I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 22, 2025

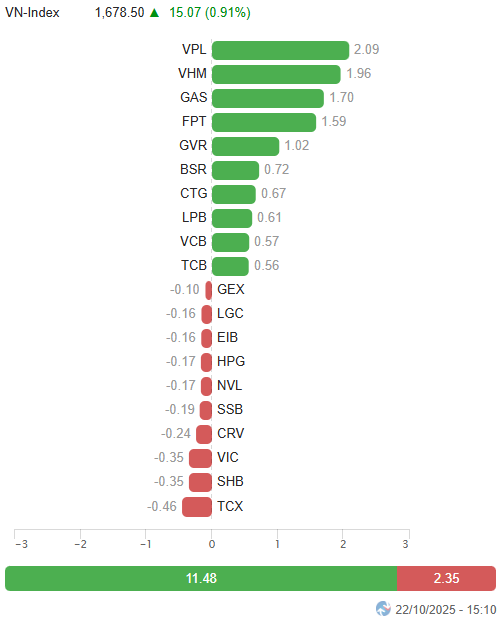

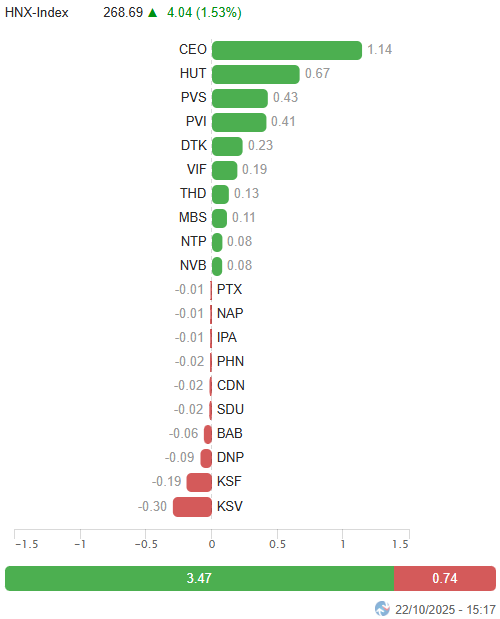

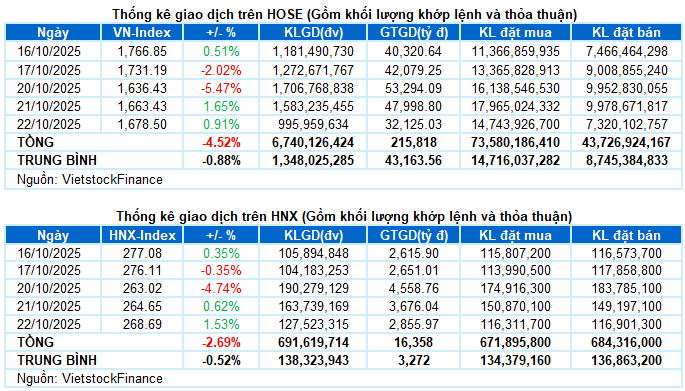

– Key indices continued their recovery trend during the October 22 trading session. Specifically, the VN-Index rose by 0.91%, reaching 1,678.5 points, while the HNX-Index also increased by 1.53%, closing at 268.69 points.

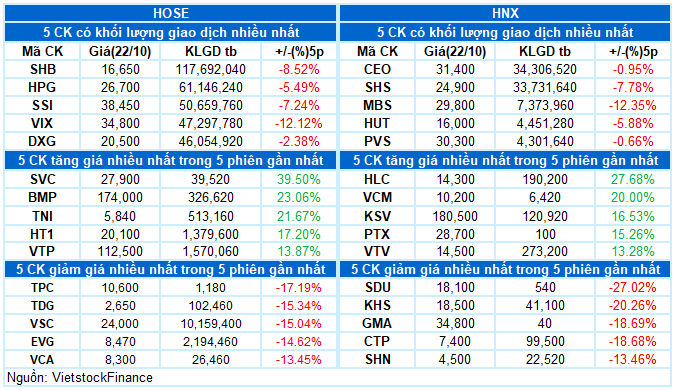

– Trading volume on the HOSE floor decreased by 40.5%, totaling over 910 million units. The HNX floor recorded more than 107 million matched units, a 23.5% decline compared to the previous session.

