Recent data from Avison Young highlights four key drivers accelerating real estate growth in the areas surrounding Ho Chi Minh City (HCMC) towards the end of the year.

First Driver: Enhanced Infrastructure Strengthening Regional Connectivity

According to Avison Young representatives, the region’s transportation network is rapidly improving with the development and expansion of highways, ring roads, and metro systems, ensuring seamless intra-city, inter-provincial, and regional connections.

This enhanced connectivity is a pivotal factor boosting the value of real estate in neighboring areas, driving urban decentralization and the development of multi-centered cities.

A prime example is Ring Road 4, connecting HCMC with nearby provinces like Dong Nai, Tay Ninh, the Mekong Delta, and Cambodia, forming a comprehensive transportation network. Once completed, it will serve as a vital regional transport link, reducing congestion in HCMC’s center and neighboring areas, while fostering economic growth and real estate development.

Similarly, the Hanoi Highway extension project, stretching from Saigon Bridge to Tan Van Junction, is set to expand to 16 lanes by 2027, drawing significant attention to the area’s real estate market.

The Tan Van Junction project is also progressing, aiming for technical completion by late 2025 and full completion by 2026. As the most complex part of HCMC’s Ring Road 3, it will finalize regional connectivity and unlock new development opportunities.

Additionally, key infrastructure projects at the city’s gateways, such as the Binh Thai Junction, Ring Road 3, and the expansion of the HCMC-Long Thanh Expressway (An Phu to Ring Road 2 section), are accelerating to alleviate chronic congestion.

The completion of these projects between 2025 and 2028 will reduce travel times from HCMC’s center to Binh Duong and Dong Nai to just 15-20 minutes, transforming the eastern real estate market.

Projects near these critical infrastructure hubs are gaining traction. For instance, The Gio Riverside by An Gia, located at the intersection of Hanoi Highway and Ring Road 3, directly benefits from regional infrastructure development. Residents can reach Tran Bien Ward (Dong Nai) in 5 minutes, the Bien Hoa-Vung Tau Expressway in 10 minutes, Long Thanh International Airport in 20 minutes, and Vung Tau in 70 minutes.

Notably, the project is slated for completion in late 2027, coinciding with the stable operation of these transport networks. This strategic timing positions it to meet housing demand from professionals and workers at the airport, high-tech zones, and satellite industrial clusters, while offering long-term price appreciation potential. As An Gia’s flagship 2025 project, it comprises two 40-story towers with 3,000 apartments, surrounded by amenities like the New Eastern Bus Station, Aeon Mall Bien Hoa, and Thu Duc University Village.

Other projects near key infrastructure, such as Fresia Riverside, Vinhomes Grand Park, The Classia, MT Eastmark City, The 9 Stellars, Palm Marina, and Aqua City, also benefit from the region’s infrastructure roadmap.

