Dragon Capital, a leading foreign fund group, has recently reported a significant transaction involving the purchase of TAL shares from Taseco Land, a prominent real estate investment company.

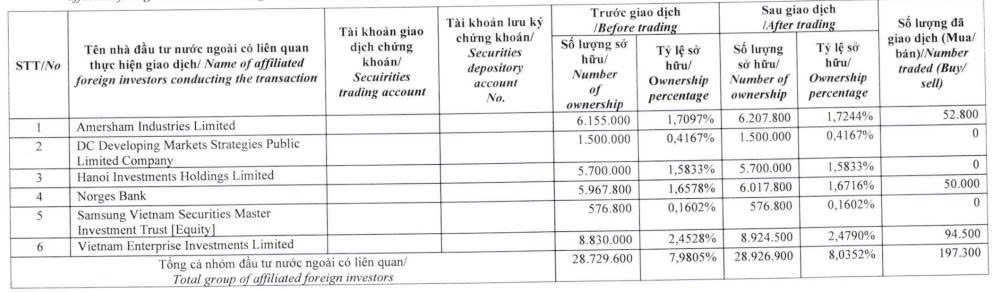

On October 16, 2025, Dragon Capital executed a strategic acquisition of 197,300 TAL shares through three of its member funds. Amersham Industries Limited acquired 52,800 shares, Norges Bank secured 50,000 shares, and Vietnam Enterprise Investments Limited purchased 94,500 shares.

Following this transaction, Dragon Capital’s holdings in TAL increased from over 28.7 million shares to more than 28.9 million shares, elevating its ownership stake from 7.9805% to 8.0352% of Taseco Land’s capital.

Source: TAL

Based on the closing price of TAL shares on October 16, 2025, at 50,300 VND per share, Dragon Capital’s investment in this transaction is estimated to be over 9.9 billion VND.

In related news, Taseco Land has announced several insider trading notifications. Mrs. Trần Thị Ngạn, spouse of Mr. Vũ Quốc Huy, Deputy General Director of Taseco Land, has registered to sell 20,000 TAL shares to address personal financial needs.

The transaction is scheduled to take place via order matching on the stock exchange from October 18, 2025, to November 18, 2025. Prior to this, Mrs. Ngạn held 161,700 TAL shares, representing a 0.045% stake in Taseco Land. If successful, her holdings will decrease to 141,700 shares, or 0.039%.

Similarly, Mrs. Cao Thị Thu Hiền, sister of Mrs. Cao Thị Lan Hương, Deputy General Director and Authorized Information Discloser, has registered to sell her entire holding of 57,750 TAL shares, equivalent to a 0.016% stake.

This transaction is expected to occur between October 16, 2025, and November 15, 2025. Upon completion, Mrs. Hiền will no longer be a shareholder of Taseco Land.

Previously, on September 22, 2025, Taseco Land successfully concluded a private placement of 48.15 million shares. The company distributed these shares to 15 professional securities investors, with 28.15 million shares purchased by domestic investors and 20 million shares by foreign investors.

At an offering price of 31,000 VND per share, Taseco Land raised a total of 1,492.65 billion VND. After deducting expenses, the company’s net proceeds from the offering amounted to 1,492.55 billion VND.

Following the successful issuance, Taseco Land’s outstanding shares increased from 311.85 million to 360 million, raising its chartered capital from 3,118.5 billion VND to 3,600 billion VND.

PV

New Crypto “Player” Enters the Digital Asset Arena, Aiming for $42 Million Annual Revenue: Just 2 Employees, Accumulated Losses in the Hundreds of Millions

The company seeks shareholder approval for a private placement of 10 million shares at an offering price of 20,000 VND per share.

SeABank Leader’s Relative Seeks to Offload 5 Million SSB Shares

Mr. Le Tuan Anh, son of Mrs. Nguyen Thi Nga—Standing Vice Chairwoman of SeABank’s Board of Directors—has registered to sell 5 million SSB shares to restructure his personal finances.