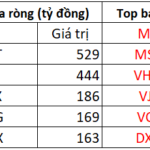

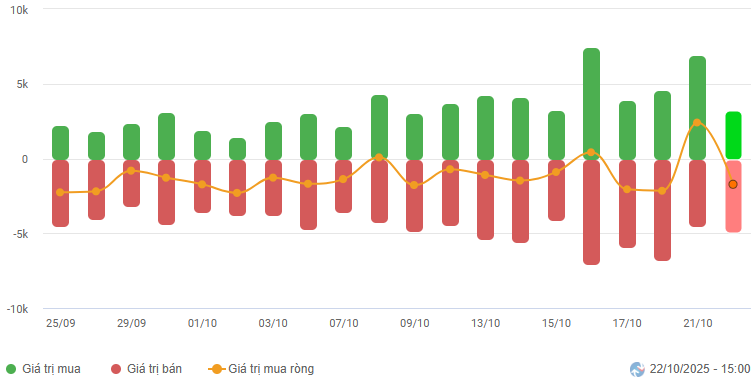

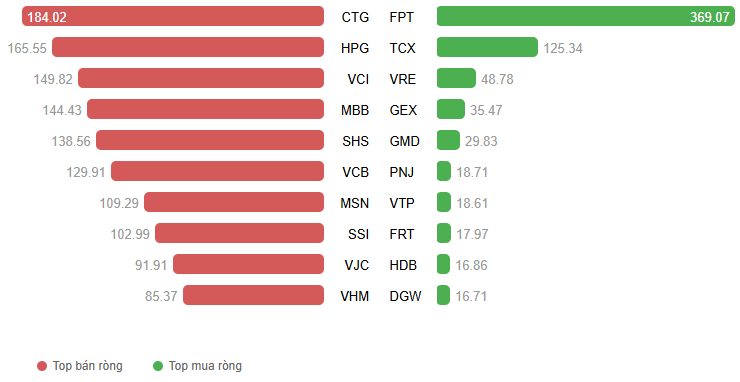

– Foreign investors turned net sellers, with a value of 1.5 trillion VND on the HOSE and nearly 200 billion VND on the HNX.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

– The market witnessed an impressive rebound on October 22. The VN-Index started with a slight increase but soon stalled as buying momentum weakened. The significant drop in liquidity compared to the previous session indicated heightened investor caution, particularly as key sectors like banking and real estate weakened after the previous day’s recovery. Additionally, foreign investors’ return to net selling further deprived the market of the necessary support to sustain the morning’s recovery. In the afternoon session, the situation turned more negative as leading stocks continued to decline, pushing the VN-Index down to 1,630 points. However, buying interest at lower levels re-emerged, driving the index back into positive territory by the close. The VN-Index ended the day up 0.91%, at 1,678.5 points.

– In terms of influence, VPL, VHM, GAS, and FPT were the top contributors, adding over 7 points to the VN-Index. Conversely, no single stock had a significant negative impact, with only the “newcomer” TCX subtracting about half a point from the index.

