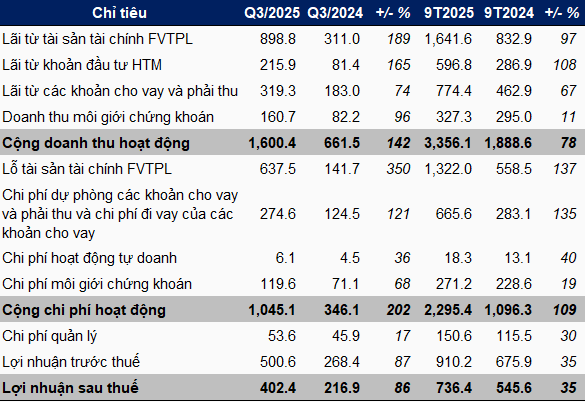

In Q3, the primary profit contributor for ACBS was proprietary trading, with a gross profit of over VND 255 billion, a 55% increase. Brokerage activities also saw a significant rise, generating a profit of more than VND 41 billion, 3.7 times higher than before. Additionally, profits from held-to-maturity investments (HTM) reached nearly VND 216 billion, a 2.7-fold increase.

Lending revenue exceeded VND 319 billion, a 74% growth. However, this was offset by a substantial provision of nearly VND 275 billion for loan and receivable expenses, as well as borrowing costs for loans, which were 2.2 times higher than the same period last year.

For the first nine months, ACBS reported a net profit of over VND 736 billion, a 35% increase. Proprietary trading and HTM investments remained the key growth drivers, while brokerage activities declined due to rising costs and lending pressures from provisions.

In proprietary trading, the company earned more than VND 301 billion, a 15% increase. This was primarily driven by a 23% rise in profits from the sale of financial assets recorded through profit/loss (FVTPL), reaching nearly VND 192 billion, mainly from stock sales. However, there were recorded losses from futures contracts and repurchase activities for warrant issuers.

The company also added VND 98 billion in revaluation gains on FVTPL financial assets, including reduced losses from stock revaluation and increased gains from underlying assets for warrant hedging. Nevertheless, this figure was lower than the VND 118 billion recorded in the first nine months of 2024.

For 2025, ACBS aims for a pre-tax profit of VND 1.35 trillion, a 60% increase from 2024. With over VND 910 billion in pre-tax profit in the first nine months, the ACB ecosystem member has achieved 67% of its annual target.

|

Q3 and 9-month 2025 business results of ACBS

Unit: Billion VND

Source: VietstockFinance

|

As of September 30, 2025, ACBS’s total assets reached a new milestone of over VND 39.4 trillion, 1.5 times higher than the beginning of the year. In fact, the company had already surpassed its 2025 asset target of VND 32.85 trillion in Q2.

The asset growth was primarily driven by an increase in outstanding loans, which rose from nearly VND 8.7 trillion to almost VND 16.3 trillion, mostly from margin lending. HTM investments also saw a significant increase, from nearly VND 11.5 trillion to almost VND 15.4 trillion, with term deposits reaching VND 14.3 trillion.

The fair value of FVTPL financial assets increased from over VND 3.1 trillion to more than VND 6 trillion, primarily invested in bonds, stocks, and underlying assets for warrant hedging.

ACBS’s business operations were supported by a more abundant capital base. Borrowed capital increased by VND 8.1 trillion to nearly VND 24.5 trillion, all in short-term maturities. Multiple partners provided loans to ACBS, notably BIDV with an outstanding balance of over VND 4.9 trillion. The company also issued VND 200 billion in short-term bonds.

| ACBS Total Assets Reach New Milestone |

– 11:58 22/10/2025

HSC Securities Reports Q3 Profits Double Year-on-Year

HSC Securities (HOSE: HCM) has announced its Q3 2025 business results, reporting pre-tax profits of VND 550 billion. This performance underscores sustained growth across its core business segments.

KIS Reports 84% Surge in Q3 Net Profit, Rebounding from First-Half Slump

KIS Vietnam Securities Corporation (KIS Vietnam) reported a remarkable net profit of over VND 194 billion in Q3, surging 84% year-over-year. This impressive growth was driven by strong performance across key business segments, including proprietary trading, brokerage, and lending. The stellar Q3 results helped offset the company’s lackluster performance in the first half of the year.

Where Does the Massive Capital from High-Profile IPOs Ultimately Flow?

The stock market is entering an unprecedentedly vibrant phase following a period of scarcity, as numerous companies, particularly in the securities sector, are launching initial public offerings (IPOs) worth trillions of dong. With such massive capital influx post-IPO, the question arises: how will these funds be utilized, and will the securities industry’s cash flow face dilution amid the recent surge in IPO activities?