The benchmark index regained its green hue at the opening bell, yet buyers and sellers engaged in a tug-of-war, with selling pressure occasionally dominating and pushing the VN-Index below the reference level. This back-and-forth continued into the morning session, and it wasn’t until after 2 PM that the recovery trend became more pronounced. Money swiftly flowed in, focusing on banking, securities, and several large-cap stocks.

Market-leading stocks reclaimed their green status, broadening their gains. VIC reclaimed the top position, contributing nearly 8 points to the VN-Index. VHM followed closely. Vingroup shares rose 4.4% to 203,400 VND per unit. Other stocks in the group, such as VHM, VRE, and VPL, also saw price increases.

VN30 basket includes FPT and HDB hitting their ceiling prices.

Notably, the VN30 basket saw FPT and HDB hit their ceiling prices. SSB, LPB, and VJC also reached their ceiling prices at times but narrowed their gains by the end of the session. For FPT, this marked the first time the stock hit its ceiling price since mid-April. By the close, the stock maintained a blank sell side, while the buy side still had over 3.8 million units bidding at the ceiling price.

FPT’s notable performance came after the group announced its 9-month business results, with revenue nearing 49.9 trillion VND and pre-tax profit of 9.54 trillion VND, up 10% and nearly 18% year-on-year, respectively. After a prolonged selling streak with FPT, foreign investors today returned to net buy nearly 5.8 million shares, worth nearly 530 billion VND.

Amid the market recovery, money also flowed into other stocks, particularly in banking and securities. VIX led in liquidity with a value of nearly 3.1 trillion VND. SHB, MSN, HPG, GEX, FPT, VPB, and CII followed suit.

At the close, the VN-Index rose 27 points (1.65%) to 1,663.4 points. The HNX-Index gained 1.63 points (0.62%) to 264.6 points. The UPCoM-Index fell 0.85 points (0.77%) to 109.4 points.

Liquidity decreased compared to yesterday’s sell-off, with HoSE trading value exceeding 47.1 trillion VND. Foreign investors returned to strong net buying of 2,443 billion VND, focusing on FPT, SSI, TCX, HPG, and others. Today also marked the first trading session for TCX of TCBS Securities after a successful IPO.

FPT Stock Under Truong Gia Binh’s Leadership: A Resurgence Story

FPT shares surged to their upper limit with no sellers in sight, as foreign investors returned, sparking hopes of a revival following a prolonged downward trend.

Vietstock Daily 22/10/2025: Bottom-Fishing Demand Emerges

The VN-Index rebounded after successfully testing its August 2025 low (around 1,605-1,630 points). If this level holds, short-term recovery prospects look more promising. However, the risk of a correction remains as the MACD and Stochastic Oscillator indicators continue to weaken following strong sell signals.

Technical Analysis for the Afternoon Session of October 21: Continued Adjustment

The VN-Index persists in its corrective phase, testing the August 2025 lows. Meanwhile, the HNX-Index is trending downward, clinging to the Lower Band of the Bollinger Bands.

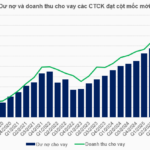

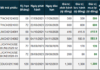

Margin Debt Surpasses 384 Trillion VND, Ample Room for Growth Remains

Amidst a robust market uptrend and significantly heightened liquidity, margin debt in the securities sector surged to a record high of over 384 trillion VND by the end of Q3. This momentum propelled securities firms to achieve a substantial increase in lending revenue, reaching nearly 9.4 trillion VND during the same quarter.