Xuan Thien Securities Corporation (XTSC) has recently approved the results of its share offering and the plan to handle unsold shares from the recent offering to existing shareholders.

Specifically, XTSC offered 135 million shares (10 times the current outstanding shares). The rights issue ratio is 1:10, meaning shareholders holding 1 share are entitled to purchase 10 new shares. The offering price is set at VND 10,000 per share.

As of October 15, 2025, the company has successfully distributed over 54 million shares (more than 40% of the total registered offering).

The remaining 80.96 million shares (59.97% of the total registered offering) will be offered at VND 10,000 per share to 14 investors. The registration and payment period for these shares is from October 17 to November 7, 2025. These 80.96 million shares will be subject to a one-year transfer restriction.

Among the 14 investors, Ms. Thai Kieu Huong, a member of XTSC’s Board of Directors, will acquire the largest portion with 13.33 million shares; Mr. Nguyen Van Thien, Chairman of Xuan Thien Group, will receive 7 million shares; and Mr. Ho Ngoc Bach, Board Member and CEO of XTSC, will be allocated over 6 million shares.

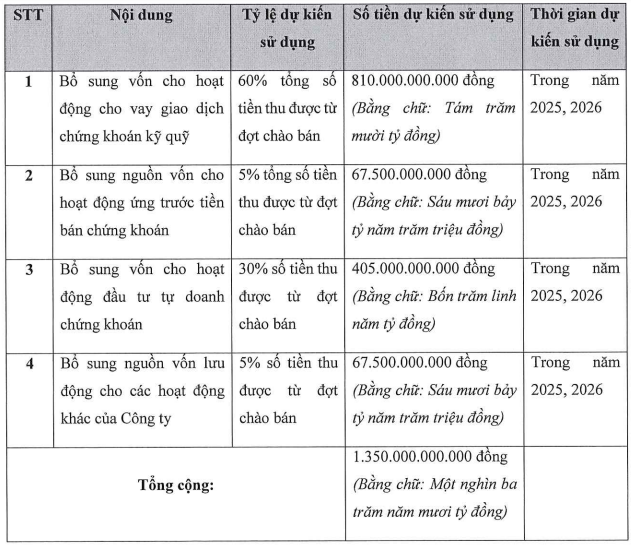

Upon completion of this issuance, Xuan Thien Securities will increase its charter capital from VND 135 billion to VND 1,485 billion. With VND 1,350 billion raised from the offering, the company plans to allocate capital to the following business activities:

This is one of the two capital increase plans approved at the 2025 Annual General Meeting of Shareholders.

Regarding the other plan, Xuan Thien Securities also intends to offer 151.5 million shares privately to 3 strategic investors. However, according to a recent notice from the State Securities Commission dated September 11, the review of the offering file has been halted as XTSC’s Board of Directors has decided to temporarily suspend this plan.

In Q3 2025, Xuan Thien Securities recorded VND 536 million in operating revenue, a 31% decrease compared to the same period last year.

All revenue came from interest income on held-to-maturity investments. Operating expenses amounted to nearly VND 754 million, with an additional VND 3.6 billion in management costs.

As a result, Xuan Thien Securities reported a pre-tax loss of over VND 4 billion, compared to a profit of VND 134 million in the same period last year. For the first nine months of the year, the company accumulated a pre-tax loss of over VND 2.6 billion.

BIG Group Holdings Issues Shares to Restructure Cash Flow and Expand Hotel Chain, Exports

On October 16th, the Board of Directors of Big Group Holdings Joint Stock Company (UPCoM: BIG) passed a resolution approving the public offering of nearly 15.1 million shares, aiming to raise approximately VND 151 billion. This move is expected to strengthen BIG’s financial health and expand its core business operations.

Vingroup Chairman Pham Nhat Vuong Completes Transfer of 60 Million VIC Shares to VinEnergo as Capital Contribution

Chairman Phạm Nhật Vượng has pledged over 60 million VIC shares, representing 1.55% of Vingroup’s charter capital, as capital contribution to VinEnergo.