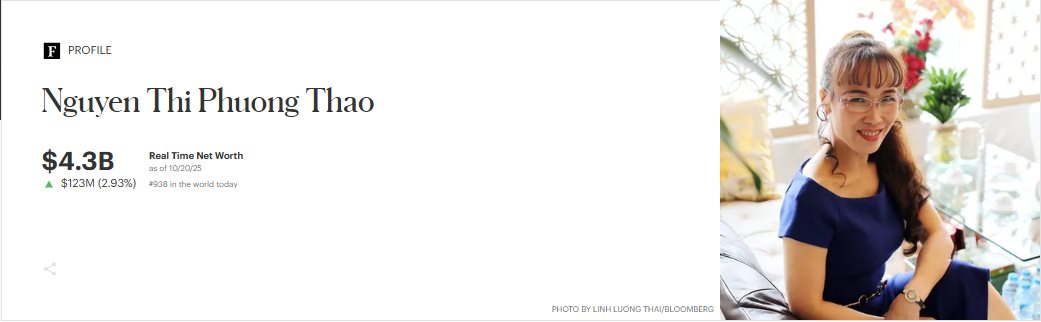

In addition to VJC, billionaire Nguyen Thi Phuong Thao also holds shares in HDBank (HDB). Currently, HDB shares are priced at VND 30,950 per share, up 2.3%.

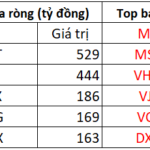

With these share prices, billionaire Nguyen Thi Phuong Thao’s securities assets are valued at nearly VND 41,400 billion, an increase of approximately VND 2,200 billion compared to the previous trading session’s close.

On Forbes’ billionaire list, Vietnam’s sole female billionaire saw her wealth increase by USD 123 million to USD 4.3 billion, ranking 938th globally.

What Lies Ahead for the Stock Market After the ‘Dark Day’?

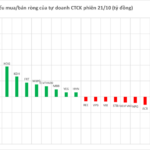

Robust buying momentum in the afternoon session bolstered the VN-Index’s recovery, driven notably by the resurgence of large-cap stocks. The VN30-Index surged over 45 points, with FPT and HDB hitting their daily limits.

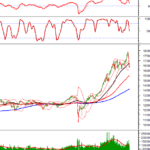

Vietstock Daily 22/10/2025: Bottom-Fishing Demand Emerges

The VN-Index rebounded after successfully testing its August 2025 low (around 1,605-1,630 points). If this level holds, short-term recovery prospects look more promising. However, the risk of a correction remains as the MACD and Stochastic Oscillator indicators continue to weaken following strong sell signals.