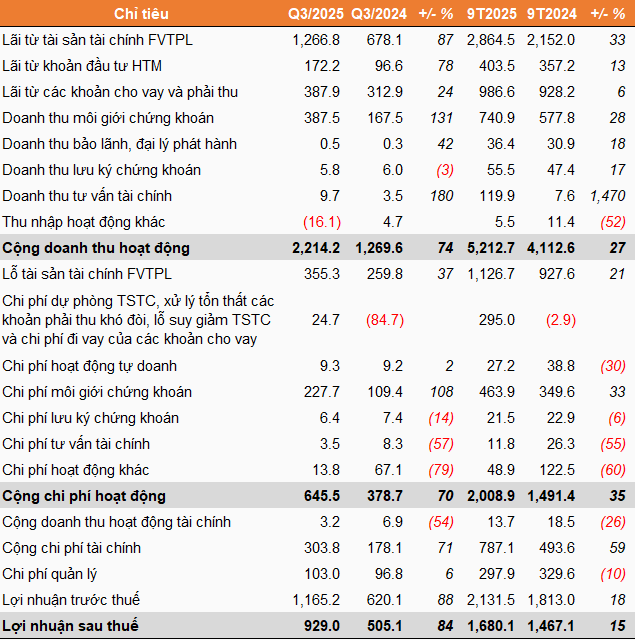

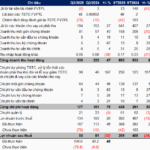

VNDIRECT’s proprietary trading arm generated over VND 903 billion in profits, a 2.2-fold increase year-on-year, driven by higher gains from the sale of financial assets measured at fair value through profit or loss (FVTPL), particularly bonds, certificates of deposit, and listed stocks. Additionally, the revaluation gains on FVTPL financial assets were significantly larger.

Brokerage activities saw robust growth, with profits nearing VND 160 billion, a 2.8-fold increase compared to the same period last year. Revenue from margin lending also rose by 24% to nearly VND 388 billion.

Overall, the positive market momentum and improved liquidity in Q3 created favorable conditions for key segments such as proprietary trading, lending, and brokerage, benefiting not only VNDIRECT but also most securities companies.

However, VNDIRECT faced pressure from provisioning nearly VND 25 billion for loan impairments, receivables, and financial asset value impairments, contrasting with the VND 85 billion reversal in the same period last year. Financial activities also incurred a loss of over VND 300 billion, up from VND 171 billion in the previous year. Despite these challenges, the company maintained a successful quarter.

With Q3 results, VNDIRECT’s nine-month pre-tax profit surged to over VND 2.1 trillion, and post-tax profit reached nearly VND 1.7 trillion, up 18% and 15% year-on-year, respectively. The company has achieved more than 90% of its annual profit target.

In fact, exceeding 90% of the profit goal after nine months was already shared by CEO Nguyễn Vũ Long at the extraordinary shareholders’ meeting on October 10, prior to the official release of the Q3 financial report. At that time, VNDIRECT’s leadership expressed optimism about potentially surpassing the plan by 20-30% and achieving the capital efficiency target by the end of 2025.

