The Vietnam Posts and Telecommunications Group (VNPT) has set an opening price of VND 17,588 per share for VNPT EPAY, valuing the entire lot at nearly VND 74 billion. Interested investors can register and deposit from October 20 to November 10, 2025. The auction is scheduled for 9:30 AM on November 17 at Saigon – Hanoi Securities Corporation (SHS), the advisor for the transaction.

Established in 2008 with a charter capital of VND 120 billion, VNPT EPAY operates in online payments and electronic top-up cards. In 2017, VMG Media Corporation (UPCoM: ABC) sold its entire 62.25% stake in VNPT EPAY to two South Korean investors, GPS and UTC Investment. Post-transaction, GPS and UTC accused ABC of providing inaccurate financial information about VNPT EPAY and sued for VND 755 billion in compensation.

In 2022, GPS and UTC requested the Hanoi People’s Court to recognize an international arbitration award, but the court rejected it. The investors appealed to the High People’s Court, which upheld the original decision in early 2023, reducing the compensation claim to VND 100 billion. By late 2023, ABC’s total legal costs related to the case exceeded VND 80 billion.

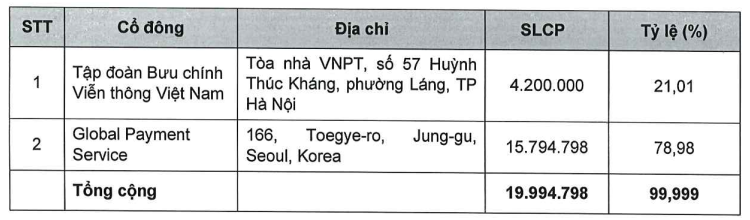

As of early September 2025, VNPT EPAY’s charter capital is nearly VND 200 billion. Major shareholders include VNPT with over 21% and GPS with 78.98%. Mr. Kim Je Hee, a South Korean national, serves as CEO and legal representative.

|

Shareholder Structure of VNPT EPAY as of September 1, 2025

Source: VNPT EPAY

|

With VNPT EPAY Case Resolved, ABC Stock Escapes Warning Status

According to the 2024 audited financial report, VNPT EPAY recorded net revenue of over VND 1,545 billion, a 25% decrease from 2023. The company posted a post-tax loss of nearly VND 23 billion, compared to a VND 5 billion loss the previous year. Accumulated losses reached nearly VND 112 billion by the end of 2024. Total assets were VND 637 billion, a slight increase from the beginning of the year, with liabilities of VND 544 billion, down 6%, accounting for 86% of capital.

Previously, VNPT announced the public auction of its entire 360,000 shares in Posts and Telecommunications Construction Services JSC (UPCoM: PTO), representing 30% of PTO’s capital. Post-transaction, VNPT will no longer hold shares in PTO. The starting price is set at VND 50,598 per share, valuing the lot at over VND 18 billion.

Additionally, VNPT will auction its entire 2 million shares in Vietnam Technology and Communication JSC (VNTT, UPCoM: TTN), equivalent to 5.43% of VNTT’s capital, at a starting price of VND 28,492 per share. The total value of this lot is expected to be nearly VND 57 billion.

These transactions are part of the Restructuring Plan for the Vietnam Posts and Telecommunications Group until 2025, approved by the Prime Minister under Decision No. 620/QĐ-TTg dated July 10, 2024.

VNPT Auctions Entire 30% Stake in PTO, Starting Price Nearly Triple Market Value

– 07:05 22/10/2025

Before Shark Binh’s AnTEx, a Series of Multi-Trillion-Dollar Crypto Scams Were Dismantled by Police

Prior to reports of Hanoi Police collaborating with Mr. Nguyen Hoa Binh (Shark Binh) to investigate allegations tied to the AntEx cryptocurrency project, Vietnamese authorities had already dismantled numerous fraudulent investment schemes involving virtual currencies across the country.