I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 21, 2025

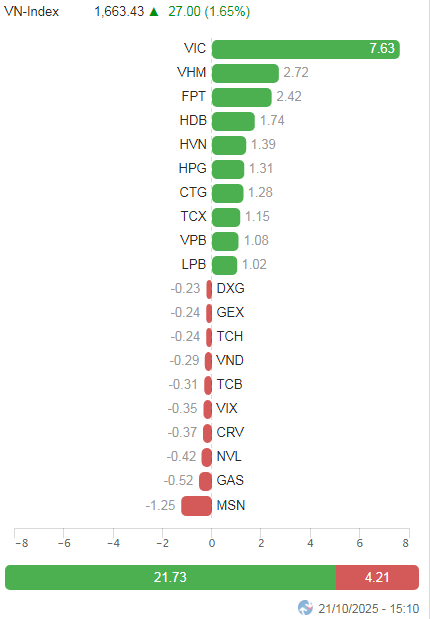

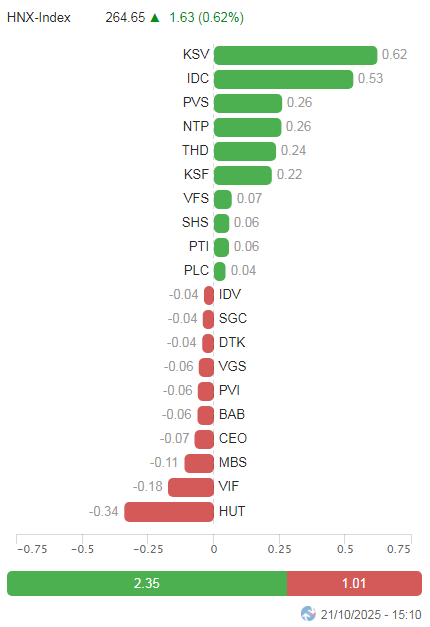

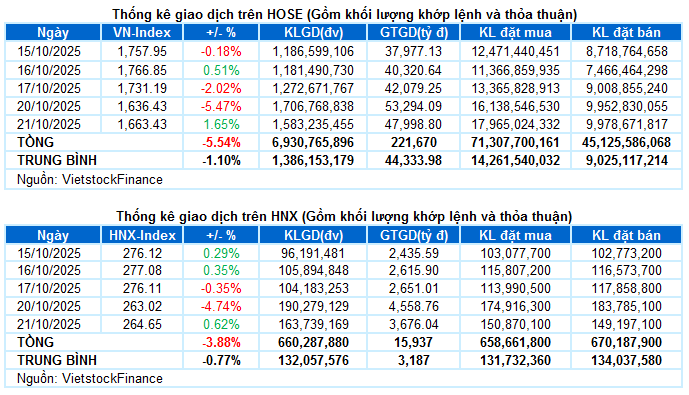

– Major indices rebounded unanimously during the October 21 trading session. Specifically, the VN-Index rose by 1.65%, reaching 1,663.43 points; the HNX-Index also increased by 0.62%, closing at 264.65 points.

– Trading volume on the HOSE floor decreased slightly by 6.5%, totaling over 1.5 billion units. The HNX floor recorded nearly 141 million matched units, down 16.7% from the previous session.