|

VNDIRECT’s Q3 and 9-month 2025 business results

Unit: Billion VND

Source: VietstockFinance

|

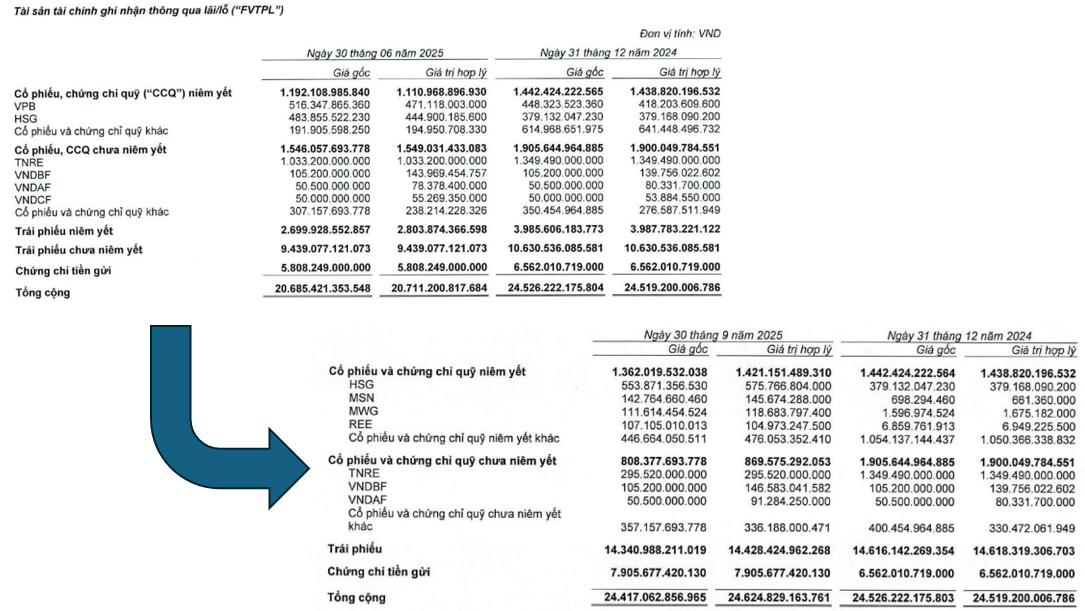

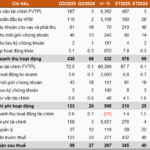

As of the end of Q3, VNDIRECT’s total assets grew by 27% year-to-date to over VND 56 trillion. The majority of this comprises FVTPL financial assets valued at over VND 24.6 trillion, slightly up from the beginning of the year; outstanding loans increased from over VND 10.3 trillion to over VND 14.8 trillion; and held-to-maturity (HTM) investments rose from nearly VND 5.6 trillion to nearly VND 10.5 trillion.

Within the FVTPL financial asset portfolio, bonds account for over VND 14.4 trillion, followed by certificates of deposit at over VND 7.9 trillion. The company also invests in stocks, notably HSG, MSN, MWG, and TNRE (Trung Nam Renewable Energy).

Compared to the cost basis at the end of Q2, VNDIRECT significantly reduced its TNRE holdings from over VND 1 trillion to over VND 295 billion, while substantially increasing investments in bonds, certificates of deposit, and listed stocks.

|

Significant changes in VNDIRECT’s FVTPL financial asset portfolio

Source: 2025 Semi-annual Reviewed Financial Statements and Q3/2025 Financial Statements of VNDIRECT

|

In terms of funding, VNDIRECT increased short-term borrowings from over VND 22.4 trillion to nearly VND 31.8 trillion to finance its operations, while equity capital remained at VND 15.2 trillion.

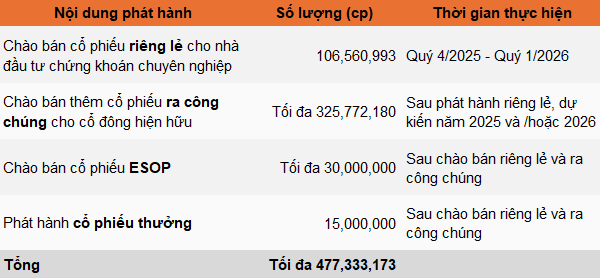

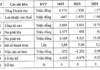

However, VNDIRECT’s equity is expected to rise significantly in the near future, as the recent extraordinary shareholders’ meeting approved notable capital increase plans.

Specifically, three capital increase plans approved at the 2024 annual shareholders’ meeting but not yet implemented—including the private placement of over 268.6 million shares, the issuance of up to 30 million ESOP shares, and the issuance of 15 million bonus shares—have been finalized under a new schedule. Notably, the private placement volume has been reduced to nearly 106.6 million shares.

Additionally, shareholders approved a new plan to issue up to nearly 325.8 million shares to the public, to be executed after the private placement and before the ESOP and bonus share issuances.

|

VNDIRECT’s 4 new share issuance and offering plans

Source: VNDIRECT, compiled by the author

|

– 17:15 21/10/2025

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.

Bầu Đức Celebrates: Hoàng Anh Gia Lai (HAG) Reports 25% Surge in Q3 Net Profit Despite 80% Revenue Plunge in Pig Farming Sector

In the first nine months of the year, cumulative net revenue surpassed 5.6 trillion VND, marking a 34% increase compared to the same period in 2024. Post-tax profit recorded an impressive 1.312 trillion VND, reflecting a robust 54% growth year-over-year.

Record Profits for LPBS Driven by Proprietary Trading and Lending Surge

In Q3/2025, LPBank Securities Corporation (LPBS) reported a remarkable net profit of over 98 billion VND, a 3.4-fold increase compared to the same period last year. This impressive growth was primarily driven by strong performance in proprietary trading and lending activities. As a result, the company’s cumulative profit for the first nine months soared to more than 345 billion VND, an 8.6-fold surge, setting a new record high.