Top Influencing Stocks on the Index. Unit: Points

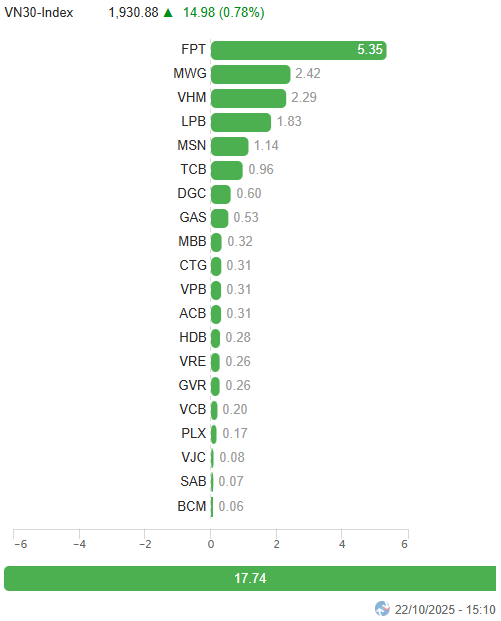

– The VN30-Index closed up nearly 15 points (+0.78%), at 1,930.88 points. The basket’s breadth favored buyers, with 21 stocks rising, 8 falling, and 1 unchanged. GAS stood out with a remarkable 5.4% gain. FPT and GVR also shone, each rising by 4.3%. On the downside, SHB and SSB led the decliners, falling by 2.1% and 1.6%, respectively.

Green dominated most sectors. Information technology led the market with a 4% gain, as stocks like FPT (+4.3%), ELC (+1.18%), VEC (+4.65%), and DLG (up to the limit) traded actively. Non-essential consumer goods followed, with standout performers including VPL (+6.61%), FRT (+4.49%), DGW (+3.86%), and MWG (+1.81%).

Industrial and real estate sectors also had impressive sessions, with notable names such as ACV (+4.7%), GMD (+1.52%), VGC (+2.99%), CII (+2.22%), VCG (+1.96%), BMP (+2.96%), VTP (+1.35%), DPG (+2.3%); VHM (+1.89%), PDR (+4.08%), DXG (+2.5%), TCH (+4.88%), DIG (+2.74%), HDC (+3.06%), KHG (+3.04%), NLG (+2.04%), and CEO hitting the upper limit.

In contrast, the communication services sector was the only one in the red, down 1.39%, as major stocks like VGI (-2.27%), VNZ (-0.59%), YEG (-0.79%), and CTR (-1.15%) faced significant selling pressure.

The VN-Index formed a Dragonfly Doji candlestick pattern with trading volume falling below the 20-session average. The 1,605-1,630 point range remains critical support to bolster short-term recovery expectations.

II. TREND AND PRICE VOLATILITY ANALYSIS

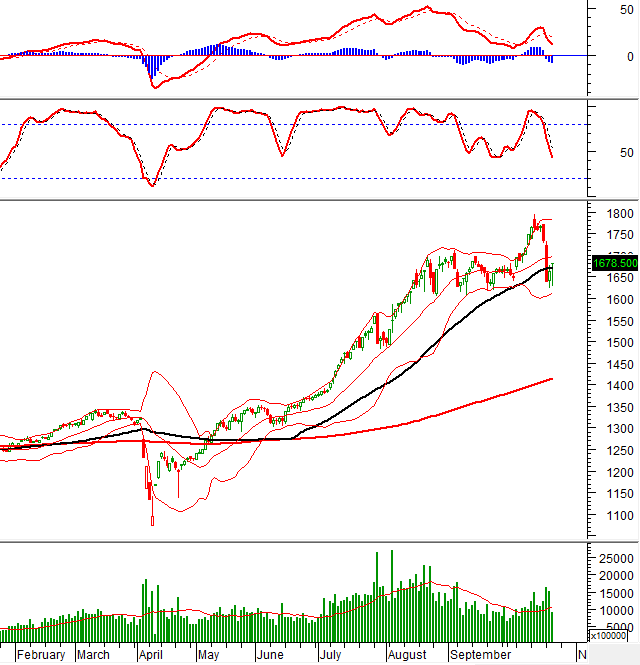

VN-Index – Dragonfly Doji Candlestick Pattern Emerges

The VN-Index formed a Dragonfly Doji candlestick pattern with trading volume falling below the 20-session average. This pattern often signals a short-term reversal.

The 1,605-1,630 point range remains critical support to bolster short-term recovery expectations.

