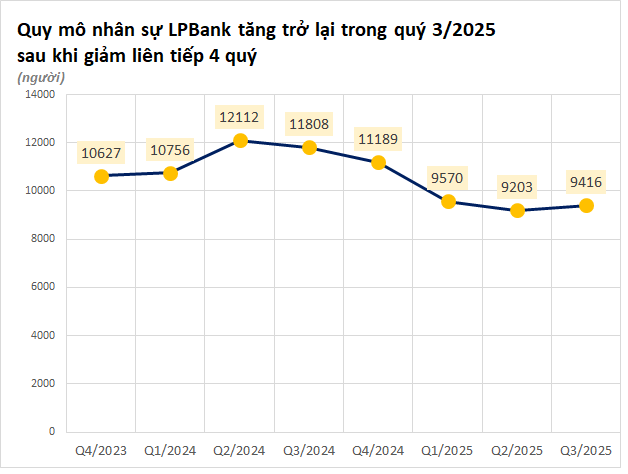

According to the Q3 2025 financial report of Loc Phat Commercial Joint Stock Bank (LPBank – LPB), the bank’s workforce as of September 2025 stood at 9,416 employees, marking an increase of 213 staff members during the quarter. This is the first quarter LPBank has expanded its workforce after four consecutive quarters of reductions.

Previously, from mid-2024 to mid-2025, LPBank had downsized its workforce by over 2,900 employees, shrinking from 12,112 to 9,203. The most significant reduction occurred in Q1 2025, with a cut of more than 1,600 employees.

LPBank led the banking sector in workforce reduction during the first half of 2025, cutting nearly 2,000 jobs. Other banks also implemented similar measures, including VIB and Sacombank, which reduced over 1,000 positions each, ACB with 607 cuts, ABBank with 469, Agribank with 273, and Vietcombank with 191.

Regarding employee compensation, in the first nine months of 2025, the average monthly salary at LPBank was VND 24.71 million, an increase of VND 5.4 million compared to the same period in 2024. The average monthly income for the same period was VND 27.45 million, up by VND 5.2 million year-on-year.

Despite significant workforce reductions, LPBank’s operating expenses rose slightly by 1.6% year-on-year. The cost-to-income ratio (CIR) for the nine months stood at 28.31%, among the lowest in the banking industry.

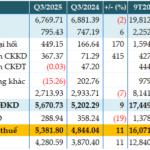

In Q3 2025, the bank’s pre-tax profit reached VND 3,448 billion, a 19% increase year-on-year. For the first nine months, pre-tax profit totaled VND 9,611 billion, up 9% compared to the same period last year.

Each LPBank employee generated approximately VND 1 billion in pre-tax profit during the first three quarters, an increase of VND 244 million year-on-year.

Beyond LPBank, many banks are expected to ease workforce reductions in the coming period. According to a survey by the State Bank of Vietnam, the proportion of credit institutions planning to cut jobs has reached its lowest level in the first three quarters.

Specifically, to meet increased workloads in the second half of the year, 43.9% of credit institutions reported hiring additional staff in Q3 2025, the highest rate in the first three quarters. Only 6.4% plan to reduce staff in Q4 2025, the lowest rate for the year.

As of Q3 2025, 78.3% of credit institutions stated their current workforce adequately meets job demands, while 19.8% reported labor shortages, and 1.9% indicated overstaffing.

For Q4 2025 and the full year, employment prospects remain positive, with 38.3% to 48.6% of credit institutions planning to hire and only 6.4% to 20.6% expecting to reduce staff.

FPTS Reports Pre-Tax Profit of VND 167 Billion in Q3/2025 from Proprietary Trading

Despite booking profits from the sale of MSH shares, FPTS still reported a proprietary trading loss in Q3/2025. As a result, the company announced pre-tax profits of VND 167 billion.

ACB Reports 11% Rise in Q3 Pre-Tax Profit as Bad Debt Improves

Asian Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 5,382 billion in Q3/2025, marking an 11% year-on-year increase. This growth was driven by higher non-interest income and effective cost-cutting measures. Notably, the bank’s non-performing loans (NPLs) decreased by 15% compared to the beginning of the year, reflecting improved asset quality.

Q3/2025 Financial Report Deadline on October 21: Real Estate Firms Double Profits Year-on-Year, Fertilizer Companies Report Nearly 100 Billion VND in Losses

Two leading securities firms, SSI and VNDirect, have reported remarkable third-quarter profits exceeding 1,000 billion VND. SSI recorded a pre-tax profit of 1,782 billion VND, a 90% surge, while VNDirect achieved a pre-tax profit of 1,165 billion VND, marking an 88% increase compared to the same period last year.