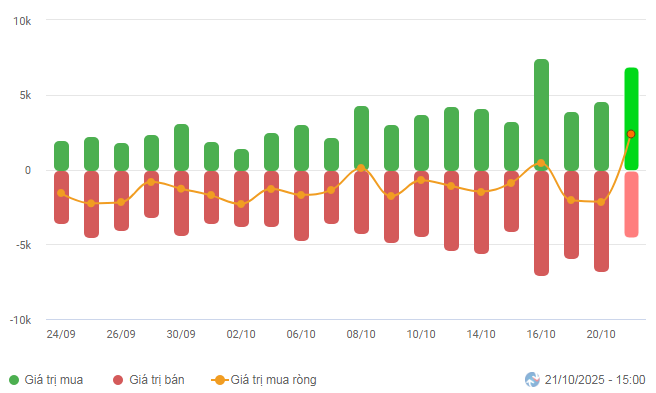

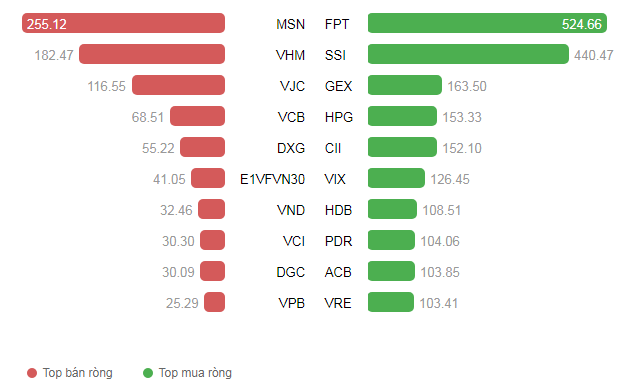

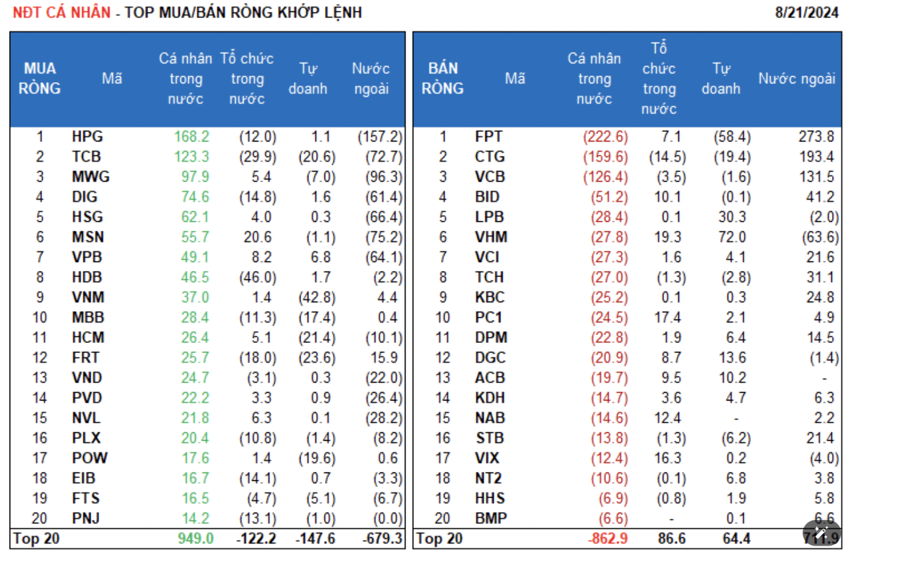

– Positive signals came from foreign investors, who reversed to strong net buying with a value of over VND 2.3 trillion on the HOSE and nearly VND 82 billion on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market recovered on October 21 after an unexpected drop the previous day. The VN-Index opened positively as blue-chip stocks regained widespread green, helping investor sentiment stabilize somewhat. However, divergence remained evident as investors were cautious. Selling pressure to take advantage of the rebound for portfolio restructuring weakened the index toward the end of the morning session. Nevertheless, the strong net buying by foreign investors was a notable highlight. In the afternoon session, the index gradually resumed its upward trend, with market breadth significantly improving. The VN-Index closed with a 27-point recovery (+1.65%), reaching 1,663.43 points.

– In terms of influence, VIC led the way, contributing 7.6 points to the VN-Index. Additionally, VHM and FPT added a combined total of over 5 points. Conversely, MSN, GAS, and NVL were significant drags, taking away more than 2 points from the overall index.

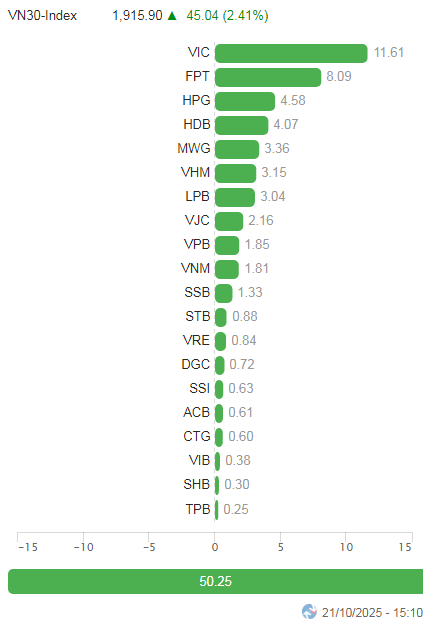

Top Stocks Impacting the Index. Unit: Points

– The VN30-Index closed with a 45-point gain, reaching 1,915.9 points. Buyers dominated with 26 gainers and 4 losers. Notably, FPT and HDB stood out with impressive gains. Following closely were SSB, VIC, LPB, and VJC, all rising over 3%. On the downside, MSN remained under significant pressure, dropping 4.8%, while the remaining three losers—GAS (-1.8%), TCB, and VCB—edged lower below the reference level.