Second Driver: Attracting Migrant Workers and FDI

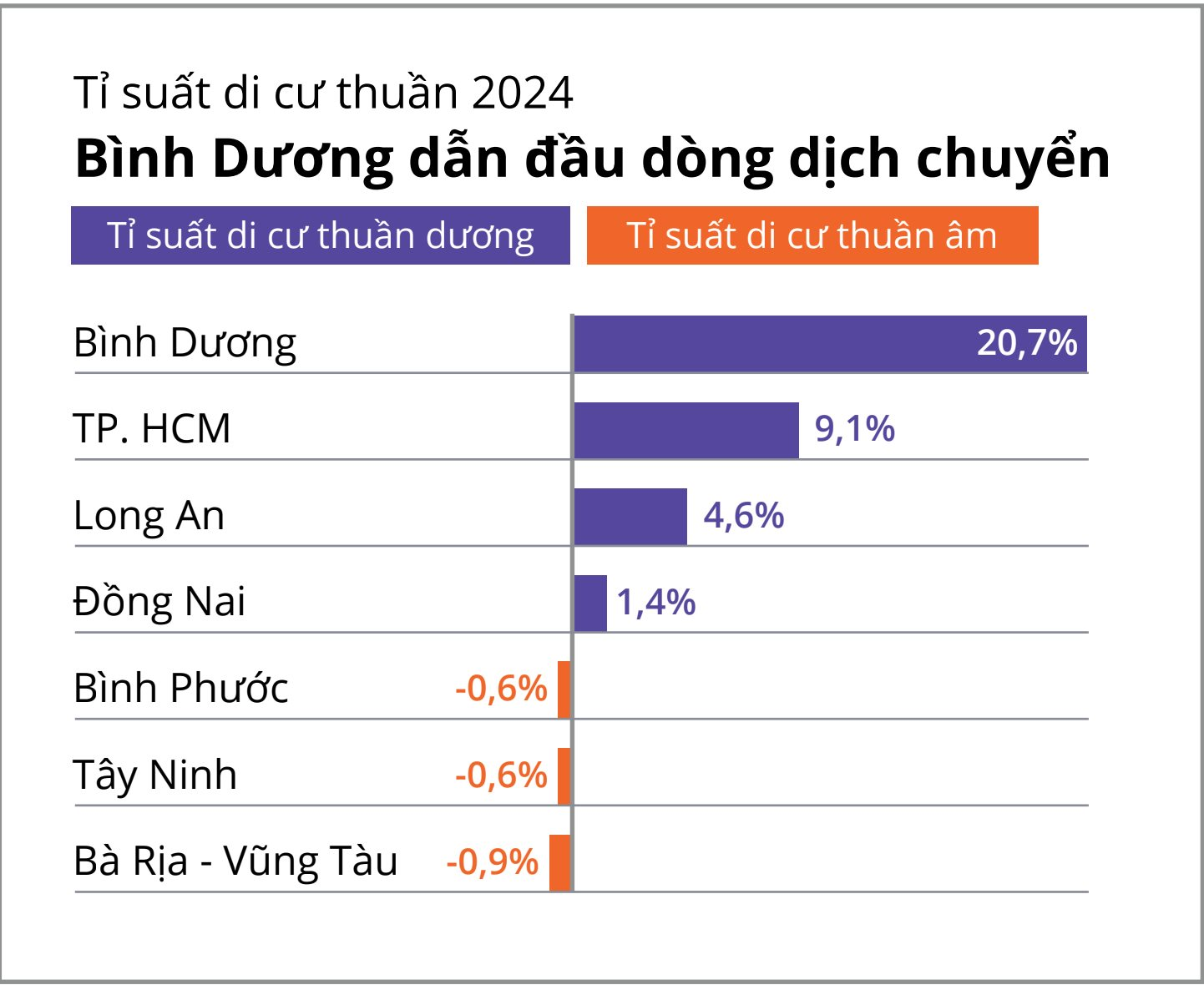

Avison Young reports that in 2024, Binh Duong led in attracting migrant workers with a net migration rate of 20.7%, along with the highest employment growth rate (3.52%). Dong Nai and Tay Ninh are close contenders, showcasing their potential.

Source: Avison Young

This labor migration is driven by high FDI inflows. In 2024, Binh Duong, Dong Nai, and Long An recorded FDI levels above the national average ($0.68 million), with Binh Duong leading at 20% growth, followed by Long An (17%) and Dong Nai (8%).

Abundant job opportunities increase the population, driving housing demand, particularly from migrant workers, serviced apartment investors, and middle to low-income earners seeking affordable housing.

Avison Young predicts that as living costs rise in HCMC, labor migration to neighboring provinces with strong economic potential will continue.

Third Driver: Abundant Land and Competitive Pricing

With limited land in HCMC, surrounding areas like Binh Duong, Ba Ria-Vung Tau, Dong Nai, and Tay Ninh are emerging as attractive investment destinations.

These areas offer not only ample land but also more affordable primary real estate prices compared to HCMC. While HCMC’s average apartment price is $3,100/m², Ba Ria-Vung Tau, Binh Duong, Dong Nai, and Tay Ninh offer prices of $2,000/m², $1,800/m², $1,400/m², and $1,300/m², respectively, a 1.6-2.4 times difference.

Binh Duong has seen the highest real estate interest, up 49% post-merger. Illustrative image

Real estate interest in these satellite markets, especially Binh Duong, has surged, with a 49% increase post-merger.

Avison Young experts believe that with effective management, urban decentralization can ease HCMC’s housing pressure and foster balanced growth in the Southern real estate market.

Fourth Driver: Multi-Centered Urban Structure and Post-Merger Prospects

Post-merger, the new HCMC spans over 6,700 km² with a population exceeding 14 million, significantly increasing housing demand.

Each satellite area has unique real estate advantages. Binh Duong’s population, land, and infrastructure make it ideal for diverse housing types, from commercial apartments to villas. Ba Ria-Vung Tau leverages tourism for second-home development, while Dong Nai and Tay Ninh’s vast land and scenery support large-scale low-rise housing projects.

However, challenges remain. Infrastructure project timelines, post-merger planning adjustments, and legal changes (e.g., the amended Land Law) will influence investor decisions.

“Golden Land” of Nha Rong Port: A Paradigm Shift and the “Wave of Consensus”

There are decisions that transcend mere administrative significance, resonating deeply with the hearts of an entire community. When Ho Chi Minh City Party Secretary Tran Luu Quang announced the suspension of real estate projects at the Nha Rong-Khanh Hoi Port area and the land plot at 1 Ly Thai To Street, reallocating them for public spaces and parks to serve the people, the nation’s sentiment was nearly unanimous: it was the right decision.

Ho Chi Minh City Mandates Timely Completion of Nguyen Duy Trinh Road Project

Ho Chi Minh City authorities have directed the acceleration of the Nguyen Duy Trinh road expansion project, ensuring timely completion, preventing planning overlaps, and optimizing the use of public investment funds.

Hotspots in Ho Chi Minh City Attracting Significant Investment from Homebuyers

After a prolonged period of suppressed demand for apartments in Ho Chi Minh City due to a scarcity of residential units, the recent influx of new condominium projects has significantly stimulated buyer interest. This surge in supply has ignited vibrant market activity, creating hotspots that are attracting substantial investment from homebuyers.

Lâm Đồng: Billion-Dollar LNG Power Projects Awaiting Land Clearance

Two multi-billion-dollar LNG power projects in Son My 1 Industrial Zone, despite being approved years ago, remain barren land to this day.