The State Bank of Vietnam, Zone 2 Branch (SBV Z2, overseeing Ho Chi Minh City and Dong Nai Province), has issued a directive to commercial banks in the region, temporarily halting loans for real estate deposits based on agreements with brokerage firms.

If these agreements are deemed legally valid, banks are required to establish specific risk assessment and control procedures before approving any loans.

Mr. Nguyen Manh Tuan, a real estate investor in Ho Chi Minh City, stated that if banks restrict loans for deposits through such agreements, the market will enter a new phase. According to Mr. Tuan, many developers will struggle financially if banks tighten lending conditions. Currently, most developers authorize third-party brokerage firms to collect payments from buyers.

For legally compliant real estate projects, buyers only sign deposit and purchase agreements. (Illustrative image: Dai Viet)

Ms. Dao Thanh Huyen, a representative of a Ho Chi Minh City-based real estate company, shared that banks tightening loans for deposits through “agreements” protects investors and buyers from fraudulent projects.

According to Ms. Huyen, many projects lacking legal compliance have authorized third-party brokers to collect reservations and deposits from buyers. Some developers often “operate without capital,” illegally raising funds despite not meeting requirements.

Ms. Huyen added that, due to insufficient conditions for official sales, brokers often “circumvent the law” by signing agreements with buyers or using equivalent documents. Some projects, lacking 1/500 scale planning approval, still proceed with sales or collaborate with banks for loans, which is non-compliant.

“For projects with 1/500 scale planning, construction permits, completed foundation work, and capital mobilization approval, documents like ‘agreements’ are not used,” Ms. Huyen noted.

She explained that for legally compliant projects, buyers only sign deposit and purchase agreements. Banks then disburse funds based on the purchase agreement.

Mr. Tran Thang Long, a Ho Chi Minh City real estate expert, believes the State Bank is effectively managing the situation by warning commercial banks. This tightening measure protects the interests of investors and buyers.

According to Mr. Long, legal and financial risks in real estate projects are currently high. Without caution, the consequences could be severe.

Mr. Long advised that to identify legally compliant projects, buyers should ensure the project has 1/500 scale planning, a construction permit, and has paid land use fees. Only after these steps can a project be approved for capital mobilization and bank disbursement.

“Reputable, professional developers typically do not allow third parties to collect deposits. Only projects lacking legal compliance use third parties for deposits or related documents,” Mr. Long said.

Previously, VTC News reported that the State Bank of Vietnam, Zone 2 Branch, issued a warning to commercial banks about legal and credit risks associated with loans for real estate deposits based on agreements between buyers and brokerage firms.

SBV Z2 stated that such lending practices could lead to serious legal risks. If an agreement is declared invalid, banks may face prolonged disputes and difficulties in debt recovery, especially when the collateral is tied to a legally incomplete project.

In addition to legal risks, the regulator warned of potential bad debt and financial losses. Loan disbursements to brokers or consultants depend entirely on the project’s progress and legal status. If a project is delayed, suspended, or non-compliant, banks risk capital loss.

Particularly, if banks inadequately assess the financial capacity of brokers or fail to control fund disbursement—such as ensuring deposit refunds as promised—credit risks increase significantly.

This not only generates bad debt and processing costs but also directly impacts the bank’s financial safety and business results.

Beyond legal and credit risks, SBV Z2 highlighted reputational risks. In disputes between buyers and brokers, customers often accuse banks of enabling illegal activities, especially when projects stall or fail to meet delivery timelines.

Three Cases of Deposit Insurance Payouts

According to the Governor of the State Bank of Vietnam, Nguyen Thi Hong, one of the significant new provisions in the draft is the regulation of the timing for insurance premium obligations to arise. This enables regulatory authorities to proactively manage risks and enhance protection for depositors.

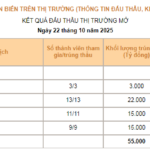

Historic Liquidity Injection: SBV Executes Record-Breaking Forward Purchase Operation

On October 22nd, the State Bank of Vietnam (SBV) injected a record-breaking VND 55 trillion into the financial system through open market operations, utilizing a fixed interest rate of 4% per annum. This marks the largest single-day injection ever conducted by the central bank via this channel.