Dividends received from the associated company (SITC – Dinh Vu Logistics LLC) also decreased in Q3/2025. In the same period in 2024, Dinh Vu Port recorded income from the liquidation of fixed assets.

These factors led to the port operator in Hai Phong reporting a 34% decline in pre-tax profit for Q3 this year, reaching only approximately 95 billion VND.

Container yard at Dinh Vu Port – Image: DVP

|

The recently announced Q3 revenue and profit results both fell short of the plan set by the Dinh Vu Port Board of Directors at their meeting in early August. The company’s targets for the quarter were 140,000 TEU in volume, 188 billion VND in revenue, and 108 billion VND in pre-tax profit.

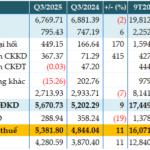

As a result, the port operator is still far from achieving the 2025 plan assigned by shareholders. In the first nine months of the year, the company achieved net revenue of 436 billion VND and pre-tax profit of 259 billion VND, down 16% and 20% year-on-year, respectively, reaching only approximately 46% and 55% of the annual plan.

– 10:58 21/10/2025

Dinh Vu Port’s Q3 Profits Plummet 34%, Threatening Annual Targets

Dinh Vu Port Investment and Development Joint Stock Company (HOSE: DVP) has released its Q3 2025 financial report, revealing a net revenue of VND 129 billion, marking a 28% decline compared to the same period last year.

ACB Reports 11% Rise in Q3 Pre-Tax Profit as Bad Debt Improves

Asian Commercial Bank (HOSE: ACB) reported a pre-tax profit of nearly VND 5,382 billion in Q3/2025, marking an 11% year-on-year increase. This growth was driven by higher non-interest income and effective cost-cutting measures. Notably, the bank’s non-performing loans (NPLs) decreased by 15% compared to the beginning of the year, reflecting improved asset quality.

FPT Profits Soar: Earning $1.5 Million Daily

After the first nine months of 2025, FPT reported revenues of VND 49,887 billion and pre-tax profit of VND 9,540 billion, achieving 71% of the annual plan and marking a nearly 18% increase compared to the same period last year. This positive performance is driven by the growth of the Technology and Telecommunications segments, with overseas IT services and the Made-by-FPT ecosystem continuing to expand robustly.

Q3/2025 Financial Report Deadline on October 21: Real Estate Firms Double Profits Year-on-Year, Fertilizer Companies Report Nearly 100 Billion VND in Losses

Two leading securities firms, SSI and VNDirect, have reported remarkable third-quarter profits exceeding 1,000 billion VND. SSI recorded a pre-tax profit of 1,782 billion VND, a 90% surge, while VNDirect achieved a pre-tax profit of 1,165 billion VND, marking an 88% increase compared to the same period last year.