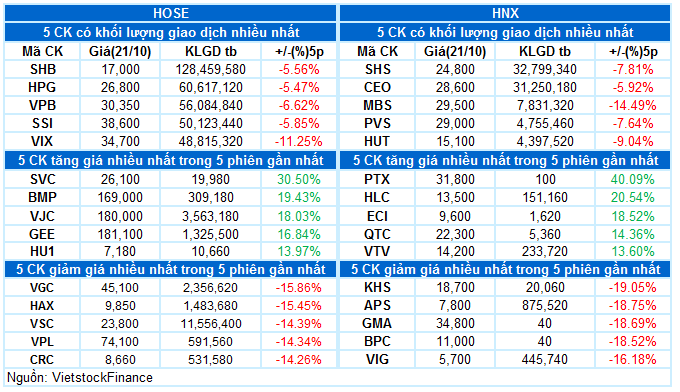

Green returned to most sectors. Information technology led with impressive gains, driven by FPT‘s ceiling recovery, CMG (+3.78%), ELC (+3.66%), ITD (+5%), and HPT (+11.11%).

Real estate followed with a 2% increase, thanks to standout performers like VIC (+4.36%), VHM (+2.69%), VRE (+1.7%), IDC (+5.97%), NLG (+2.23%), SJS (+3.41%), KHG (+5.99%), SIP (+3%), and NTL (+2.12%). However, several stocks in this sector faced heavy selling pressure, including NVL, DXS, and SCR hitting the floor, while DXG, DIG, TCH, HDC, and LDG dropped over 4%.

Notable ceiling gainers in other sectors included HDB (finance); GEE, BMP, TV2 (industrials); and FRT (non-essential consumer goods).

Conversely, the utilities sector struggled, declining 0.35%, weighed down by GAS (-1.75%), VSH (-4.78%), HDG (-3.58%), and GEG (-1%), despite REE (+2.5%), POW (+1.14%), NT2 (+1.43%), BWE (+1.49%), TDM (+2.68%), and TTA (+2.22%) attracting decent buying interest.

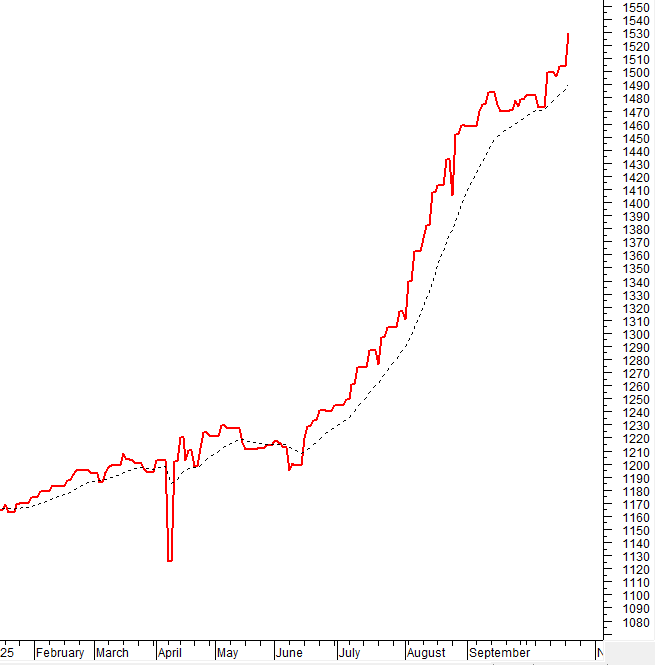

The VN-Index rebounded after successfully testing the August 2025 low (equivalent to the 1,605-1,630 range). If this level holds, the short-term recovery outlook will be more favorable. However, adjustment risks remain as the MACD and Stochastic Oscillator indicators continue to weaken after giving strong sell signals.

II. TREND AND PRICE VOLATILITY ANALYSIS

VN-Index – August 2025 Low Provides Strong Support

The VN-Index rebounded after successfully testing the August 2025 low (equivalent to the 1,605-1,630 range). If this level holds, the short-term recovery outlook will be more favorable.

However, adjustment risks remain as the MACD and Stochastic Oscillator indicators continue to weaken after giving strong sell signals.

HNX-Index – Closely Tracking the Lower Band of Bollinger Bands

The HNX-Index moved sideways and is closely tracking the Lower Band of Bollinger Bands.

The Stochastic Oscillator and MACD indicators continue to decline after giving sell signals, so adjustment risks persist.

The broken August 2025 low (equivalent to the 265-270 range) is a resistance level the index needs to surpass to improve its short-term outlook.

Cash Flow Analysis

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition continues in the next session, the risk of a sudden drop (thrust down) will be mitigated.

Foreign Investor Cash Flow: Foreign investors returned to strong net buying on October 21, 2025. If foreign investors maintain this action in upcoming sessions, the situation will improve more positively.

III. MARKET STATISTICS ON OCTOBER 21, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:15 October 21, 2025

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.

October 22, 2025: Optimism Returns to the Warrant Market

As the trading session closed on October 21, 2025, the market witnessed 138 stocks advancing, 99 declining, and 24 remaining unchanged. Foreign investors continued their net selling streak, offloading a total of VND 8.55 billion worth of shares.