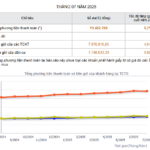

Data from the State Bank of Vietnam (SBV) reveals that by the end of July 2025, individual deposits in the banking system surged by 9.68% compared to the beginning of the year, reaching nearly VND 7,750 trillion. Meanwhile, deposits from economic organizations stood at VND 7,980 trillion, a decrease of approximately VND 128 trillion from the previous month, equivalent to a 1% decline. However, compared to the start of the year, deposits from this segment still increased by over 4%.

Thus, after the first seven months of 2025, the total deposits from individuals and economic organizations in the banking system exceeded VND 15,700 trillion.

Mr. Nguyen Quang Huy – CEO of the Faculty of Finance and Banking, Nguyen Trai University, explained that bank deposits consist of various components: funds awaiting payment, disbursed loans not yet utilized, strategic term deposits to lock in interest rates, and even CASA (demand deposits), which can surge as individuals await investment opportunities.

Over the past period, deposit interest rates have remained stable despite accelerated credit growth, thanks to the system’s ample liquidity. This has enabled banks to maintain low interest rates to foster economic growth. Mr. Huy noted that interest rates are no longer the sole determining factor. Low nominal rates do not diminish the appeal of savings. In an investment environment where risks outweigh expected returns, individuals prioritize safety and liquidity over yield. Banks, with their transparency, convenience, and deposit insurance, naturally become a haven for temporarily idle capital.

Additionally, real estate—a high-value, high-entry asset—remains illiquid. The property market persists at high prices, with sluggish transactions and limited liquidity. Participation requires capital in the billions of VND, beyond the reach of most households. Holding real estate in this phase entails significant opportunity costs and capital lock-in risks, prompting many to opt for savings accounts as a temporary measure while awaiting new opportunities.

Gold remains a traditional safe-haven asset, but entry barriers are growing. Gold prices have soared, exceeding VND 100 million per tael, making physical gold accumulation less accessible for the majority. Coupled with storage costs and international price volatility, gold is no longer a flexible option for small and medium-sized idle funds. Banks, with their stable albeit low interest rates, emerge as a structured repository for funds.

Bonds and stocks, while promising, carry higher risks. The corporate bond market is still rebuilding trust after a period of volatility and calls for transparency. Meanwhile, the stock market hovers near historic highs, reflecting future growth expectations.

Narrowing safety margins have made individual investors more cautious, with many locking in stock profits and temporarily parking funds in banks. Capital remains within the financial system, shifting from risky to safe assets.

In the corporate sector, businesses are also increasing cash reserves. As the fourth quarter approaches, many companies are bolstering working capital for year-end orders, raw material procurement, and Lunar New Year expenses. Holding funds in bank accounts ensures liquidity and readiness for market fluctuations and peak payment demands.

Thus, bank deposits serve as a transitional harbor before a new cycle. These funds are not dormant but await activation. Once real estate prices adjust to reasonable levels, bonds regain trust, and stocks establish new accumulation bases, this capital will swiftly shift to real investment sectors, fueling a new growth cycle for the economy.

For banks, ample deposits provide a stable, low-cost capital source, enhancing lending and investment capabilities as credit demand recovers.

On the policy front, funds within the system reflect confidence in national financial safety, offering the SBV flexibility to stabilize exchange rates and inflation.

At the economic level, internally circulating idle funds signal an energy accumulation phase, preparing for the next growth stage.

In conclusion, low interest rates do not diminish banks’ appeal. In uncertain times, safety and liquidity are the greatest returns. Rising deposits do not signify stagnation but rather preparation for capital to re-enter the economy when conditions improve.

– 11:11 22/10/2025

Vietnam’s Prime Minister: Economy Demonstrates Resilience Against External Shocks, Leading Global Growth

At the opening session of the 10th Meeting of the 15th National Assembly, Prime Minister Pham Minh Chinh highlighted eight remarkable achievements in the implementation of the Socio-Economic Development Plan for 2025 and the five-year period 2021–2025. Notably, Vietnam’s economy has demonstrated robust resilience against external shocks, sustaining one of the highest growth rates globally. The country’s economic scale has surged, climbing five positions to rank 32nd worldwide.