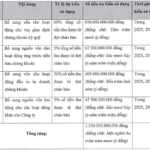

The bonds in question are DIGH2326001, issued on December 29, 2023, and DIGH2326002, issued on March 25, 2024, both with a 36-month term.

The total issuance value of these two bond series amounts to 1.6 trillion VND. DIG plans to repurchase them in Q4/2025 and Q1/2026 using equity capital and/or other legal sources of funding.

The company aims to restructure its debt, optimize capital costs, and enhance its market reputation through this repurchase.

According to the 2025 semi-annual review report, the DIGH2326001 bond, valued at 600 billion VND, was utilized for the Long Tan tourism urban area project in Nhon Trach, Dong Nai, as per its issuance purpose.

Meanwhile, the DIGH2326002 bond, worth 1 trillion VND, saw approximately 155 billion VND allocated to the same Long Tan project. The remaining 845 billion VND is currently held in a bond account at HDBank.

The CSJ Tower Vung Tau tourist apartment complex is now operational.

In other developments, DIC Corp is offering 150 million shares to existing shareholders at a ratio of 1,000:232, allowing shareholders with 1,000 shares to purchase 232 new shares. The subscription and payment period runs from October 20 to November 14, 2025.

With a selling price of 12,000 VND per share, DIG aims to raise 1.8 trillion VND, increasing its charter capital to 7.964 trillion VND.

The proceeds will be allocated as follows: 1.2 trillion VND for the Cap Saint Jacques (CSJ) complex phase 3 and the Vi Thanh commercial residential area, and the remaining 600 billion VND for bond repurchases.

This offering replaces the previous plan to issue 200 million shares to the public, as per the Public Offering Registration Certificate No. 231/GCN-UBCK dated December 12, 2024, issued by the State Securities Commission.

Ha Ly

BIG Group Holdings Issues Shares to Restructure Cash Flow and Expand Hotel Chain, Exports

On October 16th, the Board of Directors of Big Group Holdings Joint Stock Company (UPCoM: BIG) passed a resolution approving the public offering of nearly 15.1 million shares, aiming to raise approximately VND 151 billion. This move is expected to strengthen BIG’s financial health and expand its core business operations.