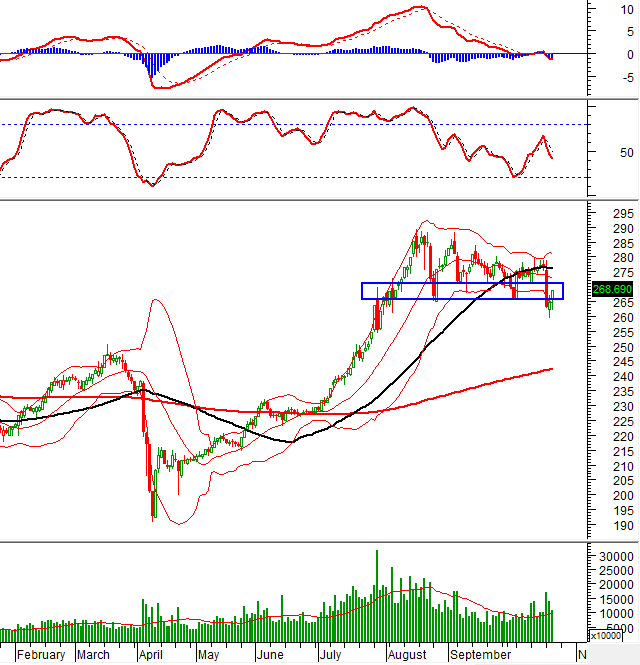

HNX-Index – Testing the 265-270 Point Range

The HNX-Index surged after a tug-of-war session, with trading volume remaining above the 20-session average. However, shakeout risks persist as the MACD indicator stays below the zero line.

The recovery outlook will strengthen if the index decisively breaks through the 265-270 point range in upcoming sessions.

Capital Flow Analysis

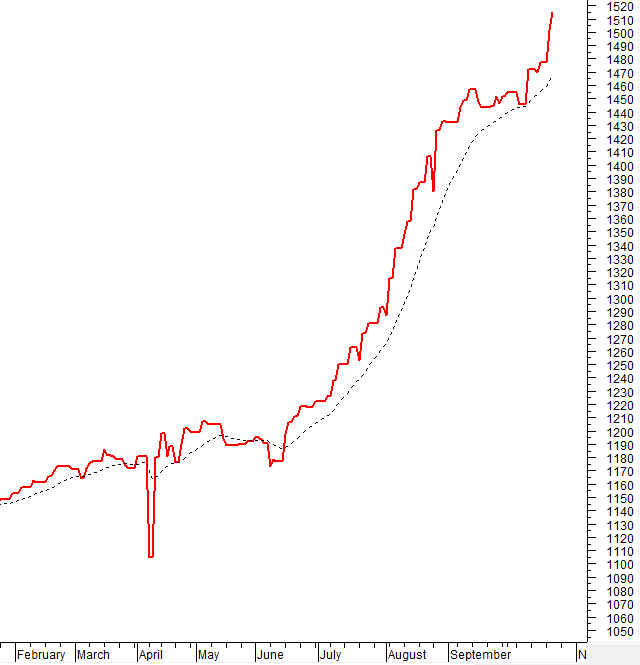

Smart Money Movement: The Negative Volume Index for the VN-Index is above the 20-day EMA. If this continues in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors turned net sellers on October 22, 2025. If this trend continues in upcoming sessions, market volatility may persist.

III. MARKET STATISTICS FOR OCTOBER 22, 2025

Economic Analysis & Market Strategy Department, Vietstock Advisory Division

– 18:02 October 22, 2025

Technical Analysis for the Afternoon Session of October 22: Intense Tug-of-War

The VN-Index opened on a positive note but soon entered a corrective phase. The author anticipates that the August 2025 support level will be tested once again. Meanwhile, the HNX-Index remains anchored to the Lower Band of the Bollinger Bands.

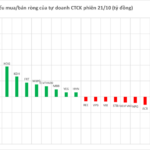

Blue-Chip Stock Surges as Brokerage Firms’ Proprietary Trading Desks Record Massive Net Buying on October 21st

Proprietary trading firms continued their net buying streak on the Ho Chi Minh City Stock Exchange (HOSE), accumulating a total of VND 434 billion in the latest session.