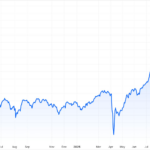

SHB Bank’s stock (SHB) debuted on the stock market in April 2009 with an initial market capitalization of just 3.04 trillion VND, equivalent to 200 million circulating shares.

After over 16 years, SHB’s market cap has soared to nearly 78 trillion VND, with approximately 4.6 billion shares in circulation.

Calculations reveal that an investor employing a dollar-cost averaging strategy—purchasing just 1 SHB share daily—would now hold 15,969 shares. The total investment, including full exercise of purchase rights and net of cash dividends, amounts to 63.7 million VND. Meanwhile, the current value of this investment stands at 271 million VND, reflecting a remarkable 326% return on investment.

Observably, the SHB investment remained stagnant for nearly 11 years, yielding no returns. It wasn’t until around February 2020 that the investment’s value began to surpass the initial capital.

The strategy’s most significant drawdown occurred in December 2011, with a loss of approximately 60% (SHB’s share price plummeted to 5,400 VND). Conversely, the highest profit was recorded in June 2021, exceeding 400%.

According to the recently released financial report, SHB’s pre-tax profit for the first nine months of 2025 reached 12,307 billion VND, a 36% increase year-on-year.

As of September 30, 2025, SHB’s total assets stood at 852,695 billion VND, marking a 14% rise compared to the end of 2024.

October 23, 2025: Foreign Investors Continue Net Selling Streak in Warrant Market

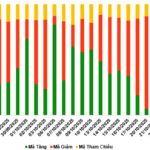

At the close of trading on October 22, 2025, the market saw 106 stocks rise, 128 fall, and 34 remain unchanged. Foreign investors continued their net selling streak, with a total net outflow nearing 3.19 billion VND.

“Exclusive Insights: Two Investment ‘Sharks’ Discuss Stocks vs. Real Estate Amid VN-Index’s Historic Crash and Year-End Investment Trends”

In just a few months, the investment landscape has witnessed a dramatic shift: stock markets soared to new highs only to plummet nearly 100 points, gold surged exponentially, and real estate began showing signs of recovery. As 2025 draws to a close, amidst the turbulent market waves, investors once again face the age-old question: which asset—gold, stocks, or real estate—truly serves as the safest haven?

SMB to Distribute Remaining 2025 Dividends, Sabeco Poised for Significant Gains

On October 21, the Board of Directors of Saigon Beer – Central Joint Stock Company (HOSE: SMB) passed a resolution to pay the second dividend installment of 2025 in cash at a rate of 20% (VND 2,000 per share). The ex-dividend date is set for November 13, with the dividend payment scheduled for November 26.